Holiday Inn 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

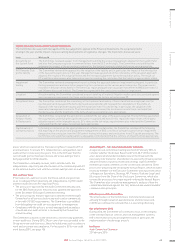

Directors’ Remuneration Report continued

Audited

This Annual Report on Directors’ Remuneration explains how the Directors’

Remuneration Policy (DR Policy) was implemented in 2015 and the resulting payments

each of the Directors received. This report is subject to an advisory vote by shareholders

at the 2016 AGM. The notes to the single-figure table provide further detail, where

relevant, for each of the elements that make up the total single figure of remuneration

in respect of each of the Executive Directors.

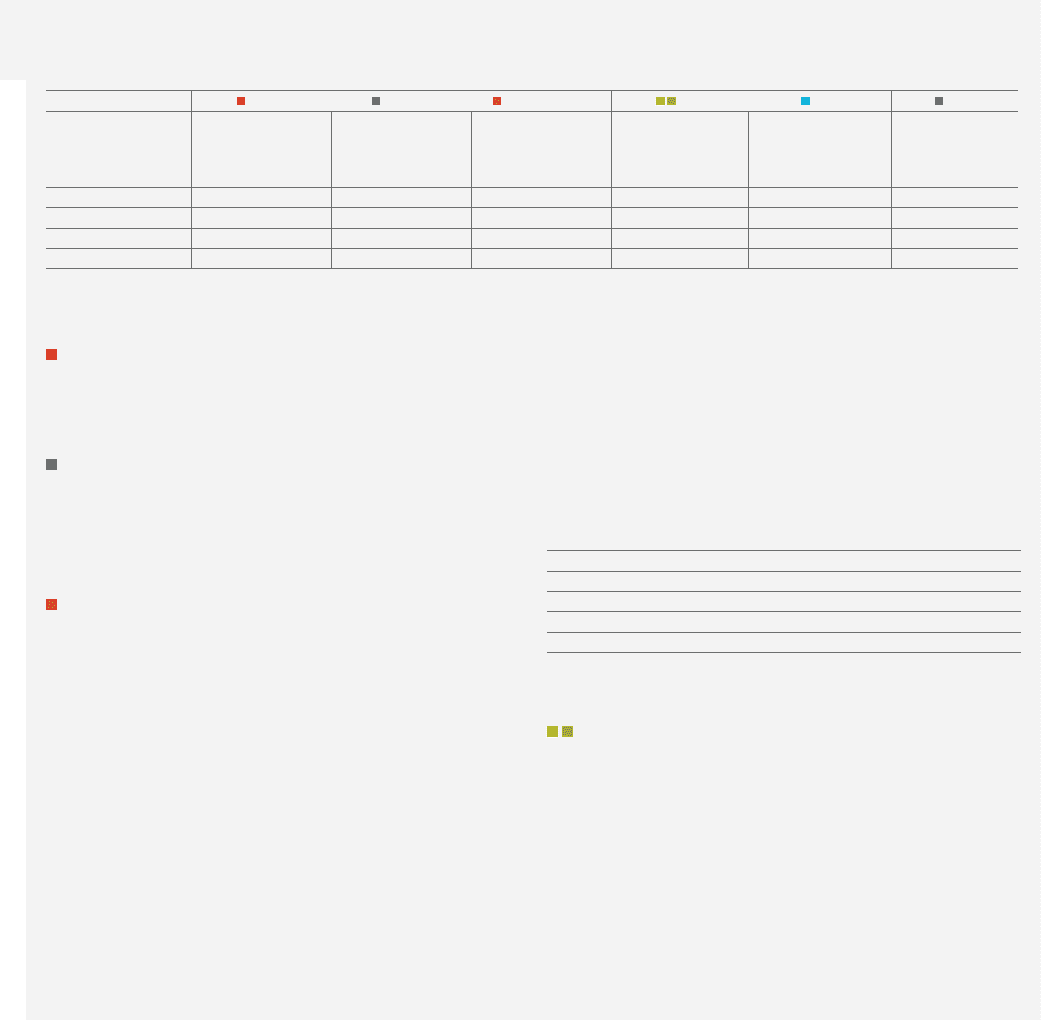

Annual Report on Directors’ Remuneration

Single total figure of remuneration – Executive Directors

Fixed pay Variable pay

Salary Benefits Pension benefit APP LTIP Total

Executive Directors 2015

£000

2014

£000

2015

£000

2014

£000

2015

£000

2014

£000

2015

£000

2014

£000

2013/15

cycle

(value of

shares)

