Holiday Inn 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

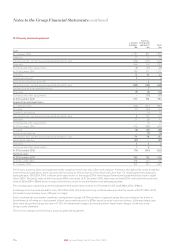

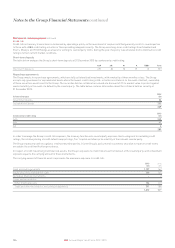

20. Financial risk management continued

Liquidity risk

The treasury function ensures that the Group has access to sufficient funds to allow the implementation of the strategy set by the Board.

Short-term borrowing requirements are met from drawings under uncommitted overdrafts and facilities. Medium- and long-term borrowing

requirements are met through the following facilities and instruments:

Bank facilities Expiry

$1,275m Revolving Syndicated Facility 30 March 2020a

$75m Revolving Bilateral Facility 30 March 2020a

Bonds issued under the Group’s £1,500m Medium Term Note programme Repayment date

£250m 6% bonds 9 December 2016

£400m 3.875% bonds 28 November 2022

£300m 3.75% bonds 14 August 2025

a The Syndicated and Bilateral facilities also contain two one-year extension options, exercisable in 2016 and 2017.

The Syndicated and Bilateral facilities contain two financial covenants: interest cover and net debt divided by earnings before interest, tax,

depreciation and amortisation (EBITDA). The Group has been in compliance with all of the financial covenants in its loan documents throughout

the year, none of which is expected to present a material restriction on funding in the near future.

At the year end, the Group had cash of $1,137m which is predominantly held in short-term deposits, repurchase agreements, and cash funds which allow

daily withdrawals of cash. The Group also had overdrafts of $39m as part of cash pooling arrangements (see note 17). Most of the Group’s funds are held

in the UK or US, although $1m (2014: $4m) is held in countries where repatriation is restricted as a result of foreign exchange regulations.

The following are the undiscounted contractual cash flows of financial liabilities, including interest payments:

Less than

1 year

$m

Between 1

and 2 years

$m

Between 2

and 5 years

$m

More than

5 years

$m

Total

$m

31 December 2015

Non-derivative financial liabilities:

Bank overdrafts 39 – – – 39

£250m 6% bonds 2016 393 – – – 393

£400m 3.875% bonds 2022 23 23 69 638 753

£300m 3.75% bonds 2025 17 17 50 521 605

Finance lease obligations 17 17 48 3,268 3,350

Trade and other payables 839 178 263 192 1,472

Provisions 15–––15

Derivative financial liabilities:

Forward foreign exchange contracts 3–––3

31 December 2014

Non-derivative financial liabilities:

Bank overdrafts 107 – – – 107

Unsecured bank loans 361 – – – 361

Secured bank loans 3–––3

£250m 6% bonds 2016 23 414 – – 437

£400m 3.875% bonds 2022 24 24 73 697 818

Finance lease obligations 16 16 48 3,284 3,364

Trade and other payables 769 174 194 345 1,482

Provisions 19––10

Derivative financial liabilities:

Forward foreign exchange contracts (2) – – – (2)

Trade and other payables includes the cash flows relating to the future redemption liability of the Group’s loyalty programme. The repayment

profile has been determined by actuaries based on expected redemption profiles and could in reality be different from expectations.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

123IHG Annual Report and Form 20-F 2015