Holiday Inn 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184

|

|

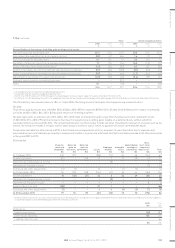

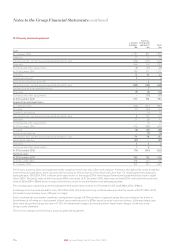

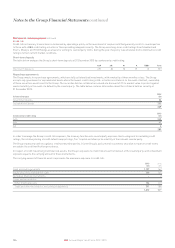

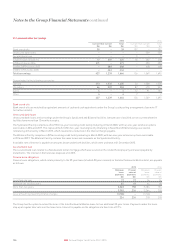

16. Trade and other receivables

2015

$m

2014

$m

Current

Trade receivables 354 327

Other receivables 28 47

Prepayments 74 63

Loans to and receivables from associates 611

462 448

Non-current

Loans to associates 33

Trade and other receivables are designated as loans and receivables and are held at amortised cost.

Trade receivables are non-interest-bearing and are generally on payment terms of up to 30 days. The fair value of trade and other receivables

approximates their carrying value.

The maximum exposure to credit risk for trade and other receivables, excluding prepayments, at the end of the reporting period by geographic

region is:

2015

$m

2014

$m

Americas 233 221

Europe 54 76

Asia, Middle East and Africa 66 53

Greater China 38 38

391 388

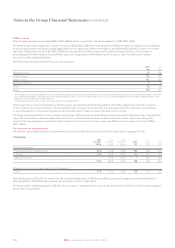

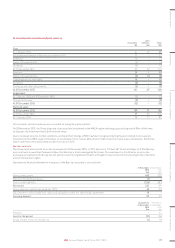

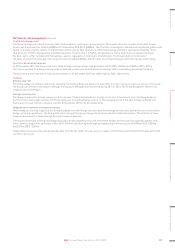

The ageing of trade and other receivables, excluding prepayments, at the end of the reporting period is:

2015 2014

Gross

$m

Provision

$m

Net

$m

Gross

$m

Provision

$m

Net

$m

Not past due 280 (1) 279 275 – 275

Past due 1 to 30 days 64 (3) 61 57 (3) 54

Past due 31 to 180 days 52 (5) 47 57 (3) 54

Past due more than 180 days 51 (47) 4 46 (41) 5

447 (56) 391 435 (47) 388

The credit risk relating to balances not past due is not deemed to be significant.

The movement in the provision for impairment of trade and other receivables during the year is as follows:

2015

$m

2014

$m

2013

$m

At 1 January (47) (43) (47)

Provided (28) (22) (18)

Amounts written back 12 914

Amounts written off 798

At 31 December (56) (47) (43)

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

119IHG Annual Report and Form 20-F 2015