Holiday Inn 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

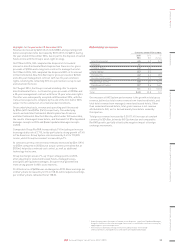

Americas hotel and room count

Hotels Rooms

At 31 December 2015

Change

over 2014 2015

Change

over 2014

Analysed by brand

InterContinental 50 – 17,109 212

Kimpton 61 61 10,976 10,976

Crowne Plaza 172 (9) 46,316 (2,050)

Hotel Indigo 40 1 5,071 520

EVEN Hotels 3 1 446 150

Holiday Innc772 2 135,995 (285)

Holiday Inn Express 2,106 46 186,972 4,371

Staybridge Suites 211 14 22,662 1,462

Candlewood Suites 341 19 32,328 1,620

Other 84 621,700 2,582

Total 3,840 141 479,575 19,558

Analysed by ownership type

Franchised 3,548 71 422,230 5,015

Managed 287 70 55,715 14,543

Owned and leased 5– 1,630 –

Total 3,840 141 479,575 19,558

Percentage of Group

hotel and room count

76.3 (0.1) 64.4 (0.4)

c Includes 23 Holiday Inn Resort properties (5,902 rooms) and 16 Holiday Inn Club Vacations

properties (5,231 rooms) (2014: 20 Holiday Inn Resort properties (4,864 rooms) and 12

Holiday Inn Club Vacations properties (4,027rooms)).

The Americas System size increased by 141 hotels (19,558 rooms),

including the acquisition of 62 Kimpton hotels (11,325 rooms), to 3,840

hotels (479,575 rooms) during 2015. 183 hotels (22,942 rooms) opened

in the year, compared to 178 hotels (20,823 rooms) in 2014. Openings

included 130 hotels (14,963 rooms) in the Holiday Inn brand family,

representing 65.2% of the region’s openings, and seven Kimpton

hotels (1,157 rooms).

104 hotels (14,709 rooms) were removed from The Americas System

in 2015, demonstrating our continued commitment to quality, compared

to 95 hotels (12,230 rooms) in 2014. 44.0% of 2015 room removals were

Holiday Inn rooms in the US (31 hotels, 6,466 rooms) compared to 45.0%

in 2014 (34 hotels, 5,499 rooms). Eight Kimpton hotels (1,506 rooms)

exited The Americas System in 2015.

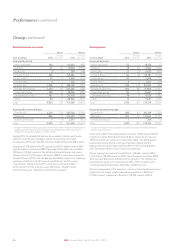

Americas pipeline

Hotels Rooms

At 31 December 2015

Change

over 2014 2015

Change

over 2014

Analysed by brand

InterContinental 4 (3) 1,545 (792)

Kimpton 18 18 3,366 3,366

Crowne Plaza 15 (3) 2,490 (716)

Hotel Indigo 30 (1) 4,024 (235)

EVEN Hotels 8 5 1,262 678

Holiday Innd 125 (14) 18,203 (1,952)

Holiday Inn Express 449 60 43,945 6,820

Staybridge Suites 105 15 11,230 1,636

Candlewood Suites 98 9 8,720 1,003

Other 13 31,599 381

Total 865 89 96,384 10,189

Analysed by ownership type

Franchised 809 69 85,863 6,883

Managed 55 20 10,319 3,308

Owned and leased 1–202 (2)

Total 865 89 96,384 10,189

d Includes seven Holiday Inn Resort properties (1,657 rooms) (2014: nine Holiday Inn Resort

properties (1,916 rooms)).

At 31 December 2015, The Americas pipeline totalled 865 hotels

(96,384 rooms), including 18 Kimpton hotels (3,366 rooms),

representing an increase of 89 hotels (10,189 rooms) over the prior

year. Strong signings of 325 hotels (37,655 rooms) were ahead of last

year by six hotels, but lower by 453 rooms. The majority of 2015

signings were within the Holiday Inn brand family (208 hotels, 22,826

rooms) but also included 10 Kimpton hotels (1,532 rooms) and 78

hotels (7,607 rooms) for our extended-stay brands, Staybridge Suites

and Candlewood Suites.

69 hotels (7,661 rooms) were removed from the pipeline in 2015,

up slightly in terms of both hotels and rooms from 2014 (64 hotels,

7,108 rooms).

a Underlying excludes the impact of owned-asset disposals, significant liquidated damages,

Kimpton, and the results from managed-lease hotels, translated at constant currency by

applying prior-year exchange rates.

b Royalties are fees, based on rooms revenue, that a franchisee pays to the brand owner

for use of the brand name.

37

IHG Annual Report and Form 20-F 2015

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS