Holiday Inn 2015 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

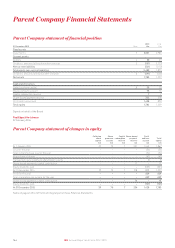

Notes to the Parent Company Financial Statements continued

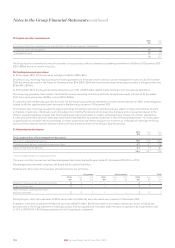

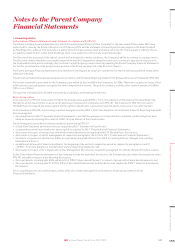

5. Creditors: amounts falling due within one year

2015

£m

2014

£m

Bank overdraft –1

£250m 6% bonds 2016 (note 6) 251 –

Amounts due to Group undertakings 300 1,132

551 1,133

6. Creditors: amounts falling due after more than one year

2015

£m

2014

£m

£250m 6% bonds 2016 –250

£400m 3.875% bonds 2022 397 396

£300m 3.75% bonds 2025 300 –

697 646

The 6% fixed interest sterling bonds were issued on 9 December 2009 and are repayable in full on 9 December 2016. Interest is payable annually

on 9 December each year. The bonds were initially priced at 99.465% of face value and are unsecured.

The 3.875% fixed interest sterling bonds were issued on 28 November 2012 and are repayable in full on 28 November 2022. Interest is payable

annually on 28 November each year. The bonds were initially priced at 98.787% of face value and are unsecured.

The 3.75% fixed interest sterling bonds were issued on 14 August 2015 and are repayable in full on 14 August 2025. Interest is payable annually

on 14 August each year. The bonds were initially priced at 99.014% of face value and are unsecured.

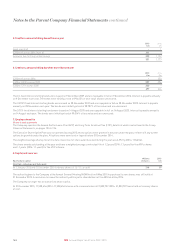

7. Employee benefits

Share-based payments

The Company operates the Annual Performance Plan (APP) and Long Term Incentive Plan (LTIP), details of which can be found in the Group

Financial Statements, on pages 134 to 136.

The Executive Share Option Plan was not operated during 2015 and no options were granted in the year under the plan, neither will any further

options be granted under the plan. All options were exercised or lapsed before 31 December 2014.

The weighted average share price at the date of exercise for share awards vested during the year was 2,592.1p (2014: 1,966.5p).

The share awards outstanding at the year end have a weighted average contractual life of 1.2 years (2014: 1.1 years) for the APP scheme

and 1.1 years (2014: 1.1 years) for the LTIP scheme.

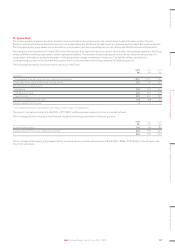

8. Capital and reserves

Equity share capital

Millions

of shares

2015

£m

Allotted, called up and fully paid

At 1 January 2015 and 31 December 2015 (ordinary shares of 15 265/329p each) 248 39

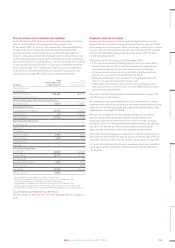

The authority given to the Company at the Annual General Meeting (AGM) held on 8 May 2015 to purchase its own shares was still valid at

31 December 2015. A resolution to renew the authority will be put to shareholders at the AGM on 6 May 2016.

The Company no longer has an authorised share capital.

At 31 December 2015, 11,538,456 (2014: 11,538,456) shares with a nominal value of £1,823,707 (2014: £1,823,707) were held as treasury shares

at cost.

148 IHG Annual Report and Form 20-F 2015