Holiday Inn 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Material contracts

The following contracts have been entered into otherwise than in the

course of ordinary business by members of the Group: (i) in the two

years immediately preceding the date of this document in the case of

contracts which are or may be material; or (ii) that contain provisions

under which any Group member has any obligation or entitlement that

is material to the Group as at the date of this document. To the extent

that these agreements include representations, warranties and

indemnities, such provisions are considered standard in an agreement

of that nature, save to the extent identified below.

Disposal of 80 per cent interest in InterContinental New York Barclay

On 19 December 2013, Constellation Barclay Holding US, LLC, which

is an affiliate of Constellation Hotels Holding Limited, agreed to acquire,

pursuant to a contribution agreement, an 80 per cent interest in a joint

venture with IHG’s affiliates to own and refurbish the InterContinental

New York Barclay hotel. The 80 per cent interest was acquired for gross

cash proceeds of $274 million. IHG’s affiliates hold the remaining

20 per cent interest. The disposal was completed on 31 March 2014.

IHG’s management affiliate has also secured a 30-year management

contract on the hotel, which commenced in 2014, with two 10-year

extension rights at IHG’s discretion, giving an expected contract length

of 50 years.

Constellation Barclay Holding US, LLC and IHG’s affiliates have agreed

to invest through the joint venture in a significant refurbishment,

repositioning and extension of the hotel. This commenced in 2014

and will take place over a period of approximately 18 months.

Under the contribution agreement, IHG’s affiliates gave certain

customary warranties and indemnities to Constellation Barclay

Holding US, LLC.

Disposal of InterContinental Paris – Le Grand

On 7 December 2014, a share sale and purchase agreement was

entered into between BHR Holdings B.V. (part of IHG) and Constellation

Hotels France Grand SA. Under the agreement, BHR Holdings B.V.

agreed to sell Société Des Hotels InterContinental France, the owner

of InterContinental Paris – Le Grand, to Constellation Hotels France

Grand SA. The gross sale proceeds agreed were €330 million in cash.

The disposal was completed on 20 May 2015.

In connection with the sale, IHG secured a 30-year management

contract on the hotel, with three 10-year extension rights at IHG’s

discretion, giving an expected contract length of 60 years.

Under the agreement, BHR Holdings B.V. gave certain customary

warranties and indemnities to Constellation Hotels France Grand SA.

Acquisition of the Kimpton Hotels & Restaurants business

On 15 December 2014, a share sale and purchase agreement was

entered into between Kimpton Group Holding LLC and Dunwoody

Operations, Inc., an affiliate of IHG. Under the agreement, Dunwoody

Operations, Inc. agreed to buy Kimpton Hotel & Restaurant Group, LLC,

the principal trading company of the Kimpton group, from Kimpton

Group Holding LLC. The purchase completed on 16 January 2015.

The purchase price payable by Dunwoody Operations, Inc. in respect

of the acquisition was $430 million paid in cash.

Under the agreement, Dunwoody Operations, Inc. gave certain

customary warranties and indemnities to the seller.

Disposal of InterContinental Hong Kong

On 10 July 2015, a share sale and purchase agreement was entered

into between Hotel InterContinental London (Holdings) Limited

(part of IHG) and Supreme Key Limited. Under the agreement, Hotel

InterContinental London (Holdings) Limited agreed to sell Trifaith

Investments Limited, the owner of InterContinental Hong Kong

Limited, which in turn is the owner of InterContinental Hong Kong,

to Supreme Key Limited. The gross sale proceeds agreed were

$938 million in cash. The disposal completed on 30 September 2015.

In connection with the sale, IHG secured a 37-year management

contract on the hotel, with three 10-year extension rights at IHG’s

discretion, giving an expected contract length of 67 years.

Under the agreement, Hotel InterContinental London (Holdings)

Limited gave certain customary warranties and indemnities to

Supreme Key Limited.

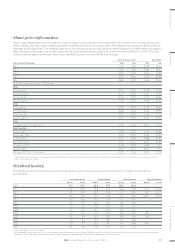

£1.5 billion Euro Medium Term Note programme

In 2015, the Group updated its Euro Medium Term Note programme

(Programme) and issued a tranche of £300 million 3.750% notes due

14 August 2025 (2015 Issuance).

On 16 June 2015, an amended and restated trust deed (Trust Deed)

was executed by InterContinental Hotels Group PLC as issuer (Issuer),

Six Continents Limited and InterContinental Hotels Limited as

guarantors (Guarantors) and HSBC Corporate Trustee Company (UK)

Limited as trustee (Trustee), pursuant to which the trust deed dated

27 November 2009, as supplemented by two supplemental trust deeds

dated 7 July 2011 and 9 November 2012 between the same parties

relating to the Programme, were amended and restated. Under the

Trust Deed, the Issuer may issue notes (Notes) unconditionally and

irrevocably guaranteed by the Guarantors, up to a maximum nominal

amount from time to time outstanding of £1.5 billion (or its equivalent

in other currencies). Notes are to be issued in series (each a Series)

in bearer form. Each Series may comprise one or more tranches (each

a Tranche) issued on different issue dates. Each Tranche of Notes will

be issued on the terms and conditions set out in the updated base

prospectus dated 16 June 2015 (Base Prospectus) as amended and/or

supplemented by a document setting out the final terms (Final Terms)

of such Tranche or in a separate prospectus specific to such Tranche.

Under the Trust Deed, each of the Issuer and the Guarantors has given

certain customary covenants in favour of the Trustee.

Final Terms were issued (pursuant to the previous base prospectus

dated 27 November 2009) on 9 December 2009 in respect of the issue

of a Tranche of £250 million 6% Notes due 9 December 2016 (2009

Issuance). Final Terms were issued (pursuant to the previous base

prospectus dated 9 November 2009) on 26 November 2012 in respect

of the issue of a Tranche of £400 million 3.875% Notes due 28 November

2022 (2012 Issuance). Final Terms were issued pursuant to the Base

Prospectus on 12 August 2015 in respect of the 2015 Issuance.

The Final Terms issued under each of the 2009 Issuance, 2012

Issuance and 2015 Issuance provide that the holders of the Notes

have the right to repayment if the Notes (a) become non-investment

grade within the period commencing on the date of announcement

of a change of control and ending 90 days after the change of control

(Change of Control Period) and are not subsequently, within the

Change of Control Period, reinstated to investment grade; (b) are

downgraded from a non-investment grade and are not reinstated to

its earlier credit rating or better within the Change of Control Period;

or (c) are not credit rated and do not become investment-grade credit

rated by the end of the Change of Control Period.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

163IHG Annual Report and Form 20-F 2015