Holiday Inn 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

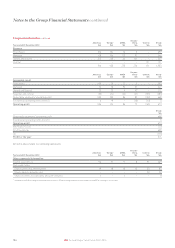

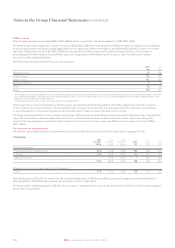

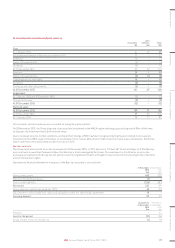

11. Assets sold and held for sale

Assets sold

During the year ended 31 December 2015, the Group sold one hotel in the Europe region, InterContinental Paris – Le Grand on 20 May 2015, and

one hotel in the Greater China region, InterContinental Hong Kong on 30 September 2015. On 30 November 2015, the Group disposed of its share

of assets and liabilities in a joint operation in the AMEA region.

Principal disposals during the year ended 31 December 2014 were the sale of InterContinental Mark Hopkins San Francisco on 27 March 2014 and

the disposal of an 80.1% interest in InterContinental New York Barclay on 31 March 2014. The Group’s 19.9% retained interest is accounted for as

an associate as described in note 14. Both transactions took place in The Americas region.

During the year ended 31 December 2013, the Group sold one hotel in the Europe region, InterContinental London Park Lane.

2015

$m

2014

$m

2013

$m

Consideration

Current year disposals:

Cash consideration, net of costs paid 1,289 345 460

Other financial assetsa–52 –

Intangible assets – management contracts 97 50 40

Investment in associate –22 –

Accrued disposal costs (3) ––

1,383 469 500

Net assets disposed:

Property, plant and equipment (6) (110) –

Non-current assets held for sale (577) (228) (294)

Other financial asset –(5) –

Other assets held for sale, including cash and cash equivalents (43) ––

Net current liabilities –46

Borrowings 2––

Deferred tax liability held for sale 66 ––

Other liabilities held for sale 48 ––

(510) (339) (288)

Exchange losses reclassified from currency translation reserve (2) –(46)

Gain on disposal of hotels from continuing operations 871 130 166

Net cash inflow arising on disposalsb

Disposal of hotel assets, net of costs and cash disposed

Cash consideration, net of costs paid 1,289 345 460

Less: cash and cash equivalents disposed (11) ––

Costs paid – prior year disposals (1) ––

1,277 345 460

Distribution from associate on sale of hotel ––17

Tax paid on disposals (1) –(5)

1,276 345 472

a Includes $27m deferred consideration subsequently received and included within ‘proceeds from other financial assets’ in the Group statement of cash flows.

b Unless otherwise stated relates to current year disposals.

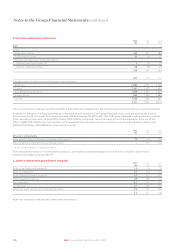

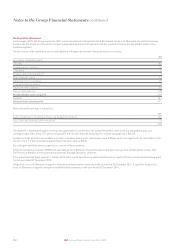

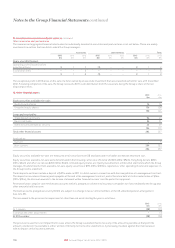

Assets held for sale

There were no assets held for sale at 31 December 2015. InterContinental Paris – Le Grand was held for sale at 31 December 2014.

2015

$m

2014

$m

Assets and liabilities held for sale

Assets classified as held for sale:

Property, plant and equipment –306

Other assets –4

–310

Liabilities classified as held for sale:

Deferred tax (note 7) –(66)

Other liabilities –(28)

–(94)

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

113IHG Annual Report and Form 20-F 2015