£000

2012/14

cycle

(value of

shares)

£000

2015

£000

2014

£000

Richard Solomons 785 759 31 30 236 3,186 1,187 1,128 960 1,508 3,199 6,611

Paul Edgecliffe-Johnson 450 420 23 28 135 126 690 619 349 426 1,647 1,619

Kirk Kinsell 64 479 16 27 30 111 0365 463 996 573 1,978

Tracy Robbins 445 434 30 20 134 130 672 644 551 862 1,832 2,090

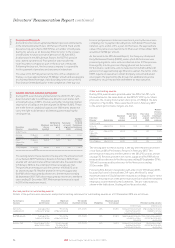

Fixed pay

Salary: salary paid for the year. Kirk Kinsell was paid in US

dollars. The figure shown is the actual amount earned for the

portion of the year Mr Kinsell remained employed until he left

IHG on 13 February 2015. Sterling equivalents were calculated

using an exchange rate of $1=£0.65.

Benefits: for Executive Directors, this includes, but is not limited

to, taxable benefits such as company car, healthcare and life

cover. Provision during 2015 was in line with previous years

and the approved DR Policy. No extraordinary payments

were made.

Pensions

Pension benefit: for current Executive Directors, in line with

DR Policy, the value of IHG contributions to pension plans and

any cash allowances, equalling 30% of salary, paid in lieu of

pension contributions.

• The 2014 figure for Richard Solomons included an amount of

£2.958m in respect of a one-off cash payment relating to pension

entitlements and was fully explained in the 2014 report.

• Richard Solomons did not participate in any IHG pension plan

in 2015 and instead received a cash allowance of 30% of salary

equal to £235,575. Mr Solomons also received life assurance

cover of six times salary.

• Neither Paul Edgecliffe-Johnson nor Tracy Robbins participated

in any IHG pension plan in 2015 and instead they both received a

cash allowance of 30% of salary equal to £135,000 and £133,575

respectively. They both also received life assurance cover

of four times pensionable salary.

• Kirk Kinsell participated in the US 401(k) Plan and the US

Deferred Compensation Plan. The US 401(k) Plan is a tax

qualified plan providing benefits on a defined contribution

basis, with the member and relevant company both contributing.

The US Deferred Compensation Plan is a non-tax qualified plan,

providing benefits on a defined contribution basis, with the

member and the relevant company both contributing.

Contributions made by, and in respect of, Kirk Kinsell in these

plans, up to his date of leaving on 13 February 2015, were:

£a

Director’s contributions to US Deferred Compensation Plan 1,389

Director’s contributions to US 401(k) Plan 6,943

Company’s contributions to US Deferred Compensation Plan 27,177

Company’s contributions to US 401(k) Plan 2,777

Age at 31 December 2015 60

a Sterling values have been calculated using an exchange rate of $1=£0.65.

Variable Pay

2015 APP (cash and deferred shares)

Operation

Award levels were determined based on salary as at 31 December

2015 on a straight-line basis between threshold and target, and

target and maximum, and are based on achievement vs target under

each measure:

• Threshold is the minimum level that must be achieved for there

to be an award in relation to that measure; for achievement

below this, no award is made (57.5% of salary).

• Target is the target level of achievement and results in a target

award for that measure (115% of salary).

• Maximum is the level of achievement at which a maximum award

for that measure is received (200% of salary).

Notes to single total figure of remuneration – Executive Directors

72 IHG Annual Report and Form 20-F 2015