Holiday Inn 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

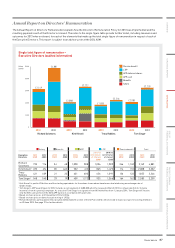

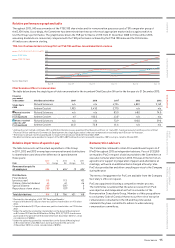

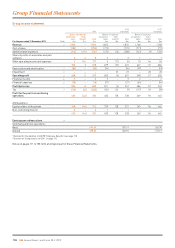

Relative performance graph and table

Throughout 2013, IHG was a member of the FTSE 100 share index and for remuneration purposes used a TSR comparator group of

theDJGH index. Accordingly, the Committee has determined that these are the most appropriate market indices against which to

test theGroup’s performance. The graph below shows the TSR performance of IHG from 31 December 2008 to 31 December 2013,

assumingdividends are reinvested, compared with the TSR performance achieved by the FTSE 100 index and the DJGH index.

All indices areshown insterling.

TSR: InterContinental Hotels Group PLC vs FTSE 100 and Dow Jones Global Hotels indices

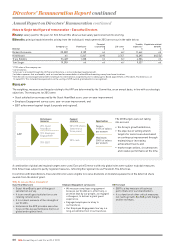

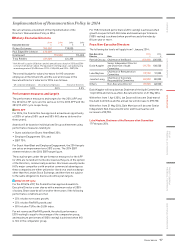

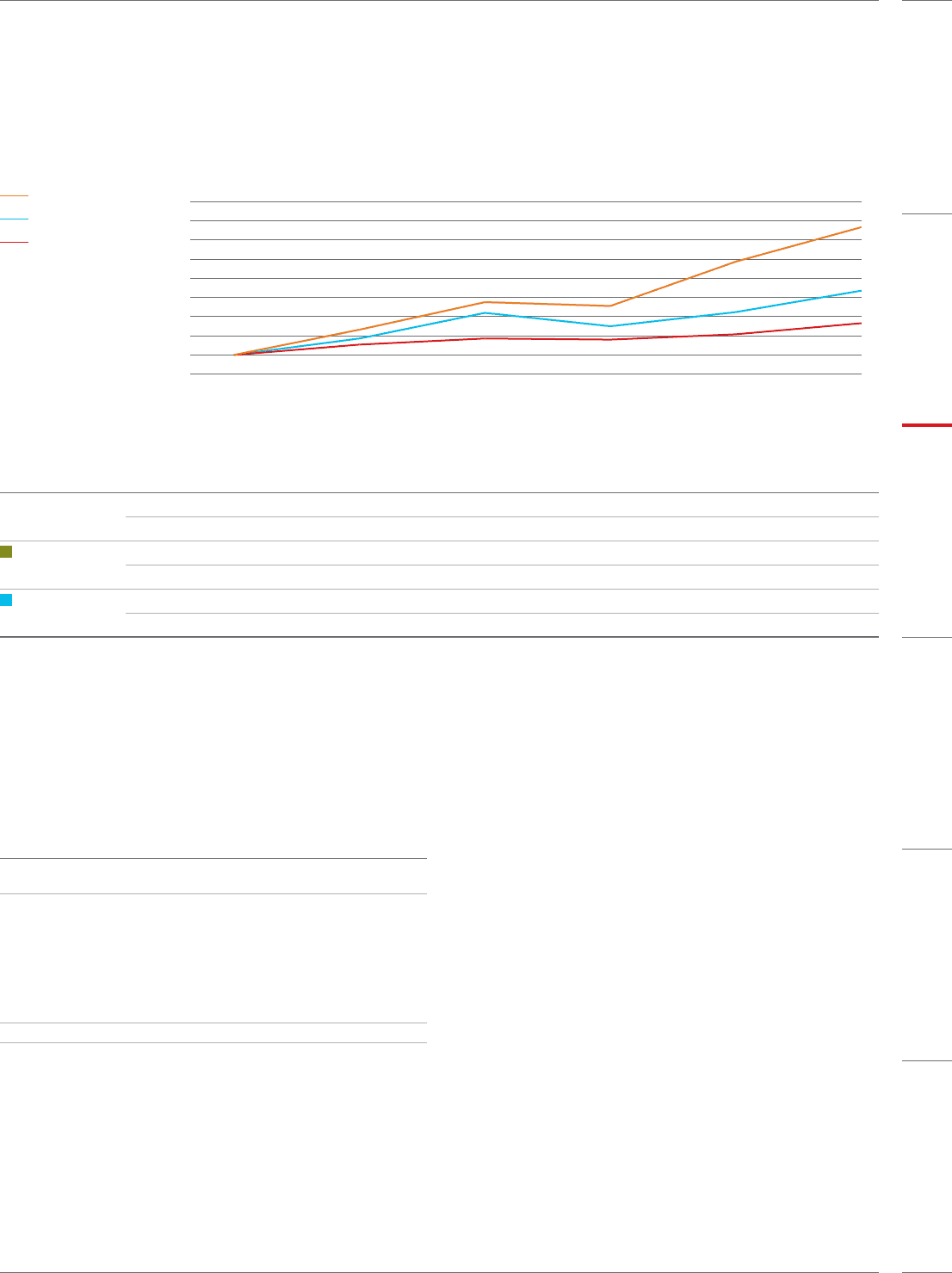

Chief Executive Officer’s remuneration

The table below shows the single figure of total remuneration for the incumbent Chief Executive Officer for the five years to 31 December 2013:

Financial

year ended

31 December Chief Executive Officer 2009 2010 201112012 2013

Single figure

£000

Richard Solomons n/a n/a 4,724 4,881 3,149

Andrew Cosslett 1,953 5,430 3,770 n/a n/a

Annual incentive

received

(% of maximum)

Richard Solomons n/a n/a 83.0 68.0 74.0

Andrew Cosslett nil2100.0 43.03n/a n/a

Shares received

under the LTIP

(% of maximum)

Richard Solomons n/a n/a 73.9 100.0 59.0

Andrew Cosslett 46.0 73.8 61.6 n/a n/a

1

Andrew Cosslett retired on 30 June 2011 and Richard Solomons was appointed Chief Executive Officer on 1 July 2011, having previously held the position of Chief

Financial Officer and Head of Commercial Development; the single figure value is the total remuneration received by each Director for that year.

2 There was no annual incentive award paid in respect of financial year ended 31 December 2009.

3 No deferred shares were awarded in respect of the 2011 ABP. Andrew Cosslett received his award as 100% cash pro-rated to 30 June 2011.

InterContinental Hotels Group PLC

DJGH Index

FTSE 100 Index

Source: Datastream

500

450

400

350

300

250

200

150

100

50

Dec 08 Dec 09 Dec 10 Dec 11 Dec 12 Dec 13

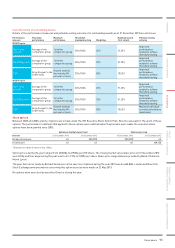

Relative importance of spend on pay

