Holiday Inn 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192

|

|

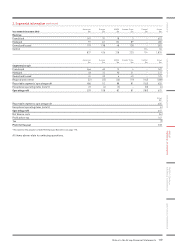

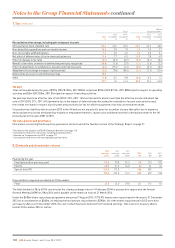

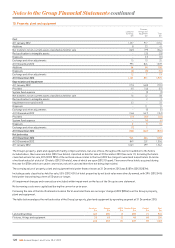

2. Segmental information continued

31 December 2012

Americas

$m

Europe

$m

AMEA

$m

Greater China

$m

Central

$m

Group

$m

Assets and liabilities

Segment assets 725 626 282 390 250 2,273

Non-current assets classified as held for sale 232 302 –––534

957 928 282 390 250 2,807

Unallocated assets:

Non-current tax receivable 24

Deferred tax assets 204

Current tax receivable 31

Derivative financial instruments 2

Cash and cash equivalents 195

Total assets 3,263

Segment liabilities (403) (249) (58) (61) (690) (1,461)

Liabilities classified as held for sale (61) ––––(61)

(464) (249) (58) (61) (690) (1,522)

Unallocated liabilities:

Current tax payable (54)

Deferred tax liabilities (93)

Loans and other borrowings (1,258)

Derivative financial instruments (19)

Total liabilities (2,946)

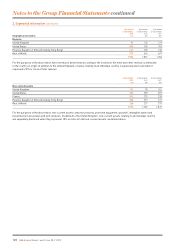

Year ended 31 December 2012

Americas

$m

Europe

$m

AMEA

$m

Greater China

$m

Central

$m

Group

$m

Other segmental information

Capital expenditure (see below) 25 19 6 7 76 133

Non-cash items:

Depreciation and amortisation120 23 14 15 22 94

Reversal of previously recorded impairment (23) – – – – (23)

Write-off of software – – – – 18 18

Demerger liability released ––––(9) (9)

Share-based payments cost – – – – 22 22

Share of profit of associates and joint ventures – – (3) – – (3)

1 Included in the $94m of depreciation and amortisation is $31m relating to administrative expenses and $63m relating to cost of sales.

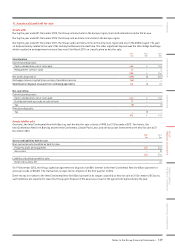

Americas

$m

Europe

$m

AMEA

$m

Greater China

$m

Central

$m

Group

$m

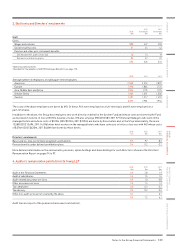

Reconciliation of capital expenditure

Capital expenditure per management reporting 25 19 6 7 76 133

Timing differences (1) ––2–1

Capital expenditure per the Financial Statements 24 19 6 9 76 134

Comprising additions to:

Property, plant and equipment 15 929641

Non-current assets classified as held for sale 5––––5

Intangible assets 2 8 4 – 70 84

Investment in associates and joint ventures 2––––2

Other financial assets –2–––2

24 19 6 9 76 134

120 IHG Annual Report and Form 20-F 2013

Notes to the Group Financial Statements continued