Holiday Inn 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Audited

Other information relating to Directors’ remuneration

Non-executive directorships of other companies

The Company recognises that its Executive Directors may be invited

to become Non-Executive Directors of other companies and that

such duties can broaden their experience and knowledge, and benefit

the Company. IHG therefore permits its Executive Directors to accept

one non-executive appointment (in addition to any positions where the

Director is appointed as the Group’s representative), subject to Board

approval, as long as this is not, in the reasonable opinion of the Board,

likely to lead to a conflict of interest. Any fees from such appointments

may be retained by the individual Executive Director.

From 13 April 2015, Richard Solomons, Chief Executive Officer, served

as a Non-Executive Director of Marks and Spencer PLC and received

fees of £70,000 accordingly.

No other current Executive Director holds any non-executive director

appointments at any other company.

Service contracts and notice periods for Executive Directors

All Executive Directors have rolling service contracts with a notice

period of 12 months. All new appointments will have 12-month notice

periods, unless, on an exceptional basis to complete an external

recruitment successfully, a longer initial period reducing to 12 months

is used. This is in accordance with the UK Corporate Governance Code.

All Directors are subject to election and annual re-election by

shareholders at the AGM.

Dividends paid to Executive Directors

An interim dividend of 17.7p per ordinary share (27.5¢ per ADR) was

paid on 2 October 2015 to shareholders on the Register of members

at the close of business on 28 August 2015.

The threshold award was subject to a global EBIT affordability

gate such that:

• if global EBIT was below 85% of target, no award would

be made; and

• if global EBIT was between 85% and 90% of target, half of

any award relating to the Guest HeartBeat and/or Employee

Engagement survey scores would be made.

These measures and outcomes are set out in the ‘At a glance’

section on page 70.

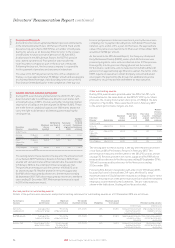

Outcome for 2015

Awards for 2015 will be paid 50% in cash and 50% in deferred

IHG shares, vesting three years after the date of grant, in February

2019. The deferred share awards are made in the form of forfeitable

shares that receive dividends during the three-year vesting period

and include the right to vote at shareholder meetings. They are not

subject to any further performance conditions. Kirk Kinsell left IHG

on 13 February 2015 and under the APP Plan rules is not entitled

to an award under the 2015 APP.

Executive

Director

Salary as at

31 December

2015

£

Award as

% of salary

Total value

of award

£000

Richard Solomons 792,000 149.9 1,187

Paul Edgecliffe-Johnson 460,000 149.9 690

Tracy Robbins 448,000 149.9 672

2013/15 LTIP (shares)

Operation

Awards are made annually and eligible executives will receive

shares at the end of that cycle, subject to achievement of the

performance measures. Growth in net rooms supply and RevPAR

is measured on a relative basis against the comparator group. This

group comprises the following major, globally branded competitors:

Accor Hotels, Choice Hotels International Inc., Hilton Worldwide,

Hyatt Hotels Corporation, Marriott International Inc., Starwood

Hotels and Resorts and Wyndham Hotels and Resorts. TSR

measures the return to shareholders by investing in IHG relative

to our competitors in the appropriate comparator group of global

hotels, as per the data sourced from Thomson Datastream.

The share price of 2,515p used to calculate the 2013/15 LTIP cycle

value shown in the single figure table is the average over the final

quarter of 2015. The share price in respect of the 2012/14 LTIP cycle

has been restated using the VWAP (Volume Weighted Average

Price) of 2,592p on the date of actual vesting on 18 February 2015.

The corresponding values shown in the 2014 report (prior to the

actual vesting) were an estimate and calculated using a share price

as at 31 December 2013 of 2,013p.

The Remuneration Committee determined that Kirk Kinsell would

be treated as a good leaver for the purposes of the LTIP awards,

in line with the DR Policy on termination of employment. Mr Kinsell

therefore retained all outstanding LTIP awards which will vest on

the normal vesting dates, subject to the satisfaction of performance

conditions, with the awards pro-rated to his leaving date. The

Remuneration Committee has reserved the right to determine that,

prior to the vesting of shares under each outstanding LTIP cycle,

Mr Kinsell’s entitlement to shares under the LTIP will be forfeited

in full if Mr Kinsell commits a breach of his continuing post-

termination contractual obligations.

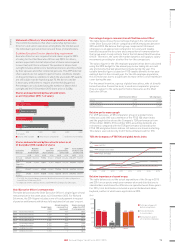

Outcome for 2013/15 cycle

This cycle will vest on 24 February 2016. Performance was below

the average of the comparator group on the relative growth in net

rooms supply and RevPAR measures and therefore these elements

will not vest. The figure for Paul Edgecliffe-Johnson includes 18,322

shares, which were granted prior to his appointment to the Board,

and an additional 9,454 shares in respect of his increased award,

pro-rated from the date of his appointment to the Board. This is

in line with the DR Policy. The outcome figure for Kirk Kinsell is his

maximum award pro-rated to his leaving date of 13 February 2015.

The outcome for this cycle is shown below:

Executive

Director

Maximum

opportunity

at grant

(number of

shares)

% of

maximum

opportunity

vested

Outcome

(number

of shares

awarded at

vest)

Total value

of award

£000

Richard

Solomons

76,319 50 38,159 960

Paul

Edgecliffe-

Johnson

27,776 50 13,888 349

Kirk Kinsell 53,049 50 18,419 463

Tracy Robbins 4 3,819 50 21,909 551

Net rooms supply and RevPAR growth were measured by reference

to the three years ending 30 September 2015; TSR was measured

by reference to the three years ending 31 December 2015.

The measures and outcomes are set out on page 70.

Tracy Robbins

Tracy Robbins was absent for health reasons for a portion of the

year, during which time any payments and awards made to her

were in line with the DR Policy and her contract of employment.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

73IHG Annual Report and Form 20-F 2015