Holiday Inn 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192

|

|

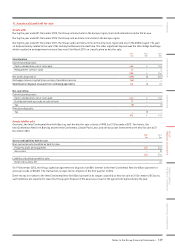

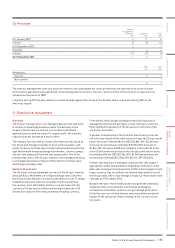

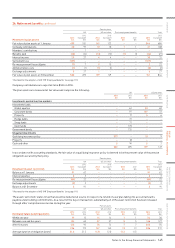

22. Loans and other borrowings continued

Facilities provided by banks

2013 2012

Utilised

$m

Unutilised

$m

Total

$m

Utilised

$m

Unutilised

$m

Total

$m

Committed 41,070 1,074 51,070 1,075

Uncommitted –80 80 –96 96

41,150 1,154 51,166 1,171

2013

$m

2012

$m

Unutilised facilities expire:

Within one year 80 96

After two but before five years 1,070 1,070

1,150 1,166

Utilised facilities are calculated based on actual drawings and may not agree to the carrying value of loans held at amortised cost.

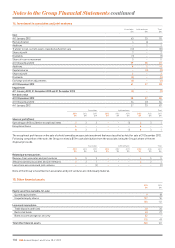

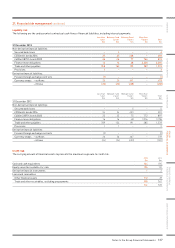

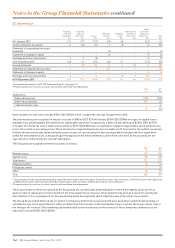

23. Derivative financial instruments

2013

$m

2012

$m

Currency swaps 11 19

Forward foreign exchange contracts (1) (2)

10 17

Analysed as:

Current assets (1) (2)

Non-current liabilities 11 19

10 17

Derivatives are recorded at their fair values as set out in note 24.

Currency swaps

At 31 December 2013, the Group held currency swaps with a principal of $415m (2012 $415m). These swaps were transacted at the same

time as the £250m 6% bonds were issued in December 2009 in order to swap the bonds’ proceeds and interest flows into US dollars.

Under the terms of the swaps, $415m was borrowed and £250m deposited for seven years at a fixed exchange rate of £1 = $1.66. The fair

value of the currency swap comprises two components: $2m (2012 $11m) relating to the repayment of the underlying principal and $9m

(2012 $8m) relating to interest payments. The element relating to the underlying principal is disclosed as a component of net debt (see

note 25). The currency swaps are designated as net investment hedges.

Forward foreign exchange contracts

At 31 December 2013, the Group held short dated foreign exchange swaps with principals of €75m (2012 €75m) and $100m (2012 $170m).

The swaps are used to manage sterling surplus cash and reduce euro and US dollar borrowings whilst maintaining operational flexibility.

The foreign exchange swaps have been designated as net investment hedges.

Notes to the Group Financial Statements 139

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION