Holiday Inn 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

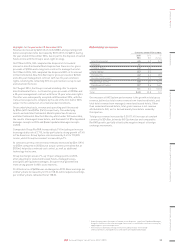

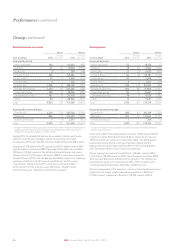

How each principal risk links to our strategic priorities

Winning Model Targeted Portfolio

Disciplined Execution Responsible Business

How the external environment for each principal risk has

changed over the past year (risk trends)

Increased risk No change in risk

Risk description Trend Impact How do we manage these risks?

Preferred brands and loyalty

A portfolio of clearly defined and

consistently delivered brands which meet

increasingly personalised guest needs

and occasions is crucial for creating brand

preference, loyalty and advocacy, and

failure to deliver this could impact our

competitive positioning, our ability to drive

growth and our reputation with guests,

owners and investors.

• Each of the brands in our portfolio is designed to meet specific guest needs

and occasions through distinct and complementary brand propositions informed

by guest research and insights (see pages 4 and 5).

• We continually review ways to increase awareness of, and loyalty to, our brands

through our loyalty programme, IHG Rewards Club, as well as global and local

marketing promotions, sponsorships and specific brand initiatives (see page 20).

• We manage brand consistency through the entire hotel life cycle, supported by clear

contractual terms, new hotel opening processes, brand standard requirements and

compliance processes. Tools, training and guidance assist owners and those working

at our hotels to deliver brand consistency.

• We continue to evaluate our brand portfolio and extend the portfolio where necessary,

through developing new brands (HUALUXE, EVEN) or acquisitions (Kimpton).

Additionally, significant analysis is given to brand presence in priority markets

and the business’ ability to grow in these markets.

Leadership and talent

Failure to recruit and retain the right

leadership talent and to give them

the tools, guidance and support to be

successful could impact IHG’s delivery

and ability to drive our strategic ambition.

• We have in place a comprehensive global people strategy (see pages 17 and 18)

to ensure we are able to recruit, retain and develop talent at our hotels, corporate

offices and central reservations offices. Supplementing the global strategy, we

have developed localised people strategies for some of our priority markets.

• Our leadership framework, support tools, and training and development programmes

help our people grow their careers, thereby managing internal talent. We proactively

manage succession planning at all levels and consider the diversity (more broadly

than gender) of our people and leadership.

• IHG Academy assists us to fill our talent pipeline whilst supporting local communities

(see page 24).

Channel management and

technology platforms

Failure to maintain and enhance our

booking and distribution channels and

technology infrastructure could impact

on our ability to deliver revenue, meet

evolving guest expectations and generate

returns for our owners and investors.

• We recognise that technological advances, the growth of intermediaries and the

sharing economy, and changing guest expectations (see pages 10 and 11) mean

that we must continually invest in, and improve, our technological systems to deliver

across the ‘Guest Journey’ and to build lifetime relationships with our guests. Our

focus is on encouraging guests to use direct booking channels. However, recognising

that some travellers use intermediaries, we seek to secure better terms with those

intermediaries for our hotels.

• Our Global Technology function works collaboratively with specialist third-party

technology providers continuously to monitor, manage and optimise our systems

and channels to enhance all aspects of the ‘Guest Journey’, and this includes testing

the resilience of our systems through business continuity practices.

Owner proposition

Failure to maintain strong relationships

with owners, and to demonstrate

attractive returns on investment, could

impact the retention and growth of IHG’s

System size and development pipeline.

• We build relationships with owners through a variety of methods, including formal

and informal communications and the IHG Owners Association.

• IHG works closely with the IHG Owners Association to ensure we have insight into

owners’ perspectives, particularly with respect to new programmes, initiatives

and the use of the System Fund (described on page 47).

• Long-term franchise and management contracts, new hotel opening teams and

processes, Hotel Solutions (our internal online portal which provides tools and

guidance to hotels across a number of operational areas) and the wider corporate

infrastructure are put in place to leverage scale, support our hotels and maintain

relationships with owners throughout the life cycle of the hotel.

• We closely monitor the performance of our revenue delivery systems and are focused

on delivering a strong return on investment for our hotel owners.

Risk management continued

IHG’s principal risks, uncertainties and review process

The external risk environment remains dynamic, with changes in political, economic, social, technological, legal and environmental risks.

However, the Group’s asset-light business model, diverse brand portfolio and wide geographical spread contribute to IHG’s resilience to events

that could affect specific segmental or geographical areas. Our Risk Working Group, chaired by the General Counsel and Company Secretary

and comprised of the heads of Global Risk Management, Global Strategy, and Global Internal Audit, provides input on, and oversight of, the

principal risk review process, which identifies and assesses risks for ongoing monitoring and review by senior management.

The Directors have carried out an assessment of the principal risks facing the Company, including those that would threaten its business model,

future performance, solvency or liquidity. These risks are reviewed formally by the Directors on a biannual basis and are considered in more detail

through the activities of the Board and Committees (see pages 61 and 62). The table below describes our principal risks and uncertainties,

which align with our strategic priorities (see page 14). These principal risks are supplemented by a broader description of risk factors set

out on pages 156 to 159.

26 IHG Annual Report and Form 20-F 2015