Holiday Inn 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

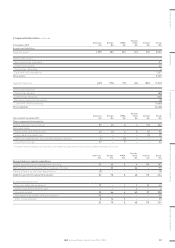

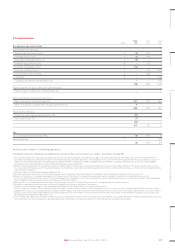

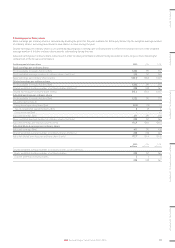

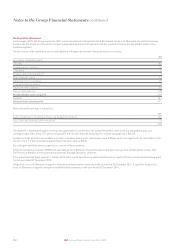

7. Tax continued

TotalaBefore exceptional itemsb

2015

%

2014

%

2013

%

2015

%

2014

%

2013

%

Reconciliation of tax charge, including gain on disposal of assets

UK corporation tax at standard rate 20.3 21.5 23.3 20.3 21.5 23.3

Non-deductible expenditure and non-taxable incomec(8.9) 4.9 16.6 1.6 1.0 1.9

Non-recoverable withholding taxes 0.1 0.4 1.2 0.3 0.4 1.2

Net effect of different rates of tax in overseas businesses 7.1 11.5 11.6 15.3 12.8 11.9

Effect of changes in tax rates and tax lawsd(1.5) 0.3 (0.1) 0.1 0.1 (0.1)

Benefit of tax reliefs on which no deferred tax previously recognised (0.1) (0.4) (15.0) (0.1) (0.3) (1.1)

Effect of adjustments to estimated recoverable deferred tax assets (0.9) 0.2 (6.4) (1.7) (0.2) (4.9)

Adjustment to tax charge in respect of prior periods (2.8) (3.7) (2.2) (5.4) (3.9) (2.1)

Deferred tax provision on unremitted earnings ––10.5 –––

Other 0.1 –(1.8) ––(0.6)

13.4 34.7 37.7 30.4 31.4 29.5

a Calculated in relation to total profits including exceptional items.

b Calculated in relation to profits excluding exceptional items.

c In 2015, total of (8.9)% represents (9.8)% in respect of accounting gains in excess of gains subject to taxation, offset by 0.9% of other items.

d In 2015, total of (1.5)% predominantly reflects the judgement that state tax law changes would now apply to the deferred gain from the 2014 disposal of InterContinental New York Barclay.

The UK statutory tax rate will reduce to 18% on 1 April 2020. The Group does not anticipate this change having a material effect.

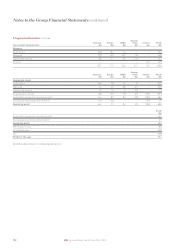

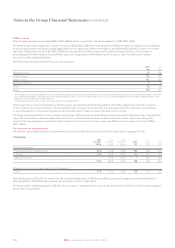

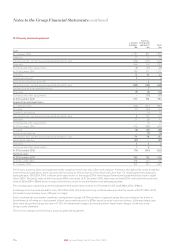

Tax paid

Total net tax paid during the year of $110m (2014: $136m, 2013: $97m) comprises $109m (2014: $136m, 2013: $92m) paid in respect of operating

activities and $1m (2014: $nil, 2013: $5m) paid in respect of investing activities.

Tax paid represents an effective rate of 8% (2014: 23%, 2013: 16%) on total profits and is lower than the effective income statement tax rate

of 30% (2014: 31%, 2013: 29%) primarily due to the impact of exceptional accounting gains taxable on a deferred basis, without which the

equivalent effective rate would be 20%. The remaining difference is primarily due to deferred taxes (including the realisation of assets such as tax

losses), the receipt of refunds in respect of prior years and provisions for tax for which no payment of tax has currently been made.

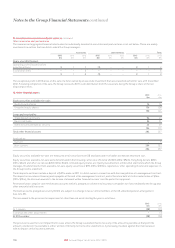

Corporation tax liabilities did not arise in 2015 in the UK and are not expected to arise for a number of years thereafter due to expenses and

associated tax losses attributable principally to employment matters, inparticular additional shortfall contributions made to the UK pension plan

in the years 2007 to 2013.

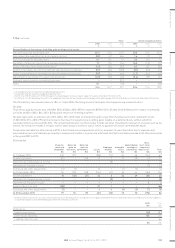

Deferred tax

Property,

plant and

equipment

$m

Deferred

gains on

loan notes

$m

Deferred

gains on

investments

$m

Losses

$m

Employee

benefits

$m

Intangible

assets

$m

Undistributed

earnings of

subsidiaries

$m

Other

short-term

temporary

differencesa

$m

Total

$m

At 1 January 2014 240 107 – (186) (37) 34 66 (157) 67

Income statement (55) – 108 17 3 22 (19) (3) 73

Statement of comprehensive income ––––(8)– –1(7)

Statement of changes in equity –––––– –(3)(3)

Exchange and other adjustments (11) (2) – 15 1 (4) (3) – (4)

At 31 December 2014 174 105 108 (154) (41) 52 44 (162) 126

Income statement 18 (50) (21) 62 6 22 29 (36) 30

Statement of comprehensive income ––––(2)– ––(2)

Statement of changes in equity –––––– –33

Assets of business sold (88)––211– ––(66)

Exchange and other adjustments (5)––44(4)(3)(1)(5)

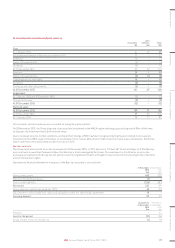

At 31 December 2015 99 55 87 (67) (32) 70 70 (196) 86

a Primarily relates to provisions, accruals, amortisation and share-based payments. Includes an asset of approximately $70m which is expected to be reclassified to current taxes subject to

a requested change of tax treatment being approved by the relevant tax authority.

2015

$m

2014

$m

Analysed as:

Deferred tax assets (49) (87)

Deferred tax liabilities 135 147

Liabilities held for sale –66

86 126

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

109IHG Annual Report and Form 20-F 2015