Holiday Inn 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Quick read

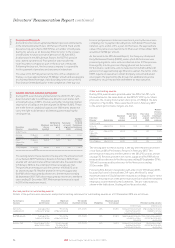

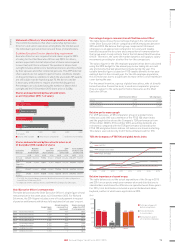

Executive Director remuneration

The table below shows the 2015 potential opportunity and the 2015 actual achievement when compared to 2014 actual achievement. The relevant

figures for each of the elements that make up the single total figure of remuneration, as shown below for the current Executive Directors, can

be found in the table on page 72. For Richard Solomons, the 2014 actual figure includes a one-off payment received in lieu of certain pension

rights, which does not form part of usual annual remuneration and which was fully disclosed in last year’s report. Further details can be found

in the notes to the single total figure of remuneration on pages 72 to 74.

Richard Solomons,

Chief Executive Officer

Paul Edgecliffe-Johnson,

Chief Financial Officer

Tracy Robbins, Executive Vice

President, Human Resources

Salary

Benefits

Pension benefit

APP cash

APP deferred shares

LTIP

Maximum = Fixed pay and maximum

award under APP and LTIP

Target = Fixed pay and on-target award

for APP (115%) and 50% of maximum

LTIP vesting

Minimum = Fixed pay and pension

benefits

0

2014

actual

6,611

4,555

3,199

1,647 1,832

1,619 2,090

2015

actual

2015

potential

1

2

3

4

5

6

7

Value

(£000)

0

2014

actual

2015

actual

2015

potential

1

2

3

4

5

6

7

Value

(£000)

0

2014

actual

2015

actual

2015

potential

1

2

3

4

5

6

7

Value

(£000)

2,227 2,607

Directors’ Remuneration Policy

Our strategy for delivering high-quality growth (detailed on pages 14 to 24) and the key performance indicators (KPIs) (set out on pages 28 to 31) through

which we monitor and measure our success, are the key drivers for the performance-related elements of our reward structure (see below):

Summary of DR Policy and remuneration architecture – Executive Directors

Implementation in 2016 Link to strategy Framework

2016 2017 2018 2019

Fixed Salary Recognises the market value of the role and the

individual’s skills, performance and experience.

Generally in line with the range applying to the corporate

population. Reviewed annually and fixed for 12 months

from 1 April.

Benefits Market-competitive and consistent with role/location;

helps recruit and retain.

Relevant benefits are restricted to the typical level

in the market location.

Pension benefit Provides funding for retirement; helps recruit and retain. Defined Contribution. Employee contributions with

matching Company contributions. A maximum cash

allowance of 30% is offered in lieu of pension contributions.

Salary is the only part of remuneration that is pensionable.

Variable Annual incentive cash (APP) The KPIs that directly link remuneration to our business

strategy include: guest satisfaction – a key measure of the

delivery of our brand strategy; OPR – measures individual

delivery of annual objectives aligned to our Winning Model;

relative growth in net rooms supply and RevPAR – industry

measures of the scale and strength of our portfolio and

the execution of our strategy to deliver high-quality growth;

EBIT and TSR – fundamental measures of our financial

health and the returns for shareholders and represent

the financial outcomes of the KPI goals.

APP: maximum annual opportunity is 200% of salary with

70% EBIT and 30% non-financial measures; 50% of award

is deferred into shares for three years. Awards are subject

to global EBIT affordability gate. Malus and clawback

apply. No post-vesting holding periods.

Annual incentive

deferred shares (APP)

LTIP: maximum annual opportunity is 205% of salary;

vesting subject to achievement of TSR (50%), net rooms

supply growth (25%) and RevPAR (25%) when measured

against an appropriate comparator group of companies

over a three-year period. Malus and clawback apply.

No post-vesting holding periods.

Long Term Incentive

Plan (LTIP)

Share-

holdings

Shareholding The following guideline shareholding requirements for our Executive Directors, together with the inclusion

of a TSR measure in our LTIP, align the interests of Directors with those of shareholders:

• 300% of salary for the Chief Executive Officer; and

• 200% of salary for other Executive Directors.

Current Directors’ shareholdings

Director Number of shares held outright Number of shares held (as % of salary) Guideline shareholding

Richard Solomons 365,625 1,227% 300%

Paul Edgecliffe-Johnson 22,014 127% 200%

Tracy Robbins 37,726 224% 200%

For further details of shares and awards held and guideline shareholdings see page 75.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

71IHG Annual Report and Form 20-F 2015