Holiday Inn 2015 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report continued

Significant agreements and change of control provisions

The Group is a party to the following arrangements which could

be terminated upon a change of control of the Company and which

are considered significant in terms of their potential impact on the

business of the Group as a whole:

• the seven-year £250m bond issued by the Company on 9 December

2009, under which, if the bond’s credit rating was downgraded in

connection with a change of control, the bond holders would have

the option to require the Company to redeem or, at the Company’s

option, repurchase the outstanding notes together with interest

accrued;

• the 10-year £400m bond issued by the Company on 26 November

2012, under which, if the bond’s credit rating was downgraded in

connection with a change of control, the bond holders would have

the option to require the Company to redeem or, at the Company’s

option, repurchase the outstanding notes together with interest

accrued;

• the five-year $1.275bn syndicated loan facility agreement dated

30 March 2015, under which a change of control of the Company

would entitle each lender to cancel its commitment and declare

all amounts due to it payable; and

• the 10-year £300m bond issued by the Company on 14 August 2015,

under which, if the bond’s credit rating was downgraded in connection

with a change of control, the bond holders would have the option

to require the Company to redeem or, at the Company’s option,

repurchase the outstanding notes together with interest accrued.

Further details on these are set out on pages 163 and 164.

Business relationships

During 2012, the Group entered into a five-year technology outsourcing

agreement with International Business Machines Corporation (IBM),

pursuant to which IBM operates and maintains the infrastructure

of the Group’s Guest Reservation System. Otherwise, there are no

specific individual contracts or arrangements considered to be

essential to the business of the Group as a whole.

Disclosure of information to Auditor

For details, see page 80.

Events after the reporting period

In February 2016, the Board proposed a $1.5 billion return of funds

to shareholders via a special dividend with share consolidation.

Listing Rules – compliance with LR 9.8.4C

Section Applicable sub-paragraph within LR 9.8.4C Location

1 Interest capitalised Group Financial

Statements, note 6,

page 108

4 Details of long-term incentive

schemes

Directors’

Remuneration Report,

pages 70 to 74

6 Waiver of future emoluments

by a Director

Directors’

Remuneration Report,

page 77

The above table sets out only those sections of LR 9.8.4C which are

relevant. The remaining sections of LR 9.8.4 are not applicable.

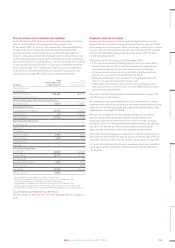

Greenhouse gas (GHG) emissions

By delivering more environmentally sustainable hotels, we can drive

cost efficiencies for owners, as well as meet the expectations of all our

stakeholders. We recognise the importance of reducing our global GHG

emissions for corporate offices and hotels – our target is to reduce our

carbon footprint per occupied room by 12 per cent across our entire

estate by 2017 (against a 2012 baseline). See page 31 for progress.

Reporting

boundary Measure 2015a2014a

Global –

corporate offices

and franchised,

managed,

owned and

leased hotelsb

(a KPI and part

of our five-year

targets)

Scope 1 Direct

emissions (tCO2e)

1,548,358.61 1,407,239.59

Scope 2 Indirect

emissions (tCO2e)

3,816,695.68 3,706,153.58

Total GHG

emissions (tCO2e)

5,365,054.29 5,113,393.16

IHG’s chosen intensity

measurement GHG

emissions per occupied

room (kgCO2e per

occupied room)

31.65 32.19

Global –

corporate offices

and managed,

owned and

leased hotelsb

(as required

under the

Companies Act

2006)

Scope 1 Direct

emissions (tCO2e)

534,273.70 491,075.00

Scope 2 Indirect

emissions (tCO2e)

1,816,697.92 1,812,930.96

Total GHG

emissions (tCO2e)

2,350,971.62 2,304,005.96

IHG’s chosen intensity

measurement GHG

emissions per occupied

room (kgCO2e per

occupied room)

52.82 56.26

a Reporting period commencing on 1 October and ending on 30 September – due to the delay

in hotels receiving their energy bills it is not possible to report accurately GHG emissions

from 1 January to 31 December.

b Includes all of our branded hotels but does not include emissions from 82 hotels. We

do not have sufficient data to estimate their emissions and believe them to be immaterial.

Scope

We report Scope 1 and Scope 2 emissions as defined by the GHG

protocol as follows:

• Scope 1 (Direct emissions): combustion of fuel and operation

of facilities; and

• Scope 2 (Indirect emissions): electricity, heat, steam and cooling

purchased for own use.

Methodology

We have worked with external consultants to give us an up-to-date

picture of IHG’s carbon footprint and to assess our performance over

the past few years. The external consultants use a sampling and

extrapolation methodology to estimate our GHG emissions.

For 2015, in line with the methodology set out in the GHG Protocol

Corporate Standard, the sample covered 2,939 (69%) of our 4,848

hotels. As IHG’s System size is continually changing and the number

of hotels reporting data to the IHG Green Engage system increases

annually, we are restating the impacts for all years from the baseline

year (2012) annually to enable comparisons to be made.

Finance

Political donations

The Group made no political donations under the Companies Act

during the year and proposes to maintain this policy.

Financial risk management

The Group’s financial risk management objectives and policies,

including its use of financial instruments, are set out in note 20

to the Group Financial Statements on pages 122 to 125.

154 IHG Annual Report and Form 20-F 2015