Holiday Inn 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group Financial Statements continued

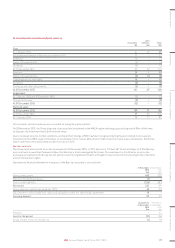

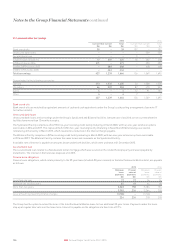

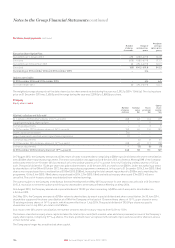

21. Loans and other borrowings

2015 2014

Current

$m

Non-current

$m

Total

$m

Current

$m

Non-current

$m

Total

$m

Bank overdrafts 39 – 39 107 – 107

Unsecured bank loans ––– –359359

Secured bank loan ––– 3–3

Finance lease obligations 17 207 224 16 202 218

£250m 6% bonds 2016 371 – 371 –390390

£400m 3.875% bonds 2022 –588588 –618618

£300m 3.75% bonds 2025 – 444 444 –––

Total borrowings 427 1,239 1,666 126 1,569 1,695

Denominated in the following currencies:

Sterling 373 1,032 1,405 20 1,008 1,028

US dollars 46 207 253 87 470 557

Euros 4–4 12 91 103

Other 4–4 7–7

427 1,239 1,666 126 1,569 1,695

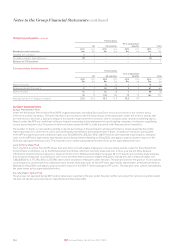

Bank overdrafts

Bank overdrafts are matched by equivalent amounts of cash and cash equivalents under the Group’s cash pooling arrangements (see note 17

for further details).

Unsecured bank loans

Unsecured bank loans are borrowings under the Group’s Syndicated and Bilateral facilities. Amounts are classified as non-current when the

facilities have more than 12 months to expiry.

The Syndicated Facility comprises a $1,275m five-year revolving credit facility maturing in March 2020, with two one-year extension options

exercisable in 2016 and 2017. This replaced the $1.07bn five-year revolving facility (maturing in November 2016) following a successful

refinancing of the facility in March 2015, which resulted in a reduction in the interest margin payable.

The Bilateral Facility comprises a $75m revolving credit facility maturing in March 2020, with two one-year extension options exercisable

in 2016 and 2017. The Bilateral Facility contains the same terms and covenants as the Syndicated Facility.

A variable rate of interest is payable on amounts drawn under both facilities, which were undrawn at 31 December 2015.

Secured bank loan

The secured bank loan related to a New Zealand dollar mortgage which was secured on the related hotel property and was repayable by

instalments. The interest in the hotel was disposed of in 2015.

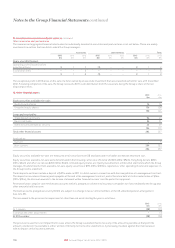

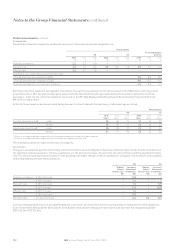

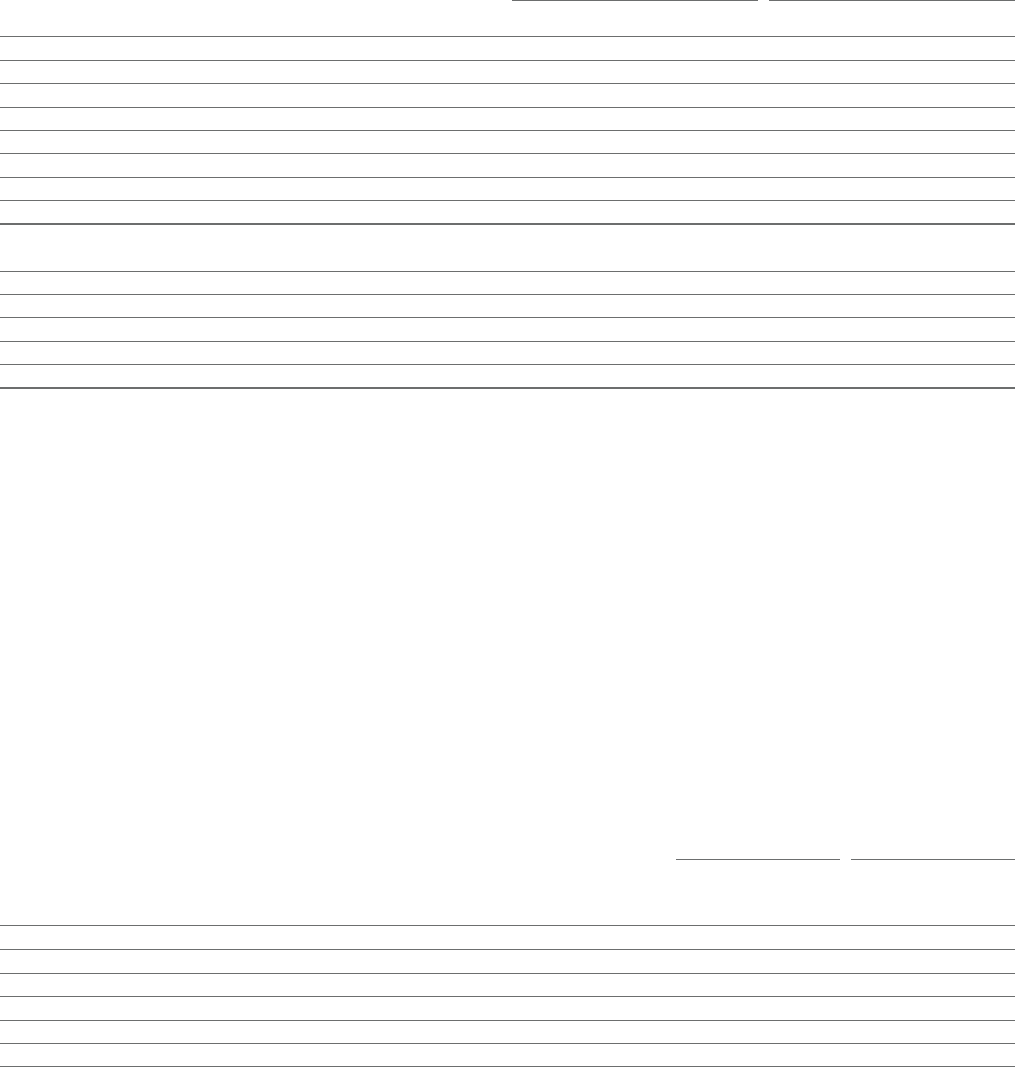

Finance lease obligations

Finance lease obligations, which relate primarily to the 99-year lease (of which 90 years remain) on the InterContinental Boston hotel, are payable

asfollows:

2015 2014

Minimum

lease

payments

$m

Present

value of

payments

$m

Minimum

lease

payments

$m

Present

value of

payments

$m

Less than one year 17 17 16 16

Between one and five years 65 49 64 48

More than five years 3,268 158 3,284 154

3,350 224 3,364 218

Less: amount representing finance charges (3,126) – (3,146) –

224 224 218 218

The Group has the option to extend the term of the InterContinental Boston lease for two additional 20-year terms. Payments under the lease

step up at regular intervals over the lease term. Interest is payable on the obligation at a fixed rate of 9.7%.

126 IHG Annual Report and Form 20-F 2015