Holiday Inn 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Quick read

I

I

I

H

H

G

G

a

t

t

a

g

g

la

n

n

c

e

e

e

a Details of how non-GAAP measures are calculated are set out on page 155.

b

Underlying excludes the impact of owned-asset disposals, managed leases, significant liquidated damages,

Kimpton, and exceptional items translated at constant currency by applying prior-year exchange rates.

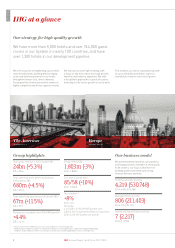

Our business modelGroup highlights

Group revenue ($)

1,803m (-3%)

2014: 1,858m

Full-year dividend (¢/p)

85/58 (+10%)

2014: 77/48.6

Fee revenuea, b

+8%

2014: +7%

Driven by:

4.4% (2014: 6.1%) RevPAR growth; and

4.8% (3.2% excluding the Kimpton acquisition,

2014: 3.4%) net System size growth

Our strategy for high-quality growth

We have more than 5,000 hotels and over 744,000 guest

rooms in our System in nearly 100 countries, and have

over 1,300 hotels in our development pipeline.

We are focused on strengthening our portfolio

of preferred brands, building and leveraging

scale, and delivering revenue to our hotels

through the lowest-cost, direct channels.

Our proposition to third-party hotel owners is

highly competitive and drives superior returns.

We execute an asset-light strategy with

a focus on the most attractive, high-growth

markets and industry segments. We take

a disciplined approach to capital allocation,

investing for the future growth of our brands.

This enables us to drive sustainable growth

in our profitability and deliver superior

shareholder returns over the long term.

Total gross revenue in IHG’s System ($)a

24bn (+5.3%)

2014: 23bn

Total operating profit before exceptional

items and tax ($)a

680m (+4.5%)

2014: 651m

Total underlying operating profit growth ($)a, b

67m (+11.5%)

2014: 57m

Revenue per available room (RevPAR) growtha

+4.4%

2014: +6.1%

We predominantly franchise our brands to,

and manage hotels on behalf of, third-party

hotel owners; our focus is therefore on

building preferred brands and strong

revenue delivery systems.

Franchised hotels (rooms)

4,219 (530,748)

2014: 4,096 (514,984)

Managed hotels (rooms)

806 (211,403)

2014: 735 (192,121)

Owned and leased hotels (rooms)

7 (2,217)

2014: 9 (3,190)

The Americas

see pages 35 to 37

Europe

see pages 38 to 40

2IHG Annual Report and Form 20-F 2015