Holiday Inn 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

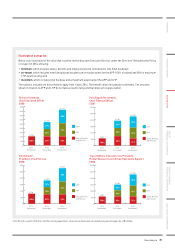

2011/13 LTIP

The performance measures for each three-year LTIP cycle are set by the Committee. Awards are made annually and eligible executives

will receive shares at the end of that cycle, subject to achievement of the performance measures. The performance measures for the

2011/13 cycle were:

• relative growth in net rooms over three years;

• relative like-for-like RevPAR growth over three years; and

• IHG’s TSR relative to the Dow Jones Global Hotel (DJGH) index.

Growth in net rooms and RevPAR is measured on a relative basis against the comparator group, comprising the following major,

globally branded competitors: Accor, Choice, Hilton, Hyatt, Marriott, Starwood and Wyndham.

These performance measures are also used for the 2012/14 and 2013/15 LTIP cycles, granted in 2012 and 2013 respectively.

Why do we use these measures?

Net rooms growth RevPAR growth TSR vs DJGH

This measures the net growth in the total

number of IHG hotel rooms over the duration

of the cycle relative to our major global

competitors. Together with the RevPAR

measure, it provides focus on ensuring a

balance between the quality of IHG hotels

and the speed at which IHG grows.

This measures success in growing our rates

for the rooms we have open for the duration

of the cycle relative to the RevPAR growth of

our major global competitors.

This measures the return to shareholders by

investing in IHG relative to our competitors

in the appropriate comparator group,

currently the DJGH index.

In order to generate higher returns for our shareholders, we need to increase revenue share, improve operating efficiency and grow

margins through increasing the number of rooms we have available to sell, as well as generating more RevPAR for those rooms.

By focusing on both net rooms growth and RevPAR growth, we are rewarding the balanced approach to growth that will support the

long-term increase in shareholder value.

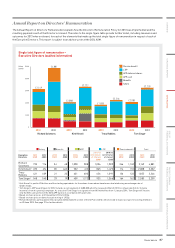

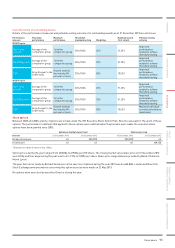

Outcome for 2011/13 cycle (audited information)

This cycle vested on 19 February 2014 as follows:

Performance

measure

Threshold

performance

Maximum

performance

Threshold/

maximum vesting Weighting

Maximum award

(% of salary at

date of award)

Actual performance

vs comparator group

Outcome

(% of maximum

award vesting)

Net rooms

growth

Average of the

comparator

group

1st in the

comparator

group

20% / 100% 25% 51.25% Below average 0%

RevPAR growth

Average of the

comparator

group

1st in the

comparator

group

20% / 100% 25% 51.25% Slightly above

average 9%

TSR

Growth equal

to the DJGH

index

Growth exceeds

the index by 8%

per year or more

20% / 100% 50% 102.5%

Growth

exceeded index by

10.4%

50%

Total vesting

outcome 59%

Net rooms and RevPAR growth were measured by reference to the three years ending 30 September 2013; TSR was measured by

reference to the three years ending 31 December 2013.

Pension benefit: the value of Company contributions to pension plans and any cash allowances paid in lieu of pension contributions.

For 2012, the figure for Richard Solomons shows the increase in his pension value as a member of the executive defined benefit section of

the IC Plan, which arose principally from his salary review when appointed Chief Executive Officer in July 2011. The defined benefit section

of the IC Plan closed to future accruals for existing members on 30 June 2013 and therefore the 2013 pension figure for Richard Solomons

also includes a cash allowance in lieu of pensions contributions for the period from 1 July 2013.

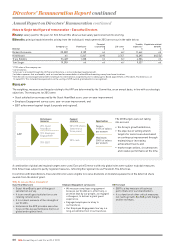

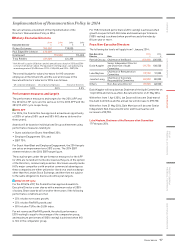

LTIP 100% IHG

shares

25% RevPAR

25% net rooms

50% TSR

Performance

measures

Payment

structure

Target:

102.5% of salary

per annum

Maximum:

205% of salary

per annum

Opportunities

90 IHG Annual Report and Form 20-F 2013

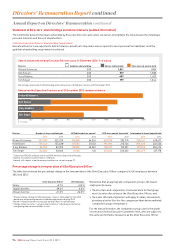

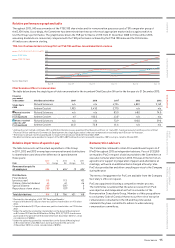

Directors’ Remuneration Report continued

Annual Report on Directors’ Remuneration continued