Holiday Inn 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

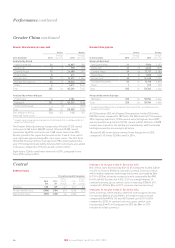

Performance continued

AMEA results

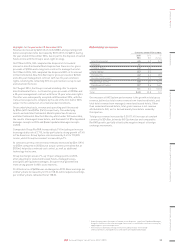

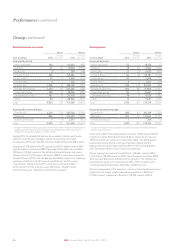

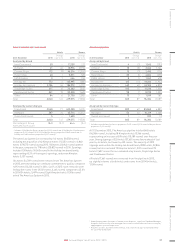

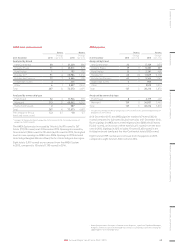

12 months ended 31 December

2015

$m

2014

$m

2015 vs

2014 %

change

2013

$m

2014 vs

2013 %

change

Revenue

Franchised 16 16 –16 –

Managed 189 187 1.1 170 10.0

Owned and leased 36 39 (7.7) 44 (11.4)

Total 241 242 (0.4) 230 5.2

Percentage of Group

revenue

13.3 13.0 0.3 12.1 0.9

Operating profit before

exceptional items

Franchised 12 12 –12 –

Managed 90 88 2.3 92 (4.3)

Owned and leased 33–4(25.0)

105 103 1.9 108 (4.6)

Regional overheads (19) (19) –(22)13.6

Total 86 84 2.4 86 (2.3)

Percentage of Group

operating profit before

central overheads and

exceptional items

10.4 10.5 (0.1) 10.4 0.1

Highlights for the year ended 31December 2015

Comprising 267 hotels (72,573 rooms) at 31 December 2015, AMEA

represented 10% of the Group’s room count and contributed 10% of

the Group’s operating profit before central overheads and exceptional

operating items during the year. 83% of rooms in AMEA are operated

under the managed business model.

Revenue decreased by $1m (0.4%) to $241m, whilst operating profit

before exceptional items increased by $2m (2.4%) to $86m, both

adversely impacted by foreign exchange translation. On an underlyinga

basis, revenue and operating profit increased by $13m (6.5%) and

$7m (8.7%) respectively.

Comparable RevPAR increased 4.5%, driven by growth in both rate

and occupancy. Performance was led by strong positive trading in

the mature markets of Japan, which grew by 14.6%, and Australia,

which increased by 4.5%. South East Asia exhibited growth of 5.7%,

however the Middle East increased by 0.2%, impacted by declining

oil prices.

Franchised revenue and operating profit remained flat at $16m

and $12m respectively. On a constant currency basis, revenue and

operating profit increased by $1m (6.3%) and $1m (8.3%) respectively.

Managed revenue increased by $2m (1.1%) to $189m and operating

profit increased by $2m (2.3%) to $90m. Comparable RevPAR

increased by 5.4%, with the majority of rooms opening in the last

quarter of 2015. Revenue and operating profit included $46m

(2014: $41m) and $5m (2014: $4m) respectively from one managed-

lease property. Excluding results from this hotel and on a constant

currency basis, revenue increased by $9m (6.2%), whilst operating

profit increased by $6m (7.1%).

In the owned and leased estate, revenue decreased by $3m (7.7%)

to $36m and operating profit remained flat at $3m. On a constant

currency basis, revenue increased by $3m (7.7%) and operating profit

increased by $1m (33.3%).

Highlights for the year ended 31December 2014

Revenue increased by $12m (5.2%) to $242m whilst operating profit

before exceptional items decreased by $2m (2.3%) to $84m. On an

underlyinga basis, revenue increased by $5m (2.5%) and operating

profit increased by $4m (5.1%). The results included a $6m benefit

from liquidated damages received in 2013 (2014: $nil). AMEA is

a geographically diverse region and performance was impacted

by political and economic factors, affecting different countries.

Comparable RevPAR increased 3.8% driven by 2.4% rate growth.

Performance was led by the Middle East, up 5.6%, driven by a solid

performance in Saudi Arabia and a recovery in Egypt. This was

supported by positive trading in the mature markets of Japan, which

grew by 6.7%, and Australia, which grew by 3.9%. Elsewhere, both

India and South East Asia exhibited steady growth, with the exception

of Thailand, which suffered from political instability in the first half

of the year.

Franchised revenue and operating profit remained flat at $16m

and $12m respectively.

Managed revenue increased by $17m (10.0%) to $187m, whilst operating

profit decreased by $4m (4.3%) to $88m. Revenue and operating profit

included $41m (2013: $21m) and $4m (2013: $1m) respectively from one

managed-lease property. Excluding results from this hotel, as well as

the benefit of $6m liquidated damages in 2013 (2014: $nil), revenue

increased by $7m (4.9%) whilst operating profit increased by $2m

(2.4%) on a constant currency basis. Comparable RevPAR increased

by 4.4%, with room count increasing by 5.9%.

In the owned and leased estate, revenue and operating profit decreased

by $5m (11.4%) to $39m and by $1m (25.0%) to $3m respectively, due to

a 6.3% decrease in RevPAR.

Asia, Middle East and Africa (AMEA) continued

42 IHG Annual Report and Form 20-F 2015