Holiday Inn 2013 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Group is exposed to the risk of litigation

Certain companies in the Group are the subject of various claims and proceedings. The ultimate outcome of these matters is

subject to many uncertainties, including future events and uncertainties inherent in litigation. In addition, the Group could be at

risk of litigation from many parties, including but not limited to: guests, customers, joint-venture partners, suppliers, employees,

regulatory authorities, franchisees and/or the owners of the hotels it manages. Claims filed in the US may include requests for

punitive damages as well as compensatory damages. Unfavourable outcomes of claims or proceedings could have a material

adverse impact on the Group’s results of operations, cash flow and/or financial position. Exposure to significant litigation or fines

may also affect the reputation of the Group and its brands.

The Group is exposed to risks related to corporate responsibility

The reputation of the Group and the value of its brands are influenced by a wide variety of factors, including the perception of

stakeholder groups such as the communities in which the Group operates. The social and environmental impacts of business

are under increasing scrutiny, and the Group is exposed to the risk of damage to its reputation if it fails to demonstrate sufficiently

responsible practices, ethical behaviour, or fails to comply with relevant regulatory requirements.

The Group is exposed to a variety of risks associated with its financial stability and ability to borrow and satisfy debt covenants

While the strategy of the Group is to extend the hotel network through activities that do not involve significant amounts of its

own capital, the Group does require capital to fund some development opportunities and to maintain and improve owned hotels.

The Group is reliant upon having financial strength and access to borrowing facilities to meet these expected capital requirements.

The majority of the Group’s borrowing facilities are only available if the financial covenants in the facilities are complied with.

Non-compliance with covenants could result in the lenders demanding repayment of the funds advanced. If the Group’s financial

performance does not meet market expectations, it may not be able to refinance existing facilities on terms considered favourable.

The Group may face difficulties insuring its business

Historically, the Group has maintained insurance at levels determined to be appropriate in light of the cost of cover and the risk

profile of the business. However, forces beyond the Group’s control, including market forces, may limit the scope of coverage

the Group can obtain and the Group’s ability to obtain coverage at reasonable rates. Other forces beyond the Group’s control,

such as terrorist attacks or natural disasters, may be uninsurable or simply too expensive to insure. Inadequate or insufficient

insurance could expose the Group to large claims or could result in the loss of capital invested in properties, as well as the

anticipated future revenue from properties, and could leave the Group responsible for guarantees, debt or other financial

obligations related to such properties.

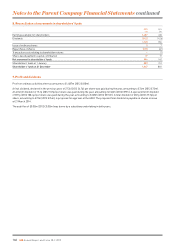

Executive Committee members’ shareholdings

Shares held by Executive Committee members (excluding the Executive Directors) as at 31 December 2013

Executive

Committee

Member Number of shares held outright APP deferred share awards LTIP share awards (unvested) Total number of shares held

2013 2012 2013 2012 2013 2012 2013 2012

Keith Barr 24,399 24,399 27,695 18,001 111,079 116,600 163,173 159,000

Angela Brav 19,286 27,135 22,501 14,200 99,650 104,254 141,437 145,589

Kenneth

Macpherson 1,797 n/a 8,421 n/a 41,654 n/a 51,872 n/a

Eric Pearson 65,293 101,914 22,356 11,548 103,553 107,738 191,202 221,200

Jan Smits 106,350 106,350 28,738 19,581 116,234 117,826 251,322 243,757

George Turner 3,277 3,277 35,893 26,653 106,100 121,057 145,270 150,987

Details of the shares held by the Executive Directors can be found on page 94.

For further details on the APP deferred share award and for the LTIP share award see pages 78, 79 and 82.

Additional Information 167

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION