Holiday Inn 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Borrowings included bank overdrafts of $39m (2014: $107m), which

were matched by an equivalent amount of cash and cash equivalents

under the Group’s cash pooling arrangements. Under these

arrangements, each pool contains a number of bank accounts with the

same financial institution, and the Group pays interest on net overdraft

balances within each pool. The cash pools are used for day-to-day cash

management purposes and are managed daily as closely as possible

to a zero balance on a net basis for each pool. Overseas subsidiaries are

typically in a cash-positive position, with the most significant balances

in the US, Canada, and Singapore, and the matching overdrafts are held

by the Group’s central treasury company in the UK.

Cash and cash equivalents include $1m (2014: $4m) that is not

available for use by the Group due to local exchange controls.

Information on the maturity profile and interest structure

of borrowings is included in notes 20 and 21 to the Group

Financial Statements.

The Group had net assets of $319m at 31 December 2015, (net

liabilities of $717m at 31 December 2014), with the increase primarily

as a result of the profit on disposal of InterContinental Hong Kong. At

the end of 2015, the Group was trading significantly within its banking

covenants and facilities.

Cash from operating activities

Net cash from operating activities totalled $628m for the year

ended 31 December 2015, up $85m on the previous year (largely

due to reduced cash flows relating to exceptional operating items).

Cash flow from operating activities is the principal source of cash

used to fund the ongoing operating expenses, interest payments,

maintenance capital expenditure and normal dividend payments of

the Group. The Group believes that the requirements of its existing

business and future investment can be met from cash generated

internally, disposition of assets, and external finance expected to

be available to it.

Cash from investing activities

Net cash inflows from investing activities totalled $589m, an increase of

$466m over 2014. $1,314m of disposal proceeds primarily related to the

disposal of InterContinental Paris – Le Grand and InterContinental Hong

Kong. Investing expenditure includes $438m, net of working capital

adjustments and cash acquired, on the acquisition of Kimpton Hotels

& Restaurants. Capital expenditure on property, plant and equipment

decreased from $84m in 2014 to $42m, as the prior year included

capital expenditure on InterContinental Paris – Le Grand and on the

first two hotels under conversion to the Group’s EVEN Hotels brand.

The Group had committed contractual capital expenditure of $76m

at 31 December 2015 (2014: $117m).

Cash used in financing activities

Net cash used in financing activities totalled $110m, which was

$626m lower than 2014, mainly due to $763m special dividends paid

and $110m shares repurchased in 2014. Net inflows from borrowings

were $279m lower than in 2014.

Overall net debt reduced during the year by $1,004m to $529m as

at 31 December 2015.

Off-balance sheet arrangements

At 31 December 2015, the Group had no off-balance sheet

arrangements that have or are reasonably likely to have a current

or future material effect on the Group’s financial condition, revenues

or expenses, results of operations, liquidity, capital expenditures or

capital resources.

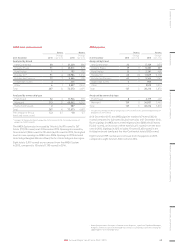

Contractual obligations

The Group had the following contractual obligations outstanding

as of 31 December 2015.

$m

Total

amounts

committed

Less

than

1 year

1-3

years

3-5

years

After 5

years

Long-term debt

obligationsa, b

1,407 370 – – 1,037

Interest payableb343 62 79 79 123

Derivatives 33–––

Finance lease

obligationsc

3,350 17 33 32 3,268

Operating lease

obligations

608 47 84 75 402

Agreed pension

scheme

contributionsd

99–––

Capital contracts

placed

76 76 – – –

Total 5,796 584 196 186 4,830

a Repayment period classified according to the related facility maturity date.

b Excluding bank overdrafts.

c Mainly represents the minimum lease payments related to the 99-year lease

(of which 90 years remain) on InterContinental Boston. Payments under the lease step up

at regular intervals over the lease term.

d Largely relates to US pension obligations.

Contingent liabilities

Contingent liabilities include performance guarantees with possible

cash outflows totalling $13m, guarantees over the debt of equity

investments of $30m, outstanding letters of credit of $37m, and

an indemnity over a $43m bank loan made to an associate. See

note 30 to the Group Financial Statements for further details.

49

IHG Annual Report and Form 20-F 2015

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS