Holiday Inn 2015 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

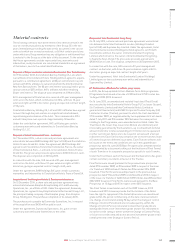

The Group is exposed to the risk of events that adversely impact

domestic or international travel

The room rates and occupancy levels of the Group could be adversely

impacted by events that reduce domestic or international travel,

such as actual or threatened acts of terrorism or war, political or

civil unrest, epidemics or threats thereof, travel-related accidents

or industrial action, natural disasters, or other local factors impacting

specific countries, cities or individual hotels, as well as increased

transportation and fuel costs. A decrease in the demand for hotel

rooms as a result of such events may have an adverse impact on

the Group’s operations and financial results. In addition, inadequate

planning, preparation, response or recovery in relation to a major

incident or crisis may cause loss of life, prevent operational continuity,

or result in financial loss, and consequently impact the value of our

brands and/or the reputation of the Group.

The Group is exposed to the risks of the hotel industry

supply-and-demand cycle

The future operating results of the Group could be adversely affected

by industry overcapacity (by number of rooms) and weak demand due,

in part, to the cyclical nature of the hotel industry, or other differences

between planning assumptions and actual operating conditions.

These conditions could result in reductions in room rates and

occupancy levels, which would adversely impact the financial

performance of the Group.

The Group is subject to a competitive and changing industry

The Group operates in a competitive industry and must compete

effectively against traditional competitors such as other global hotel

chains, local hotel companies and independent hotels to win the loyalty

of guests, employees and owners. The competitive landscape also

includes other types of businesses, such as web-based booking

channels (which include online travel agents and intermediaries),

and alternative sources of accommodation such as short-term lets

of private property. Failure to compete effectively in traditional and

emerging areas of the business could impact the Group’s market share,

System size, profitability and relationships with owners and guests.

The Group is exposed to risks related to executing and realising

benefits from strategic transactions, including acquisitions

The Group completed the acquisition of Kimpton Hotels & Restaurants

in January 2015 and may seek to make other strategic transactions,

including acquisitions, in the future. The Group may not be able to

identify opportunities or complete transactions on commercially

reasonable terms, or at all, and may not realise the anticipated

benefits from such transactions. Strategic transactions come with

inherent valuation, financial and commercial risks, and regulatory and

insider information risks during the execution of the transactions. In

addition, the Group may face unforeseen costs and liabilities, diversion

of management attention, as well as longer-term integration and

operational risks, which could result in a failure to realise benefits,

financial losses, lower employee morale and loss of talent.

The Group is dependent upon a wide range of external stakeholders

and business partners

The Group relies on the performance, behaviours and reputation

of a wide range of business partners and external stakeholders,

including, but not limited to, owners, contractors, lenders, suppliers,

vendors, joint-venture partners, online travel agents, third-party

intermediaries and other business partners which may have different

ethical values, interests and priorities. Further, the number and

complexity of interdependencies with stakeholders is evolving.

Breakdowns in relationships, contractual disputes, poor vendor

performance, insolvency, stakeholder behaviours or adverse

reputations, which may be outside of the Group’s control, could

adversely impact on the Group’s performance and competitiveness,

delivery of projects, guest experiences or the reputation of the Group

or its brands.

The Group is exposed to increasing competition from online travel

agents and intermediaries

A proportion of the Group’s bookings originate from large

multinational, regional and local online travel agents and

intermediaries with which the Group has contractual arrangements

and to which it pays commissions. These websites offer a wide breadth

of products, often across multiple brands, have growing booking and

review capabilities, and may create the perception that they offer the

lowest prices. Some of these online travel agents and intermediaries

have strong marketing budgets and aim to create brand awareness

and brand loyalty among consumers and may seek to commoditise

hotel brands through price and attribute comparison. Further, if these

companies continue to gain market share, they may impact the

Group’s profitability, undermine the Group’s own booking channels

and value to its hotel owners, and may be able to increase commission

rates and negotiate other favourable contract terms.

The Group is exposed to a variety of risks related to identifying,

securing and retaining franchise and management agreements

The Group’s growth strategy depends on its success in identifying,

securing and retaining franchise and management agreements.

This is an inherent risk for the hotel industry and the franchise

business model. Competition with other hotel companies may

generally reduce the number of suitable franchise, management and

investment opportunities offered to the Group and increase the

bargaining position of property owners seeking to become a

franchisee or engage a manager. The terms of new franchise or

management agreements may not be as favourable as current

arrangements; the Group may not be able to renew existing

arrangements on similarly favourable terms, or at all.

There can also be no assurance that the Group will be able to identify,

retain or add franchisees to the IHG System or to secure management

contracts. For example, the availability of suitable sites, market

saturation, planning and other local regulations or the availability

and affordability of finance may all restrict the supply of suitable

hotel development opportunities under franchise or management

agreements. In connection with entering into franchise or

management agreements, the Group may be required to make

investments in, or guarantee the obligations of, third parties or

guarantee minimum income to third parties. There are also risks

that significant franchisees or groups of franchisees may have

interests that conflict, or are not aligned, with those of the Group,

including, for example, the unwillingness of franchisees to support

brand improvement initiatives. This could result in franchisees

prematurely terminating contracts which would adversely impact

the overall IHG System size and the Group’s financial performance.

The Group is exposed to inherent risks in relation to changing

technology and systems

As the use of the internet and mobile technology grows and customer

needs evolve at pace, the Group may find that its evolving technology

capability is not sufficient and may have to make substantial additional

investments in new technologies or systems to remain competitive.

Failure to keep pace with developments in technologies or systems

may put the Group at a competitive disadvantage. In addition, the

technologies or systems that the Group chooses to deploy may not

be commercially successful or the technology or system strategy may

not be sufficiently aligned with the needs of the business. As a result,

this could adversely affect guest experiences, and the Group may lose

customers, fail to attract new customers, incur substantial costs or

face other losses. This could further impact the Group’s reputation

in regards to innovation.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

157IHG Annual Report and Form 20-F 2015