Holiday Inn 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

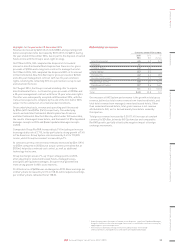

Group

Group results

12 months ended 31 December

2015

$m

2014

$m

2015 vs

2014 %

change

2013

$m

2014 vs

2013 %

change

Revenue

Americas 955 871 9.6 916 (4.9)

Europe 265 374 (29.1) 400 (6.5)

AMEA 241 242 (0.4) 230 5.2

Greater China 207 242 (14.5) 236 2.5

Central 135 129 4.7 121 6.6

Total 1,803 1,858 (3.0) 1,903 (2.4)

Operating profit

Americas 597 544 9.7 550 (1.1)

Europe 78 89 (12.4) 105 (15.2)

AMEA 86 84 2.4 86 (2.3)

Greater China 70 89 (21.3) 82 8.5

Central (151) (155) 2.6 (155) –

Operating profit before

exceptional items

680 651 4.5 668 (2.5)

Exceptional operating

items

819 29 –5480.0

1,499 680 120.4 673 1.0

Net financial expenses (87) (80) (8.8) (73) (9.6)

Profit before tax 1,412 600 135.3 600 –

Earnings per

ordinaryshare

Basic 520.0¢ 158.3¢ 228.5 140.9¢ 12.3

Adjusted 174.9¢ 158.3¢ 10.5 158.3¢ –

Average US dollar to

sterling exchange rate

$1:

£0.65

$1:

£0.61

6.6 $1:

£0.64

(4.7)

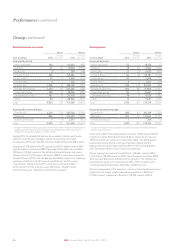

Highlights for the year ended 31 December 2015

During the year ended 31 December 2015, revenue decreased by

$55m (3.0%) to $1,803m primarily as a result of the disposal of owned

hotels in line with the Group’s asset-light strategy. Operating profit

before exceptional items increased by $29m (4.5%) to $680m.

On 16 January 2015, the Group completed the acquisition of Kimpton

Holding Group LLC (Kimpton) for cash consideration of $430m before

working capital adjustments and cash acquired, resulting in the addition

of 62 hotels (11,325 rooms) into the IHG System.

On 20 May 2015, the Group completed the sale of InterContinental

Paris – Le Grand for gross proceeds of €330m and, on 30 September

2015, the Group completed the sale of InterContinental Hong Kong

for proceeds of $928m after final working capital adjustments

and cash tax.

On an underlyinga basis, revenue and operating profit increased by

$113m (8.0%) and $67m (11.5%) respectively. The underlying results

exclude the impact of owned hotel disposals in 2015 and the prior year,

the results of managed-lease hotels, Kimpton, and significant

liquidated damages receipts (2015: $3m; 2014: $7m).

Comparable Group RevPAR increased by 4.4% (including an increase

in average daily rate of 3.1%), with growth across all regions.

IHG System size increased by 4.8% (3.2% excluding the Kimpton

acquisition) to 744,368 rooms, whilst Group fee revenueb increased

by 7.5% (3.0% excluding Kimpton).

At constant currency, net central overheads increased by $5m (3.2%)

to $160m compared to 2014 (but at actual currency decreased by $4m

(2.6%) to $151m).

Group fee margin was 46.3%, up 1.6 percentage points (up 1.3

percentage points at constant currency) on 2014, after adjusting

for owned and leased hotels, managed leases, Kimpton, and

significant liquidated damages. Group fee margin benefited from

strong growth in IHG’s scale markets, reflecting scale benefits

and tight overhead control.

Profit before tax increased by $812m to $1,412m, primarily due

to the gain on the sale of InterContinental Paris – Le Grand and

InterContinental Hong Kong. Basic earnings per ordinary share

increased by 228.5% to 520.0¢, whilst adjusted earnings per ordinary

share increased by 10.5% to 174.9¢.

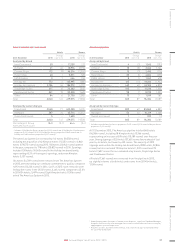

Accounting principles

The Group results are prepared under International Financial

Reporting Standards (IFRS). The application of IFRS requires

management to make judgements, estimates and assumptions,

and those considered critical to the preparation of the

Group results are set out on pages 98 and 99 of the Group

Financial Statements.

The Group discloses certain financial information both including

and excluding exceptional items. For comparability of the

periods presented, some of the performance indicators in this

Performance review are calculated after eliminating these

exceptional items. Such indicators are prefixed with ‘adjusted’.

An analysis of exceptional items is included in note 5 on page

107 of the Group Financial Statements.

P

P

P

e

r

r

f

o

o

r

m

m

a

n

n

c

e

e

e

For definitions in this section, please refer to the Glossary

on pages 176 and 177.

32 IHG Annual Report and Form 20-F 2015