Holiday Inn 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

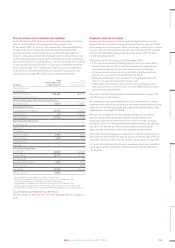

Executive Committee members’ shareholdings

Shares held by Executive Committee members (excluding the Executive Directors) as at 31 December

Number of shares

held outright

APP

deferred share awards

LTIP

share awards (unvested)

Total

number of shares held

Executive Committee member 2015 2014 2015 2014 2015 2014 2015 2014

Keith Barr 22,522 22,522 29,557 29,829 96,044 106,630 148,123 158,981

Angela Brav 32,724 32,724 25,569 24,473 86,969 97,462 145,262 154,659

Elie Maalouf –n/a –n/a 73,662 n/a 73,622 n/a

Kenneth Macpherson 7,472 7,472 31,279 8,330 73,861 64,713 112,612 80,515

Eric Pearson –1,998 28,748 25,021 90,087 102,940 118,835 129,959

Jan Smits 30,476 30,476 28,742 32,037 86,177 104,445 145,395 166,958

George Turner 17,975 –26,047 30,896 80,914 95,399 124,936 126,295

Details of the shares held by the Executive Directors can be found on page 75. These shareholdings include all beneficial interests and those held

by Executive Committee members’ spouses and other connected persons.

For further details on the APP deferred share award and for the LTIP share award, see pages 70, 72 and 73.

Executive Directors’ benefits upon termination of oce

All current Executive Directors have a rolling service contract with a notice period from the Group of 12 months. As an alternative, the Group may,

at its discretion, pay in lieu of that notice. Neither notice nor a payment in lieu of notice will be given in the event of gross misconduct.

Payment in lieu of notice could potentially include up to 12 months’ salary and the cash equivalent of 12 months’ pension contributions, and other

contractual benefits. Where possible, the Group will seek to ensure that, where a leaver mitigates their losses by, for example, finding new

employment, there will accordingly be a corresponding reduction in compensation payable for loss of office.

Further details on the policy for determination of termination payments are included in the Directors’ Remuneration Policy, which is available

on the Company’s website at www.ihgplc.com/investors under corporate governance/directors’ remuneration policy.

The Group is required to comply with existing and changing

regulations and societal expectations across numerous countries,

territories and jurisdictions

Government regulations affect countless aspects of the Group’s

business ranging from corporate governance, health and safety, the

environment, bribery and corruption, employment law and diversity,

disability access, data privacy and information protection, financial,

accounting and tax. Regulatory changes may require significant

changes in the way the business operates and may inhibit the Group’s

strategy, including the markets the Group operates in, brand protection,

and use or transmittal of personal data. If the Group fails to comply with

existing or changing regulations, the Group may be subject to fines,

prosecution, loss of licence to operate or reputational damage.

The reputation of the Group and the value of its brands are influenced by

a wide variety of factors, including the perception of stakeholder groups

such as guests, owners, suppliers and communities in which the Group

operates. The social and environmental impacts of its business are

under increasing scrutiny, and the Group is exposed to the risk of

damage to its reputation if it fails to (or fails to influence its business

partners to) undertake responsible practices and engage in ethical

behaviour, or fails to comply with relevant regulatory requirements.

The Group may face difficulties insuring its business

Historically, the Group has maintained insurance at levels determined

to be appropriate in light of the cost of cover and the risk profile of the

business. However, forces beyond the Group’s control, including

market forces, may limit the scope of coverage the Group can obtain

and the Group’s ability to obtain coverage at reasonable rates. Other

forces beyond the Group’s control, such as terrorist attacks or natural

disasters, may be uninsurable or simply too expensive to insure.

Inadequate or insufficient insurance could expose the Group to large

claims or could result in the loss of capital invested in properties,

as well as the anticipated future revenue from properties.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

159IHG Annual Report and Form 20-F 2015