Holiday Inn 2015 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

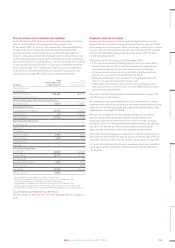

Directors’ Report

Major institutional shareholders

As at 22 February 2016, the Company had been notified of the following

significant holdings in its ordinary shares under the UK Disclosure and

Transparency Rules (DTRs).

As at

22 February

2016

As at

16 February

2015

As at

17 February

2014

Shareholder

Ordinary

shares

/ADSsa%a

Ordinary

shares

/ADSsa%a

Ordinary

shares

/ADSsa%a

BlackRock,

Inc.

12,916,001b 5.47 n/a n/a 13,061,965 5.01

Cedar Rock

Capital

Limited

14,923,417 5.07 14,923,417 5.07 14,923,417 5.07

Boron

Investments

BV

11,850,000 5.02 7,500,000 3.18 n/a n/a

The Capital

Group

Companies,

Inc.

n/a n/a 8,557,888 3.30 8,557,888 3.30

a The number of shares and percentage of voting rights was determined at the time of the

relevant disclosures made in accordance with Rule 5 of the DTRs and doesn’t reflect the

impact of any share consolidation or any changes in shareholding subsequent to the date

of notification that are not required to be notified to us under the DTRs.

b Total shown includes 475,102 contracts for difference and 440,015 qualifying financial

instruments to which voting rights are attached.

The Company’s major shareholders have the same voting rights as

other shareholders. The Company does not know of any arrangements

the operation of which may result in a change in its control.

For further details on shareholder profiles, see page 172.

2015 share awards and grants to employees

No awards or grants over shares were made during 2015 that would

be dilutive of the Company’s ordinary share capital. Our current policy

is to settle the majority of awards or grants under the Company’s

share plans with shares purchased in the market; however, the Board

continues to review its policy. Those options, which were previously

granted up to 2005, have now all been exercised or have lapsed and,

therefore, as at 31 December 2015, no options were outstanding.

The Company has not utilised the authority given by shareholders

at any of its AGMs to allot shares for cash without first offering such

shares to existing shareholders.

Employee share ownership trust (ESOT)

IHG operates an ESOT for the benefit of employees and former

employees. The ESOT purchases ordinary shares in the market and

releases them to current and former employees in satisfaction of share

awards. During the year, the ESOT released 1,580,314 shares and at

31 December 2015 it held 976,122 ordinary shares in the Company.

The ESOT adopts a prudent approach to purchasing shares, using funds

provided by the Group, based on expectations of future requirements.

Much of the information previously provided as part of the Directors’

Report is now required, under company law, to be presented as part

of the Strategic Report. This Directors’ Report includes the information

required to be given in line with the Companies Act or, where provided

elsewhere, an appropriate cross reference is given. The corporate

governance statement approved by the Board is provided on pages

52 to 67 and incorporated by reference herein.

Subsidiaries, joint ventures and associated undertakings

The Group has over 300 subsidiaries, joint ventures and associated

undertakings. A complete list of these entities is provided at note 33

of the Group Financial Statements on pages 140 to 141.

Directors

For biographies of the current Directors see pages 55 to 57.

Directors’ and officers’ (D&O) liability insurance and existence

of qualifying indemnity provisions

The Company maintains the Group’s D&O liability insurance policy,

which covers Directors and officers of the Company defending civil

proceedings brought against them in their capacity as Directors or

officers of the Company (including those who served as Directors or

officers during the year). There were no indemnity provisions relating

to the UK pension plan for the benefit of the Directors during 2015.

Articles of Association

The Company’s Articles of Association may only be amended by

special resolution and are available on the Company’s website at

www.ihgplc.com/investors under corporate governance. A summary

is provided on pages 161 to 162.

Shares

Share capital

The Company’s issued share capital at 31 December 2015 consisted

of 247,655,712 ordinary shares of 15265/329 pence each, including

11,538,456 shares held in treasury, which constitute 4.66 per cent

of the total issued share capital (including treasury shares). There

are no special control rights or restrictions on share transfers or

limitations on the holding of any class of shares.

As far as is known to management, IHG is not directly or indirectly

owned or controlled by another company or by any government.

The Board focuses on shareholder value-creation. When it decides

to return capital to shareholders, it considers all of its options,

including share buybacks and special dividends.

Share issues and buybacks

In 2015, the Company did not issue any new shares, nor did it buy back

any existing shares.

Dividends

Dividend Ordinary shares ADRs

Interim dividend

Paid 2 October 2015

17.7p 27.5¢

Final dividend

Subject to shareholder approval,

payable on 13 May 2016 to

shareholders on the Register

of Members at the close

of business on 1 April 2016

40.3p 57.5¢

152 IHG Annual Report and Form 20-F 2015