Holiday Inn 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Statement of Directors’ shareholdings and share interests

The Committee believes that share ownership by Executive

Directors and senior executives strengthens the link between

the individual’s personal interests and those of shareholders.

Guideline Executive Director shareholding requirement

Executive Directors are required to hold shares equal to 300%

of salary for the Chief Executive Officer and 200% for others,

and are expected to hold all shares (net of share sales required

to meet tax) until this is achieved. The number of shares held

outright includes all Directors’ beneficial interests and those held

by their spouses and other connected persons. The APP deferred

share awards are not subject to performance conditions. Details

on the performance conditions to which the unvested LTIP awards

are still subject can be found on page 70. We do not consider

it necessary at this time to require a further holding period.

Percentages are calculated using the number of shares held

outright and the 31 December 2015 share price of 2,658p.

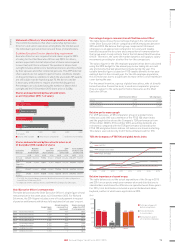

Shares and awards held by Executive Directors

as at 31 December 2015: % of salary

% of salary

Shares held outright Total shares and awards Guideline shareholding

224 1,215

631 1,824

127 867

1,227 2,203

300

200

Richard Solomons

Paul Edgecliffe-Johnson

Kirk Kinsell

Tracy Robbins

2,500

2,0001,5001,000500

0

Shares and awards held by Executive Directors as at

31 December 2015: number of shares

Executive

Director

Number

of shares

held outright

APP

deferred

share awards

LTIP

share awards

(unvested)

Total number

of shares and

awards held

2015 2014 2015 2014 2015 2014 2015 2014

Richard

Solomons

365,625 382,533 71,552 81,24 0 219,320 262,234 656,497 726,007

Paul

Edgecliffe-

Johnson

22,014 10,583 19,821 12,860 108,219 102,223 150,054 125,666

Kirk

Kinsell

117,640a117,6 4 0b49,580 49,580 172,938 172,938 340,158 340,158

Tracy

Robbins

37,726 51,418 41,808 48,932 125,168 150,041 204,702 250,391

a For 2015, the shareholdings shown for Mr Kinsell are as at his date of departure

from IHG on 13 February 2015.

b Comprised 117,092 ordinary shares and 548 American Depositary Receipts.

Chief Executive Officer’s remuneration

The table below shows the Chief Executive Officer’s single figure of total

remuneration for the seven years to 31 December 2015. For Richard

Solomons, the 2014 figure includes a one-off cash payment in respect

of pension entitlements which was fully explained in last year’s report.

Single figure

£000

Annual incentive

received (% of

maximum)

Shares received

under the LTIP

(% of maximum)

2015 Richard Solomons 3,199 75.0 50.0

2014 Richard Solomons 6,528 74.0 56.1

2013 Richard Solomons 3,149 74.0 59.0

2012 Richard Solomons 4,881 68.0 100.0

2011 Richard Solomons

Andrew Cosslett

4,724

3,770

83.0

43.0

73.9

61.6

2010 Andrew Cosslett 5,430 100.0 73.8

2009 Andrew Cosslett 1,953 0 46.0

Audited

Percentage change in remuneration of Chief Executive Officer

The table below shows the percentage change in the remuneration

of the Chief Executive Officer compared with UK employees between

2014 and 2015. We believe that a group comprised of UK-based

employees is an appropriate comparator for salary and taxable

benefits because the structure and composition of remuneration for

that group most closely reflects that of the UK-based Chief Executive

Officer. Therefore, the same UK market dynamics will apply to salary

movements providing for a better like-for-like comparison.

The salary figure for the UK employee population has been calculated

using the 2015 budget for the annual pay review taking into account

any promotions/marked adjustments made during the year. The

taxable benefits figure is based on P11D taxable benefits for tax year

ending 5 April in the relevant year. For the UK employee population,

this increase was due to a significant increase in the cost of healthcare

cover during the year.

For the annual incentive, a group of global executives, who sit directly

below Executive Committee level, is used as a comparator group as

they are subject to the same performance measures as the Chief

Executive Officer.

Chief Executive Officer UK employees

Salary +3.5% +3.0%

Taxable benefits +3.3% +60.6%

Annual incentive +5.2% +4.8%

Relative performance graph

For LTIP purposes, a TSR comparator group of a global hotels

index was used. IHG was a member of the FTSE 100 share index

and the graph below shows the Company’s TSR performance from

31 December 2008 to 31 December 2015, assuming dividends are

reinvested, compared with the TSR performance achieved by the

FTSE 100 and global hotels indices. All indices are shown in sterling.

This data is sourced directly from Thomson Datastream for IHG.

TSR: the Company vs FTSE 100 and global hotels index

100

200

300

400

500

600

700

2008 2009 2010 2011 2012 2013 2014 2015

IHG PLC

Global hotels index

FTSE 100 index

Relative importance of spend on pay

The table below sets out the actual expenditure of the Group in 2015

and 2014 on corporate employee remuneration and distributions to

shareholders and shows the difference in spend between those years.

For 2014, total distributions included a special dividend and share

buyback, neither of which were applicable in 2015.

Total operating profit

before exceptionals

Remuneration paid to

all corporate employees

Total distributions

to shareholders

1,200

1,000

400

600

800

200

0

680 651

188

1,052

628 657

($m)

2014 2014

+ 4.5% – 82.1% – 4.4%

2015 2015 2015 2014

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

75IHG Annual Report and Form 20-F 2015