Holiday Inn 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Format of this report

This year sees the introduction of a binding shareholder vote on the

Directors’ Remuneration Policy (see pages 78 to 86) in addition to

the advisory vote on the Annual Report on Directors’ Remuneration

(see pages 87 to 96). The new regulations and guidelines have

helped clarify best practice in sharing information with shareholders.

Consistent with our historic approach of transparency with

shareholders, our 2012 Directors’ Remuneration Report

reflected as much as possible of the direction and spirit of the

then draft new rules. The 2012 Directors’ Remuneration Report

won the PwC Building Public Trust Award for Executive

Remuneration Reporting in the FTSE 100.

Board changes

Paul Edgecliffe-Johnson was appointed to the Board as

Chief Financial Officer on 1 January 2014 following the resignation

of Tom Singer with effect from that date. Paul Edgecliffe-Johnson

was previously Chief Financial Officer of IHG’s Europe and Asia,

Middle East and Africa regions. Paul Edgecliffe-Johnson’s annual

salary on appointment was £420,000, with the first review date

being 1 April 2015. The usual annual and long-term incentive

award levels will apply.

Directors’ Remuneration Policy at IHG

Our Remuneration Policy remains largely unchanged from last

year. In presenting the policy we have looked to explain how the

elements relate to the business strategy and also clearly identify

where the Committee has reserved the ability to use its discretion

to ensure that actual remuneration reflects underlying business

performance and shareholder return.

We believe that the current policy as a whole is well-aligned to

the business strategy and growing long-term shareholder value.

We are comfortable that the outcomes have reflected business

performance. During 2013, the Committee discussed a number

of issues that were raised by shareholders in the context of the

public debate about executive remuneration. These included

Executive Director shareholdings, the use of the TSR as an LTIP

measure and pension arrangements.

Executive Director shareholdings

We encourage senior executives to hold shares. The Chief Executive

Officer has a minimum requirement to hold 300% of salary in

shares; other Executive Directors 200%. At the end of 2013,

the Chief Executive Officer held 1,011% of salary in shares owned

outright and a further 974% of salary in unvested share awards.

Given this level of shareholding, we do not consider it necessary at this

time to change our policy or require a post-vesting holding period.

Use of TSR as an LTIP measure

We believe that the combination of TSR, relative growth

in net rooms and RevPAR, provides the right balance and

focus for driving and rewarding long-term success at IHG.

However, we do understand that achievement of these measures

has to be underpinned by improvements across a whole range

of financial performance metrics. To support this, during 2013,

the Committee decided to reserve the discretion to review the

vesting outcomes under all of the LTIP measures at the end

of each three-year cycle against an assessment of the Group’s

earnings and the quality of financial performance over the

period, including sustainable growth and the efficient use of

cash and capital.

Dear Shareholder

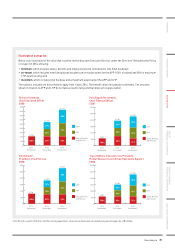

2013 corporate performance and incentive outcomes

IHG continued to deliver sustainable and attractive returns for

shareholders in 2013, as shown by the financial corporate

performance indicators in the table below.

This is the first year in which the Annual Performance Plan (APP)

has included measures of guest satisfaction (Guest HeartBeat)

and employee engagement; overall there were encouraging

performance improvements at both global and regional levels.

Under the Long Term Incentive Plan (LTIP) 2011/13 cycle, strong

three-year Total Shareholder Return (TSR) resulted in maximum

vesting of this element (50% of total award). However, there was only

partial vesting for the Revenue per available room (RevPAR) growth

element (25%), and no vesting against the net rooms growth target

(25%). This LTIP cycle was the first with relative RevPAR and rooms

growth targets.

Executive Director remuneration has reflected this overall

performance with APP awards slightly above target and

comparable to last year, and 59% vesting under the 2011/13

LTIP cycle, down on last year’s full vesting.

Corporate performance

indicators 2013 2012 2011

Operating profit before

exceptional items

+10.4%

$668m1

+10.4%

$605m2*

+25.9%

$548m3*

Full-year dividend per

share(excluding any

special dividends and

capital returns)

70¢

43.2p

64¢

41.2p

55¢

34.5p

Three-year total

TSR (annualised) +18.4% +28.2% +29.8%

1 Includes three liquidated damages receipts in 2013: $31m in The

Americas, $9m in Europe and $6m in AMEA.

2 Includes one significant liquidated damages receipt in 2012 of $3m in

The Americas.

3 Includes two significant liquidated damages receipts in 2011: $10m in

The Americas and $6m in AMEA.

* With effect from 1 January 2013 the Group has adopted IAS 19 (Revised)

‘Employee Benefits’ resulting in the following additional charges to

operating profit: $5m for the six months ended 30 June 2012; $9m for the

12 months ended 31 December 2012; $6m for the six months ended 30

June 2011 and $11m for the 12 months ended 31 December 2011.

Committee membership

Luke Mayhew Chairman

Members

Ian Dyson, David Kappler, Jonathan Linen, Ying Yeh

For full biographies, please see pages 57 to 59.

74 IHG Annual Report and Form 20-F 2013

Directors’ Remuneration Report

Remuneration Committee Chairman’s statement