Holiday Inn 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

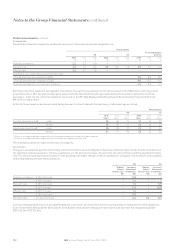

21. Loans and other borrowings continued

£250m 6% bonds 2016

The 6% fixed interest sterling bonds were issued on 9 December 2009 and are repayable in full on 9 December 2016. Interest is payable annually

on 9 December each year. The bonds were initially priced at 99.465% of face value and are unsecured. Currency swaps were transacted at the

same time the bonds were issued in order to swap the proceeds and interest flows into US dollars and were subsequently closed out during 2014.

£400m 3.875% bonds 2022

The 3.875% fixed interest sterling bonds were issued on 28 November 2012 and are repayable in full on 28 November 2022. Interest is payable

annually on28 November each year. The bonds were initially priced at 98.787% of face value and areunsecured.

£300m 3.75% bonds 2025

The 3.75% fixed interest sterling bonds were issued on 14 August 2015 and are repayable in full on 14 August 2025. Interest is payable annually

on 14 August each year. The bonds were initially priced at 99.014% of face value and are unsecured.

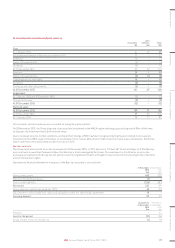

Facilities provided by banks

2015 2014

Utilised

$m

Unutilised

$m

Total

$m

Utilised

$m

Unutilised

$m

Total

$m

Committed –1,3501,350 364 709 1,073

Uncommitted –6464 46266

–1,4141,414 368 771 1,139

2015

$m

2014

$m

Unutilised facilities expire:

Within one year 64 62

After two but before five years 1,350 709

1,414 771

Utilised facilities are calculated based on actual drawings and may not agree to the carrying value of loans held at amortised cost.

Kimpton acquisition

In January 2015, a $400m bilateral term loan was drawn down to finance the acquisition of Kimpton (see note 10). The loan had a term of six

months plus two six-month extension periods, one of which was exercised in June 2015. A variable rate of interest was payable on the loan

which had identical covenants to the Syndicated Facility. The loan was repaid in full and the facility cancelled in August 2015.

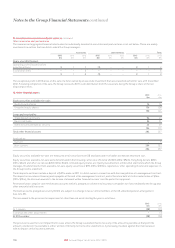

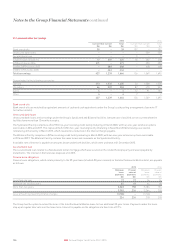

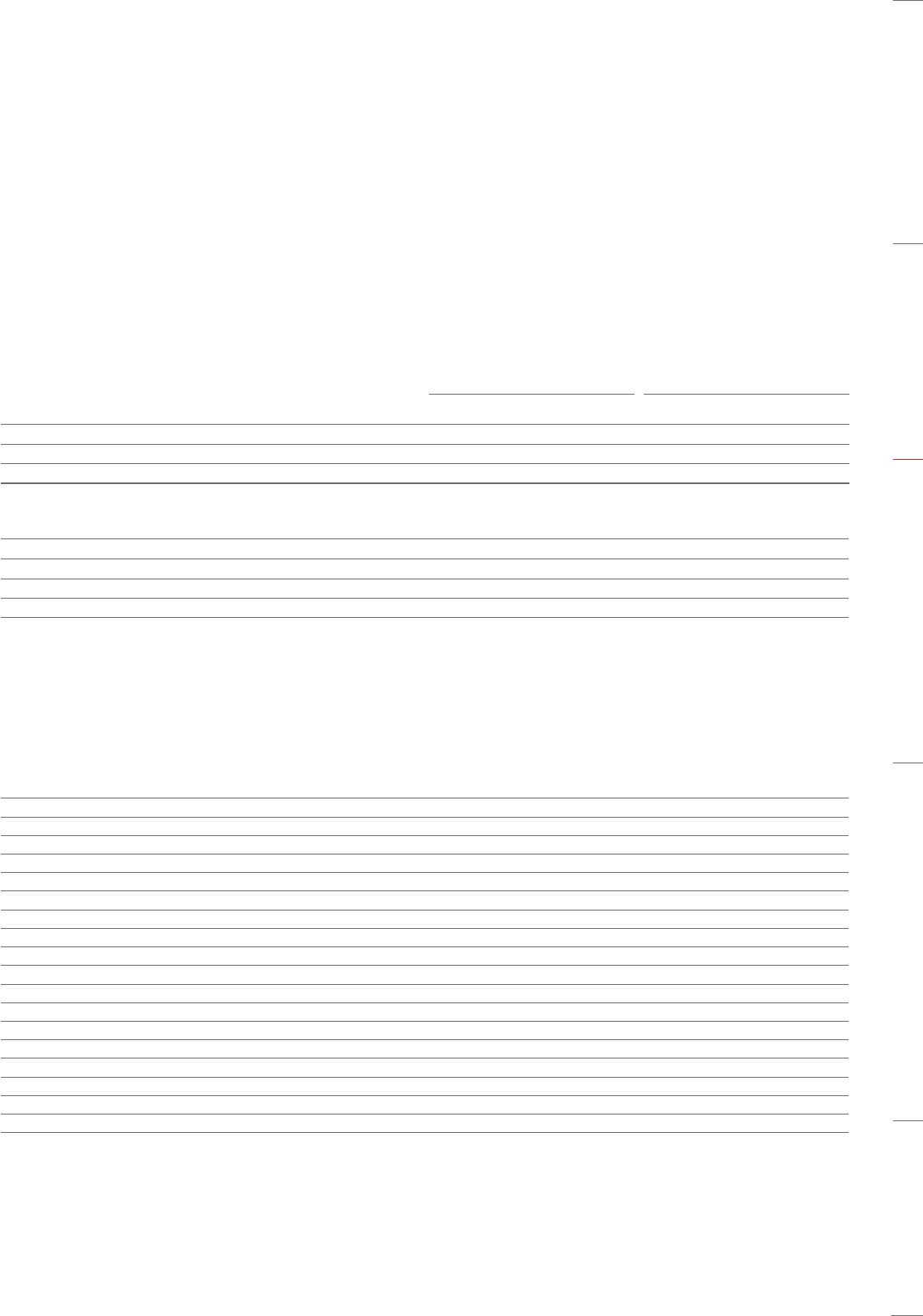

22. Reconciliation of profit for the year to cash flow from operations

For the year ended 31 December 2015 Note

2015

$m

2014

$m

2013

$m

Profit for the year 1,224 392 374

Adjustments for:

Net financial expenses 87 80 73

Income tax charge 7188 208 226

Depreciation and amortisation 96 96 85

Impairment 36 ––

Other exceptional operating items (855) (29) (5)

Equity-settled share-based cost 26 19 21 22

Dividends from associates and joint ventures 14 525

Other items 642

Decrease/(increase) in trade and other receivables 3(18) (9)

Net change in loyalty programme liability and System Fund surplus 32 42 58 61

Increase in other trade and other payables 861 8

Utilisation of provisions 19 –(2) (3)

Retirement benefit contributions, net of costs (4) (6) (18)

Cash flows relating to exceptional operating items (45) (114) (33)

Total adjustments (414) 361 414

Cash flow from operations 810 753 788

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

127IHG Annual Report and Form 20-F 2015