Holiday Inn 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

place, which are explained in a Transparency Report issued by EY on

an annual basis. To ensure EY’s independence is safeguarded, lead

audit partners rotate every five years. This is the fifth year that the

current audit partner has been in place and a new audit partner is

being appointed for 2016 onwards.

The Committee continually reviews, and is satisfied with, the

independence, objectivity and effectiveness of the relationship with EY

as the external Auditor, and with the external audit process as a whole.

Non-audit services

EY provides non-audit services to the Group, which are governed,

so as to safeguard their objectivity and independence, by IHG’s Audit

and Non-Audit Services Pre-Approval Policy.

• The policy is re-approved by the Audit Committee annually, and,

for the 2015 financial year, the policy was updated and approved

at the December 2014 Audit Committee meeting.

• The policy requires that pre-approval is obtained from the Audit

Committee for all services before any work can be commenced,

in line with US SEC requirements. The Committee is prohibited

from delegating non-audit services approval to management.

• Compliance with the policy is actively managed and an analysis

of audit and non-audit services is reviewed by the Committee

at each meeting.

The Committee is aware of, and sensitive to, investor body guidelines

on non-audit fees. During 2015, 29 per cent of services provided to the

Group were non-audit services; these included areas such as advisory

work and corporate tax compliance. For fees paid to EY for non-audit

work during 2015, see page 106.

Annual Report – fair, balanced and understandable

A separate sub-committee meeting was held in February 2016 to

consider whether the Annual Report and Form 20-F 2015 provided

a fair, balanced and understandable view of the Group with the

necessary information for shareholders to assess the Group’s position

and performance, business model and strategy. Audit Committee

members provided comments on the content and considered: (i) the

process for preparing and verifying the Annual Report, which included

review by members of the Executive Committee and input from senior

colleagues in Operations, Strategy, HR, Finance, Risk and Legal; and

(ii) a report from the Chair of the Disclosure Committee, which also

reviews the processes for preparing and verifying the Annual Report.

The Committee also considered management’s analysis of how the

content benchmarked against the ‘fair, balanced and understandable’

communication principles.

Effectiveness of the Committee

The effectiveness of the Committee is monitored and assessed

annually through evaluation questionnaires and interviews and,

in 2015, we continued to conclude that it is operating effectively.

Our priorities for 2016

During 2016, the Committee will continue to focus on the integrity

of the internal financial controls and risk management systems,

IHG’s information security arrangements and, in particular, the

implementation of technology projects.

Ian Dyson

Audit Committee Chairman

22 February 2016

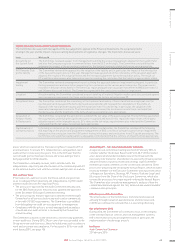

Significant matters in the 2015 Financial Statements

The Committee discussed with management the key judgements applied in the Financial Statements, the exceptional items

arising in the year and the impact of any accounting developments or legislative changes. The main items discussed were:

Issue What we did

Accounting for

the System Fund

The Committee reviewed a paper from management outlining the accounting approach adopted for the System Fund

and also the Company response to comment letters from the SEC on this topic. The Committee concluded that the

judgement in respect of the accounting treatment for the System Fund and related disclosures were appropriate.

IHG Rewards Club

points liability

The Committee reviewed the approach to the valuation of the liability and, in particular, the impact of the introduction

of the new points expiry policy in the year. Management was questioned on the consistency of the valuation approach

adopted, the results of the actuarial review and the increased judgement due to the expiration policy. The results of

EY’s audit procedures were also taken into account in reaching the conclusion that the liability is appropriately stated.

Impairment

testing

The Committee reviewed a management report outlining the approach taken on impairment testing and, in particular,

the key assumptions and sensitivities supporting the conclusions on the various asset categories. The impairments

recorded in the year on two hotels in The Americas region and against an associate investment in AMEA (see notes 12

and 14) were discussed in detail. The Committee agreed with the conclusions reached on impairment.

Litigation At each meeting, the Committee considered a report detailing all material litigation matters and discussed and agreed

any provisioning requirements for these matters based on the factors set out on page 99.

Exceptional items The Committee considered the consistency of the treatment and nature of items classified as exceptional over the

last five years and discussed the items disclosed as exceptional and reviewed the calculations of the profits on

disposal of the two significant assets sold in the year (see note 11) considering, in particular, the valuation of the

associated management contracts. The Committee also discussed the disclosures in note 5 and concluded that

the disclosures and the treatment of the items shown as exceptional were appropriate.

Acquisition of

Kimpton Hotels

& Restaurants

The Committee considered the work done to establish the fair value of the assets acquired. The Committee questioned

the assumptions underlying the significant assets recognised and noted in this regard the report from a third-party

valuation expert on the intangible assets. EY’s views on the fair values reported were also noted and the Committee

concluded that the fair values recognised were appropriate.

Capitalisation of

software projects

In forming a conclusion on the appropriateness of software capitalisation, the Committee considered the following:

GIA reporting on the project and programme management on GRS; a review of software assets from an impairment

perspective; the conclusion from the SOX control testing in this area; and conclusions from EY’s audit procedures. The

Committee concluded that capitalisation is adequately controlled and that the controls on impairment are appropriate.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

63IHG Annual Report and Form 20-F 2015