Holiday Inn 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance continued

Sources of liquidity

The Group successfully refinanced its bank debt in March 2015, putting

in place a $1.275bn revolving syndicated bank facility which matures

in March 2020 (the Syndicated Facility), with two one-year extension

options exercisable in 2016 and 2017. The Group also put in place a

$75m revolving bilateral facility (the Bilateral facility) in October 2015

which also matures in March 2020 and has two one-year extension

options exercisable in 2016 and 2017. The facilities were undrawn at

31 December 2015.

The Syndicated and Bilateral facilities contain the same terms and two

financial covenants; interest cover; and net debt divided by earnings

before interest, tax, depreciation and amortisation (EBITDA). The

Group is in compliance with all of the financial covenants in its loan

documents, none of which is expected to present a material restriction

on funding in the near future.

In August 2015, the Group issued £300m of public bonds at a 3.750%

coupon rate, the lowest funding rate the Group has achieved in the

sterling bond market. The bonds are repayable in 2025, extending

the maturity profile of the Group’s debt. This is in addition to £250m

of public bonds which are repayable on 9 December 2016 and £400m

of public bonds which are repayable on 28 November 2022.

Additional funding is provided by the 99-year finance lease (of which

90 years remain) on InterContinental Boston and other uncommitted

bank facilities (see note 21 to the Group Financial Statements). In the

Group’s opinion, the available facilities are sufficient for the Group’s

present liquidity requirements.

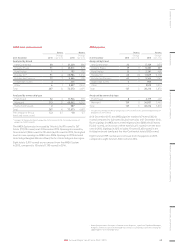

Net debt of $529m (2014: $1,533m) is analysed by currency as follows.

2015

$m

2014

$m

Borrowings

Sterling 1,405 1,028

US dollar 253 557

Euros 4103

Other 47

Cash and cash equivalents

Sterling (619) (21)

US dollar (460) (54)

Euros (15) (25)

Canadian dollar (8) (14)

Chinese renminbi (4) (8)

Other (31) (40)

Net debt 529 1,533

Average debt level 1,420 1,322

IHG pursues a tax strategy that is consistent with its business strategy

and its overall business conduct principles. This strategy seeks

to ensure full compliance with all tax filing, payment and reporting

obligations on the basis of communicative and transparent

relationships with tax authorities. Policies and procedures related

to tax risk management are subject to regular review and update

and are approved by the Board.

Tax liabilities or refunds may differ from those anticipated, in particular

as a result of changes in tax law, changes in the interpretation of tax

law, or clarification of uncertainties in the application of tax law.

Procedures to minimise risk include the preparation of thorough tax

risk assessments for all transactions carrying tax risk and, where

appropriate, material tax uncertainties are discussed and resolved

with tax authorities in advance.

IHG’s contribution to the jurisdictions in which it operates includes

a significant contribution in the form of taxes borne and collected,

including taxes on its revenues and profits and in respect of the

employment its business generates. IHG earns approximately 75% of

its revenues in the form of franchise, management or similar fees, with

almost 85% of IHG-branded hotels being franchised. In jurisdictions in

which IHG does franchise business, the prevailing tax law will generally

provide for IHG to be taxed in the form of local withholding taxes based

on a percentage of fees rather than based on profits. Costs to support

the franchise business are normally incurred regionally or globally,

and therefore profits for an individual franchise jurisdiction cannot

be separately determined.

Dividends

The Board has proposed a final dividend per ordinary share of 57.5¢

(40.3p). With the interim dividend per ordinary share of 27.5¢ (17.7p),

the full-year dividend per ordinary share for 2015 will total 85.0¢

(58.0p), an increase of 10.4% over 2014.

In February 2016, the Board proposed a $1.5bn return of funds to

shareholders by way of a special dividend and share consolidation.

Earnings per ordinary share

Basic earnings per ordinary share increased by 228.5% to 520.0¢

from 158.3¢ in 2014. Adjusted earnings per ordinary share increased

by 10.5% to 174.9¢ from 158.3¢ in 2014.

Share price and market capitalisation

The IHG share price closed at £26.58 on 31 December 2015, up from

£25.95 on 31 December 2014. The market capitalisation of the Group

at the year end was £6.3bn.

Liquidity and capital resources

48 IHG Annual Report and Form 20-F 2015