Holiday Inn 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

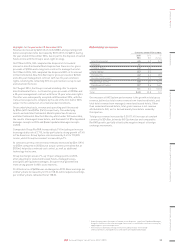

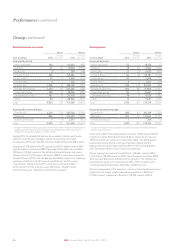

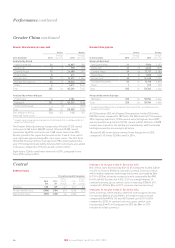

Europe results

12 months ended 31 December

2015

$m

2014

$m

2015 vs

2014 %

change

2013

$m

2014 vs

2013 %

change

Revenue

Franchised 104 104 –104 –

Managed 131 159 (17.6) 156 1.9

Owned and leased 30 111 (73.0) 140 (20.7)

Total 265 374 (29.1) 400 (6.5)

Percentage of Group

revenue

14.7 20.1 (5.4) 21.0 (0.9)

Operating profit before

exceptional items

Franchised 77 78 (1.3) 79 (1.3)

Managed 28 30 (6.7) 30 –

Owned and leased 114 (92.9) 30 (53.3)

106 122 (13.1) 139 (12.2)

Regional overheads (28) (33) 15.2 (34) 2.9

Total 78 89 (12.4) 105 (15.2)

Percentage of Group

operating profit before

central overheads and

exceptional items

9.4 11.0 (1.6) 12.8 (1.8)

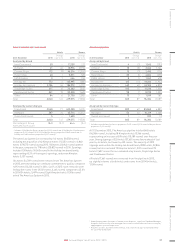

Highlights for the year ended 31 December 2015

Comprising 660 hotels (106,711 rooms) at the end of 2015, Europe

represented 14% of the Group’s room count and 9% of the Group’s

operating profit before central overheads and exceptional operating

items for the year ended 31 December 2015. Revenues are primarily

generated from hotels in the UK and continental European gateway

cities. The largest proportion of rooms in Europe are operated under

the franchise business model primarily in the upper midscale segment

(Holiday Inn and Holiday Inn Express). Similarly, in the upscale segment,

Crowne Plaza is predominantly franchised, whereas, in the luxury

segment, the majority of InterContinental-branded hotels are operated

under management agreements.

Revenue and operating profit before exceptional items decreased

by $109m (29.1%) to $265m and by $11m (12.4%) to $78m respectively.

This was primarily due to InterContinental Paris – Le Grand becoming

a managed property and the negative impact of significant foreign

exchange translation movement. On an underlyinga basis, revenue

and operating profit increased by $13m (7.5%) and $17m (23.3%)

respectively, with the transition of 61 UK managed hotels to franchise

contracts driving an increase in underlying franchise fees, and cost

efficiencies reducing regional overheads. Overall, comparable

RevPAR in Europe increased by 5.4%, with the UK increasing by 5.1%,

led by rate growth in both London and the provinces, and Germany

growing by 4.4%.

Franchised revenue remained flat at $104m, whilst operating profit

decreased by $1m (1.3%) to $77m. On a constant currency basis,

revenue and operating profit increased by $15m (14.4%) and $11m

(14.1%) respectively, following the transition of UK managed hotels

to franchise contracts.

Managed revenue decreased by $28m (17.6%) and operating profit

decreased by $2m (6.7%). Revenue and operating profit included $75m

(2014: $90m) and $1m (2014: $2m) respectively from managed leases.

Excluding properties operated under this arrangement, and on a

constant currency basis, revenue decreased by $2m (2.9%) and

operating profit increased by $3m (10.7%), impacted by the transition

of UK managed hotels to franchise contracts.

The one remaining hotel in the owned and leased estate,

InterContinental Paris – Le Grand, was sold on 20 May 2015 for gross

proceeds of €330m. Owned and leased revenue decreased by $81m

(73.0%) to $30m and operating profit decreased by $13m (92.9%) to $1m.

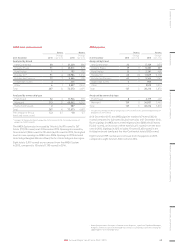

Highlights for the year ended 31 December 2014

Revenue and operating profit before exceptional items decreased

by $26m (6.5%) to $374m and by $16m (15.2%) to $89m respectively.

On an underlyinga basis, revenue and operating profit increased by

$4m (1.4%) and $3m (3.5%) respectively. Overall, comparable RevPAR

in Europe increased by 5.1%. The UK achieved a particularly strong

comparable RevPAR growth of 8.9%, with double-digit growth in

the first and third quarters. Comparable RevPAR in Germany was

also strong, increasing by 4.1%, driven by continued growth in

domestic output and a rise in employment, whilst IHG hotels in the

Commonwealth of Independent States (CIS) collectively experienced

a comparable RevPAR decline of 4.0%, reflecting a challenging

economic climate in the region during 2014.

Franchised revenue remained flat at $104m, whilst operating profit

decreased by $1m (1.3%) to $78m. Excluding the benefit of a $9m

liquidated damages receipt in 2013, revenue and operating profit

increased by $8m (8.4%) and $8m (11.4%) respectively at constant

currency. This underlying growth was mainly driven by an increase

in royalties of 8.0%, reflecting comparable RevPAR growth of 5.3%,

together with 5.7% rooms growth.

Managed revenue increased by $3m (1.9%) to $159m, whilst operating

profit was flat with 2013 at $30m. Revenue and operating profit

included $90m (2013: $89m) and $2m (2013: $2m) respectively

from managed leases. Excluding properties operated under this

arrangement and on a constant currency basis, revenue increased

by $3m (4.5%), whilst operating profit was flat. At the end of 2014,

IHG commenced a process to restructure the majority of its UK

managed hotels to new franchised contracts.

In the owned and leased estate, revenue decreased by $29m (20.7%)

to $111m and operating profit decreased by $16m (53.3%) to $14m.

At constant currency and excluding the impact of the disposal of

InterContinental London Park Lane (which contributed revenue and

operating profit of $22m and $8m respectively in 2013), owned and

leased revenue and operating profit both decreased by $7m. These

declines were driven by InterContinental Paris – Le Grand due to the

refurbishment of the Salon Opera ballroom in the first half of 2014.

The hotel delivered revenue and operating profit of $111m and $15m

respectively, a decrease of 5.9% and 34.8% compared to 2013, whilst

RevPAR decreased by 4.7%.

a Underlying excludes the impact of owned-asset disposals, significant liquidated damages,

Kimpton, and the results from managed-lease hotels, translated at constant currency by

applying prior-year exchange rates.

39

IHG Annual Report and Form 20-F 2015

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS