Holiday Inn 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

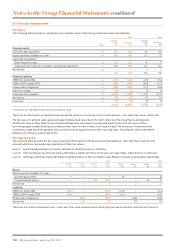

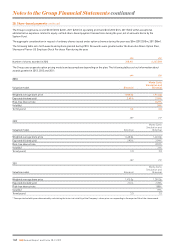

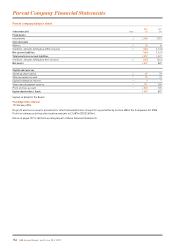

28. Share-based payments continued

Summarised information about options outstanding at 31 December 2013 under the share option schemes is as follows:

Options outstanding and exercisable

Range of exercise prices (pence)

Number

outstanding

thousands

Weighted

average

remaining

contract life

years

Weighted

average

option price

pence

Executive Share Option Plan

494.2 37 0.3 494.2

619.8 23 1.3 619.8

60 0.6 541.3

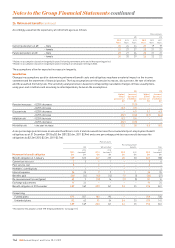

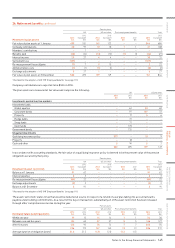

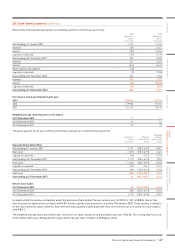

29. Equity

Equity share capital

Number of

shares

millions

Nominal

value

$m

Share

premium

$m

Equity share

capital

$m

Allotted, called up and fully paid

At 1 January 2011 (ordinary shares of 1329⁄47p each) 289 61 94 155

Issued on exercise of share options 1–88

Exchange adjustments – – (1) (1)

At 31 December 2011 (ordinary shares of 1329⁄47p each) 290 61 101 162

Share capital consolidation (19) – – –

Issued on exercise of share options 11910

Repurchased and cancelled under repurchase programme (4) (1) –(1)

Exchange adjustments – 2 6 8

At 31 December 2012 (ordinary shares of 14194 ⁄329p each) 268 63 116 179

Issued on exercise of share options 1 – 5 5

Exchange adjustments – 2 3 5

At 31 December 2013 (ordinary shares of 14194⁄329p each) 269 65 124 189

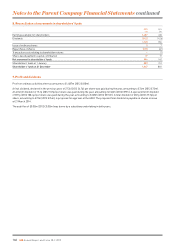

The Company was incorporated and registered in England and Wales with registered number 5134420 on 21 May 2004 as a limited

company under the Companies Act 1985 with the name Hackremco (No. 2154) Limited. On 24 March 2005 Hackremco (No. 2154)

Limited changed its name to New InterContinental Hotels Group Limited. On 27 April 2005 New InterContinental Hotels Group Limited

re-registered as a public limited company and changed its name to New InterContinental Hotels Group PLC. On 27 June 2005 New

InterContinental Hotels Group PLC changed its name to InterContinental Hotels Group PLC.

On 7 August 2012, the Company announced a $1bn return of funds to shareholders comprising a $500m special dividend with share

consolidation and a $500m share repurchase programme. The share consolidation was approved on 8 October 2012 at a General Meeting

(GM) of the Company and became effective on 9 October 2012 on the basis of 14 new ordinary shares of 14194 ⁄329p each for every 15 existing

ordinary shares of 1329⁄47p each. The special dividend of 172.0¢ per share was paid to shareholders on 22 October 2012 at a total cost of

$505m. Under the authority granted by shareholders at the GM held on 8 October 2012, the share repurchase programme commenced

in November 2012 resulting in the repurchase of 4,143,960 shares in the period to 31 December 2012 for a total consideration of $107m.

Under the same programme, a further 9,773,912 shares were purchased in the year to 31 December 2013 for a total consideration of $283m.

Shares repurchased in the year to 31 December 2013 are held as treasury shares whereas those shares repurchased in the year to

31December 2012 were cancelled. No shares were repurchased in 2011.

The authority given to the Company at the Annual General Meeting (AGM) held on 24 May 2013 to purchase its own shares was still valid at

31December 2013. Aresolution to renew the authority will be put to shareholders at the AGM on 2 May 2014.

On 6 August 2013, the Company announced a special dividend of 133.0¢ per share amounting to $355m which was paid to shareholders on

4 October 2013.

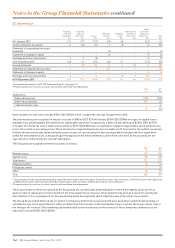

The balance classified as equity share capital includes the total net proceeds (both nominal value and share premium) on issue of the

Company’s equity share capital, comprising 14194 ⁄329p shares. The share premium reserve represents the amount of proceeds received

for shares in excess of their nominal value.

The Company no longer has an authorised share capital.

150 IHG Annual Report and Form 20-F 2013

Notes to the Group Financial Statements continued