Holiday Inn 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group Financial Statements continued

20. Financial risk management continued

Credit risk

Credit risk on treasury transactions is minimised by operating a policy on the investment of surplus cash that generally restricts counterparties

to those with a BBB credit rating or better or those providing adequate security. The Group uses long-term credit ratings from Standard and

Poor’s, Moody’s and Fitch Ratings as a basis for setting its counterparty limits. During the year, the policy was amended from a minimum A credit

rating to reflect current market conditions.

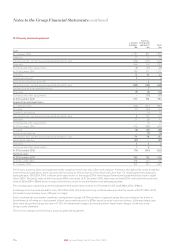

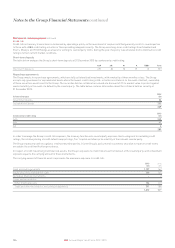

Short-term deposits

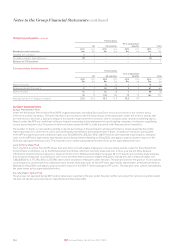

The table below analyses the Group’s short-term deposits at 31 December 2015 by counterparty credit rating.

AAA AA- A+ A BBB+ Total

Short-term deposits 497 82 30 79 15 703

Repurchase agreements

The Group invests in repurchase agreements, which are fully collateralised investments, with a maturity of three months or less. The Group

accepts only government or supranational bonds where the lowest credit rating is AA- or better as collateral. In the event of default, ownership

of these securities would revert to the Group. The securities held as collateral are valued at a discount of 2% to market value to protect against

market volatility in the event of a default by the counterparty. The table below contains information about the collateral held as security at

31 December 2015.

Collateral by type

2015

$m

Government bonds 36

Supranational bonds 253

289

Collateral by credit rating

2015

$m

AAA 243

AA+ 42

AA 4

289

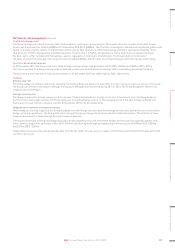

In order to manage the Group’s credit risk exposure, the treasury function sets counterparty exposure limits using metrics including credit

ratings, the relative placing of credit default swap pricings, Tier 1 capital and share price volatility of the relevant counterparty.

The Group trades only with recognised, creditworthy third parties. Itis the Group’s policy that all customers who wish to trade on credit terms

are subject to credit verification procedures.

In respect of credit risk arising from financial assets, the Group’s exposure to credit risk arises from default of the counterparty, with a maximum

exposure equal to the carrying amount of theseinstruments.

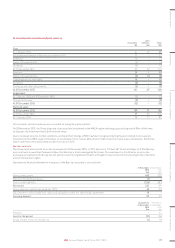

The carrying amount of financial assets represents the maximum exposure to credit risk.

2015

$m

2014

$m

Cash and cash equivalents 1,137 162

Equity securities available-for-sale 150 144

Derivative financial instruments –2

Loans and receivables:

Other financial assets 134 113

Trade and other receivables, excluding prepayments 391 388

1,812 809

124 IHG Annual Report and Form 20-F 2015