Holiday Inn 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

General information

This document constitutes the Annual Report and Financial

Statements in accordance with UK Listing Rules requirements

and the Annual Report on Form 20-F in accordance with the US

Securities Exchange Act of 1934. In previous years the Group

issued separate documents.

The Consolidated Financial Statements of InterContinental Hotels

Group PLC (the Group or IHG) for the year ended 31 December 2013

were authorised for issue in accordance with a resolution of the

Directors on 17 February 2014. InterContinental Hotels Group PLC

(the Company) is incorporated and domiciled in Great Britain and

registered in England and Wales.

Comparatives for 2011

The comparative information presented for the year ended

31 December 2011 is that previously issued on Form 20-F for that

year which differs from the Consolidated Financial Statements

issued to the UK listing authorities for 2011. The difference arose

in respect of a litigation provision of $22m ($13m net of tax) which

was recorded on Form 20-F in the year ended 31 December 2010

but not in the UK Consolidated Financial Statements until the

following year. An unfavourable court judgement on 23 February

2011, between the authorisation of the respective documents

(UK Consolidated Financial Statements on 14 February 2011 and

Form 20-F on 11 April 2011), resulted in the litigation provision

being recorded as an adjusting post balance sheet event in the

Financial Statements for the year ended 31 December 2010 issued

on Form 20-F.

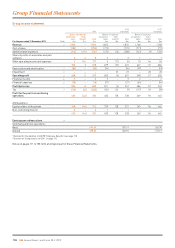

The respective numbers reported were as follows:

2011 Financial Statements2

Form 20-F1UK filing

Profit before tax ($m) 554 532

Profit for the year ($m) 473 460

Net assets ($m) 555 555

Basic earnings per ordinary

share (cents) 163.7 159.2

Diluted earnings per ordinary

share (cents) 159.8 155.4

1

These numbers form the basis of the comparatives included in this

document and exclude the litigation provision described above.

2

Before restatement for the adoption of IAS 19R ‘Employee Benefits’

(seebelow).

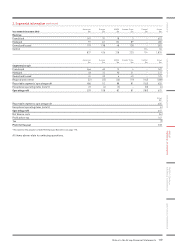

Changes in accounting policies

With effect from 1 January 2013, the Group has adopted IAS 19

(Revised) ‘Employee Benefits’ which introduces a number of

changes to accounting for defined benefit plans. The key change

that impacts the Group is the removal of expected returns on plan

assets from the income statement and its replacement with a

requirement to recognise interest on the net defined benefit asset/

liability (after any asset restrictions), calculated using the discount

rate used to measure the defined benefit obligation.

The impact of this change in accounting policy on the current

andprior year Financial Statements, which have been restated,

isas follows:

Group income statement

2013

$m

2012

$m

2011

$m

Administrative expenses (6) (9) (11)

Operating profit and profit before tax (6) (9) (11)

Tax 223

Profit for the year (4) (7) (8)

Group statement of comprehensive income

2013

$m

2012

$m

2011

$m

Profit for the year (4) (7) (8)

Re-measurement gains, net of related tax

charge of $2m (2012 $1m, 2011 $1m) 4 8 10

Tax related to pension contributions –(1) (2)

Total comprehensive income for

the year – – –

Earnings per share

2013

cents

2012

cents

2011

cents

Basic (1.5) (2.4) (2.8)

Diluted (1.5) (2.4) (2.7)

There has been no change to previously reported retained

earnings, balance sheet amounts or cash flows, other than

consequential adjustments to the analysis of operating cash flows.

The Group has also adopted IAS 1 (Amendment) ‘Presentation

of Items of Other Comprehensive Income’, which changes

the grouping of items presented in the Group statement of

comprehensive income so that items which may be reclassified

to profit or loss in the future are presented separately from

items that will never be reclassified. The amendment affects

presentation only and has had no impact on the Group’s financial

position or performance.

In addition, with effect from 1 January 2013, the Group has

implemented IAS 28 (Amendment) ‘Investments in Associates

and Joint Ventures’, IFRS 10 ‘Consolidated Financial Statements’,

IFRS 11 ‘Joint Arrangements’, IFRS 12 ‘Disclosure of Interests in

Other Entities’ and IFRS 13 ‘Fair Value Measurement’. The adoption

of these standards has had no material impact on the Group’s

financial performance or position and there has been no

requirement to restate prior year comparatives. IFRS 13 has

resulted in new disclosures which are provided in note 24.

In accordance with IFRS 7 ‘Financial Instruments: Disclosures –

Offsetting Financial Assets and Financial Liabilities’ (Amendments

to IFRS 7) additional disclosures have been made in note 18

regarding the Group’s cash pooling arrangements.

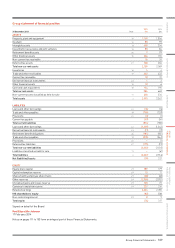

Summary of significant accounting policies

Basis of preparation

The Consolidated Financial Statements of IHG have been prepared

in accordance with International Financial Reporting Standards

(IFRSs) as issued by the IASB and in accordance with IFRS

asadopted by the European Union (EU) and as applied in

accordance with the provisions of the Companies Act 2006.

IFRS as adopted by the EU differs in certain respects from IFRS

as issued by the IASB. However, the differences have no impact

on the Group’s Consolidated Financial Statements for the

years presented.

Presentational currency

The Consolidated Financial Statements are presented in millions

ofUS dollars following a management decision to change the

reporting currency from sterling during 2008. The change was made

to reflect the profile of the Group’s revenue and operating profit which

are primarily generated in US dollars or US dollar-linked currencies.

The currency translation reserve was set to nil at 1 January 2004

ontransition to IFRS and this reserve is presented on the basis

that the Group has reported in US dollars since this date.

Equity share capital, the capital redemption reserve and shares

held by employee share trusts are translated into US dollars at

the rates of exchange on the last day of the period; the resultant

exchange differences are recorded in other reserves.

Accounting policies

Group Financial Statements 111

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION