Holiday Inn 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

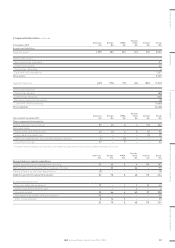

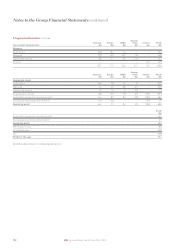

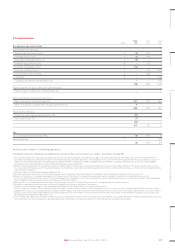

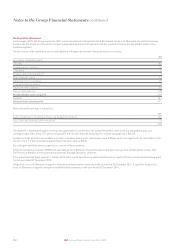

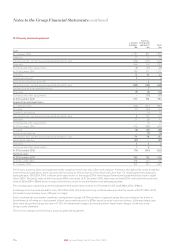

5. Exceptional items

Note

2015

$m

2014

$m

2013

$m

Exceptional operating items

Administrative expenses:

Venezuelan currency losses a(4) (14) –

Reorganisation costs b(6) (29) –

Corporate development costs c(5) ––

Kimpton acquisition costs d–(7) –

Kimpton integration costs e(10) ––

Pension settlement cost f–(6) (147)

UK portfolio restructuring g–(45) –

Litigation h––(10)

Loyalty programme rebranding costs i ––(10)

(25) (101) (167)

Share of profits of associates and joint ventures:

Share of gain on disposal of a hotel (note 14) ––6

Other operating income and expenses:

Gain on disposal of hotels (note 11) 871 130 166

Gain on disposal of investment in associate (note 14) 9––

880 130 166

Impairment charges:

Property, plant and equipment (note 12) (27) ––

Associates (note 14) (9) ––

(36) ––

819 29 5

Tax

Tax on exceptional operating items j(8) (29) (6)

Exceptional tax k––(45)

(8) (29) (51)

All items above relate to continuing operations.

The above items are treated as exceptional by reason of their size or nature, as further described on page 98.

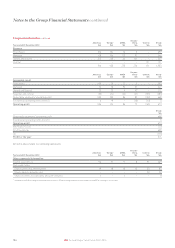

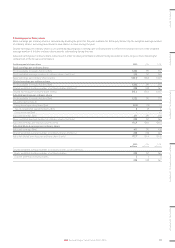

a Arises from changes to the Venezuelan exchange rate mechanisms and the adoption of the SIMADI exchange rate in 2015 and the SICAD II exchange rate in 2014, these being the most

accessible exchange rates open to the Group for converting its bolivar earnings into US dollars. The exceptional losses arise from the re-measurement of the Group’s bolivar assets and

liabilities to the relevant exchange rates, being approximately $1=190VEF on adoption of SIMADI and approximately $1=50VEF on adoption of SICAD II. The Group has used the SIMADI

exchange rate for translating the results of its Venezuelan operations since 1 April 2015.

b Relates to the implementation of more efficient processes and procedures in the Group’s Global Technology infrastructure to help mitigate future cost increases, together with, in 2014,

costs incurred in introducing a new HR operating model across the business to provide enhanced management information and more efficient processes. These restructuring programmes

have now been completed.

c Primarily legal costs related to development opportunities.

d Related to acquisition transaction costs incurred in the period to 31 December 2014 on the acquisition of Kimpton, which completed on 16 January 2015 (see note 10).

e Relates to the initial costs of integrating Kimpton into the operations of the Group. The integration programme remains in progress and further costs will be incurred in 2016.

f In 2014, resulted from a partial cash-out of the UK unfunded pension arrangements and, in 2013, resulted from a buy-in (and subsequent buy-out in 2014) of the Group’s UK funded defined

benefit obligations with the insurer, Rothesay Life. See note 25 for further details.

g Related to the costs of securing a restructuring of the UK hotel portfolio which resulted in the transfer of 61 managed hotels to franchise contracts.

h Related to an agreed settlement in respect of a lawsuit filed against the Group in the Greater China region.

i Related to costs incurred in support of the worldwide rebranding of IHG Rewards Club that was announced 1 July 2013.

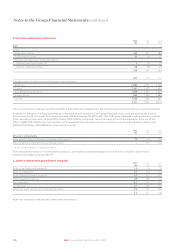

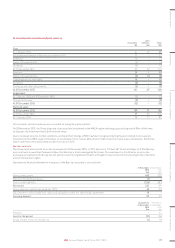

j In 2015, comprises a charge of $56m relating to disposal of hotels, a credit of $21m in respect of the 2014 disposal of an 80.1% interest in InterContinental New York Barclay reflecting the

judgement that state tax law changes would now apply to the deferred gain, and credits of $27m for current and deferred tax relief on other operating exceptional items of current and prior

periods. In 2014, the charge comprised $56m relating to the disposal of an 80.1% interest in InterContinental New York Barclay offset by a credit of $27m relating to a restructuring of the

UK hotel portfolio and other reorganisation costs.

k In 2013, comprised a deferred tax charge of $63m consequent on the disposal of InterContinental London Park Lane, together with charges and credits of $38m and $19m respectively from

associated restructurings (including intra-group dividends) and refinancings, offset by the recognition of $37m of previously unrecognised tax credits.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

107IHG Annual Report and Form 20-F 2015