The table below sets out the actual expenditure of the Group

in2011, 2012 and 2013 on employee remuneration and distributions

to shareholders and shows the difference in spend between

thoseyears:

Item

2013

$m

%

change

2012

$m

%

change

2011

$m

Remuneration paid to

all employees

656 5

6261 (1)

6341

Distributions:

Final dividend

(previous year)

Ordinary (interim) dividend

Special dividend

Repurchase of own shares

115

63

3552

2834

113

61

5053

1075

102

46

0

0

Total distributions 816 3.8 786 431 148

1

Restated for the adoption of IAS 19R ’Employee Benefits’.

2

A special dividend of $1.33 per share was paid to shareholders on 4October

2013.

3

A special dividend of $1.72 per share was paid to shareholders on 22October

2012.

4

Under the authority granted by shareholders at the General Meeting held

on 8October 2012 and the AGM held on 24 May 2013, 9,773,912 shares were

purchased in the period from 8 October 2012 to 31 December 2013 for a total

consideration of $283m.

5

Under the authority granted by shareholders at the General Meeting held

on 8October 2012, 4,143,960 shares were purchased in the period to

31 December 2012 for a total consideration of $107m.

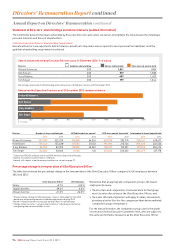

Remuneration advisers

The Committee continued to retain PricewaterhouseCoopers LLP

(PwC) throughout 2013 as independent advisers. Fees of £132,050

were paid to PwC in respect of advice provided to the Committee on

executive remuneration matters in 2013. This was in the form of an

agreed fee for support in preparation of papers and attendance at

meetings, with work on additional items charged at hourly rates.

PwC also provided tax and other consulting services to the Company

during the year.

The terms of engagement for PwC are available from the Company

Secretary’s office on request.

PwC was appointed following acompetitive tender process.

The Committee is satisfied that the advice received from PwC

was objective and independent as PwC is a member of the

Remuneration Consultants Group. Members of this group adhere

to a voluntary Code of Conduct that sets out the role of executive

remuneration consultants in the UK and the professional

standards they have committed to adhere to when advising

remuneration committees.

Governance 95

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION