Holiday Inn 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Independent Auditor’s UK Report

Independent Auditor’s Report to the

members of InterContinental Hotels

Group PLC

Our opinion on the Financial Statements

In our opinion:

• InterContinental Hotels Group PLC’s Group

Financial Statements and Parent Company

Financial Statements (the Financial

Statements) give a true and fair view

of the state of the Group’s and of the Parent

Company’s affairs as at 31 December

2015 and of the Group’s profit for the

year then ended;

• the Group Financial Statements have

been properly prepared in accordance

with International Financial Reporting

Standards (IFRSs) as adopted by

the European Union;

• the Parent Company Financial Statements

have been properly prepared in accordance

with United Kingdom Accounting Standards

(United Kingdom Generally Accepted

Accounting Practice), including Financial

Reporting Standard 101 ‘Reduced Disclosure

Framework’; and

• the Financial Statements have been

prepared in accordance with the

requirements of the Companies Act 2006,

and, as regards the Group Financial

Statements, Article 4 of the IAS Regulation.

What we have audited

InterContinental Hotels Group PLC’s (IHG’s, the Group’s) Financial Statements for the year

ended 31 December 2015 comprise:

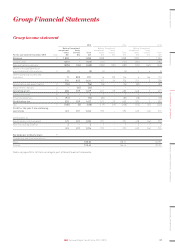

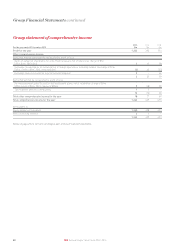

Group Company

Group income statement Parent company statement of financial position

Group statement of comprehensive income Parent company statement of changes in equity

Group statement of changes in equity Related notes 1 to 10 to the Financial Statements

Group statement of financial position

Group statement of cash flows

Related notes 1 to 33 to the Financial Statements

The financial reporting framework that has been applied in the preparation of the Group

Financial Statements is applicable law and IFRSs as adopted by the European Union. The

financial reporting framework that has been applied in the preparation of the Parent Company

Financial Statements is applicable law and United Kingdom Accounting Standards (United

Kingdom Generally Accepted Accounting Practice), including Financial Reporting Standard

101 ‘Reduced Disclosure Framework’.

Overview of our audit approach

Risks of material

misstatement

• Accounting for the hotel assessments collected as part of the revenue cycle and the allocation

of expenditures related to the marketing, advertising and loyalty programmes (the System Fund)

• The valuation of the future redemption of IHG Rewards Club points liability.

• Capitalisation of software assets and carrying value of legacy systems.

• Kimpton acquisition – purchase price accounting.

Audit scope • We performed an audit of the complete financial information of 19 components and audit

procedures on specific balances for a further 20 components.

• The components where we performed full or specific audit procedures accounted for 88%

of profit before tax adjusted for pre-tax exceptional items and 79% of revenue.

Materiality • Overall Group materiality of $30m which represents 5% of profit before tax adjusted for pre-tax

exceptional items.

Risk Our response to the risk

What we concluded

to the Audit Committee

Accounting for the hotel assessments

collected as part of the revenue cycle and

the allocation of expenditures related to

the marketing, advertising and loyalty

programmes (the System Fund)

Refer to the Strategic Report (page 47), the

Audit Committee Report (page 63); Critical

accounting policies and the use of judgements,

estimates and assumptions (page 98); and

note 32 of the Group Financial Statements.

As outlined in the Strategic Report on page 47,

the System Fund (the Fund) is a key part of the

Group’s business model.

For the year ended 31 December 2015, and as

detailed in note 32, the Fund has assessment

fees and contributions of $1,351m and expenses

of $1,455m. These amounts are not included in

IHG’s income statement.

We focus on this area because there is a risk

that the hotel assessments could be included

in IHG’s reported revenue, which would

overstate IHG’s revenues; or that Group costs

are incorrectly charged to the Fund, improperly

reducing IHG’s expenses and leading to a

misstatement of IHG’s income statement.

The magnitude of the risk (ie, the likelihood

of occurrence and the size of an error should

it occur) is consistent with the prior year.

We have tested the controls over the calculation of hotel assessments,

allocation of expenses, related IT systems and eliminations from

IHG’s ledgers.

For a sample of hotel assessments and expenses recorded in the Fund,

we agreed that they are in accordance with the principles as agreed with

the IHG Owners Association; supported by appropriate documentation

and, based on our inspection of that supporting documentation, have

made an independent assessment of whether the hotel assessments

and contributions and expenses relate to the Fund.

Given the accounting treatment adopted for the Fund is a key judgement;

we considered the appropriateness of the classification of the System

Fund surplus between short-term and long-term, and the related

disclosures provided in critical accounting policies and the use of

judgements, estimates and assumptions (page 98) and note 32 of the

Group Financial Statements.

In accordance

with the principles

agreed with the IHG

Owners Association

we are satisfied that

System Fund hotel

related assessment

fees, contributions

and expenses, have

been appropriately

identified and have

been excluded from

IHG’s Group income

statement.

Our assessment of risk of material misstatement

We identified the risks of material misstatement described below as those that had the greatest effect on our overall audit strategy, the allocation of

resources in the audit and the direction of the efforts of the audit team. In addressing these risks, we have performed the procedures below which

were designed in the context of the Financial Statements as a whole and, consequently, we do not express any opinion on these individual areas.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

81IHG Annual Report and Form 20-F 2015