Holiday Inn 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Owned and leased revenue at the InterContinental Hong Kong

increased by $3m (2.2%) to $141m, driven by a 4.5% increase in

total gross revenue derived from non-rooms business, although

this was partly offset by a RevPAR decline of 0.1%. Operating profit

increased by $2m (4.4%) to $47m.

Highlights for the year ended 31 December 2012

Revenue and operating profit before exceptional items increased by

$25m (12.2%) to $230m and by $14m (20.9%) to $81m respectively.

RevPAR increased 5.4% with 3.1% growth in average daily rate.

Franchised revenue increased by $1m (50.0%) to $3m and

operating profit by $1m (33.3%) to $4m, boosted by the opening

of the 1,224-room Holiday Inn Macao Cotai Central.

Managed revenue increased by $12m (15.6%) to $89m and operating

profit increased by $8m (18.6%) to $51m. RevPAR growth of 5.6%

reflected continued economic growth in the region, although the

whole industry was affected in the latter part of the year by the

Diaoyu/Senkaku islands territorial dispute and slower

macroeconomic conditions. There was also continued significant

Greater China System size growth for the managed estate (9.7%

rooms growth in 2012 following 14.2% rooms growth in 2011).

Owned and leased revenue increased by $12m (9.5%) to $138m and

operating profit increased by $8m (21.6%) to $45m, with RevPAR

growth of 6.7% at the InterContinental Hong Kong.

Regional costs increased by $3m (18.8%) to $19m reflecting

increased investment in operations and infrastructure in the region.

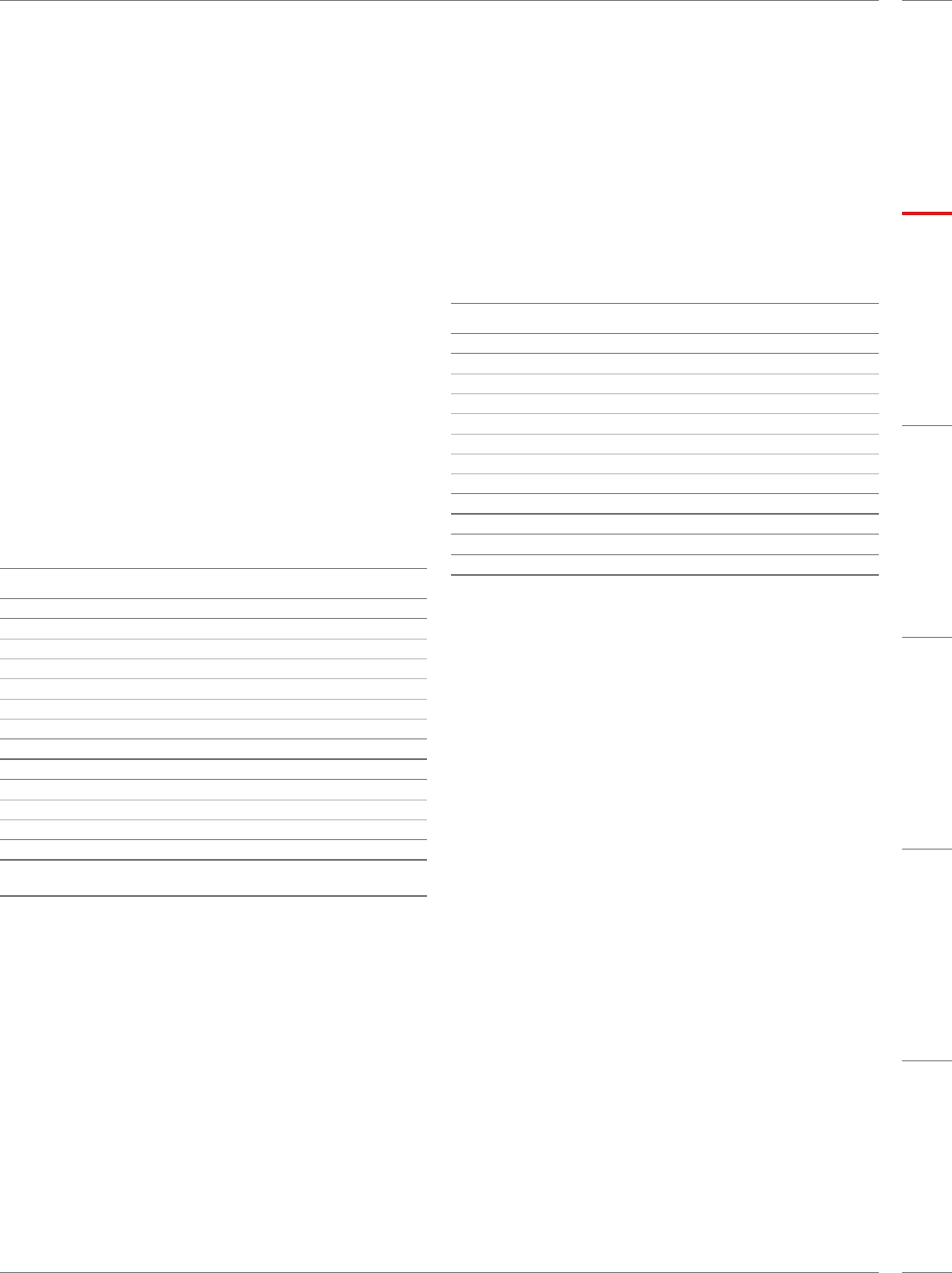

Greater China hotel and room count Hotels Rooms

At 31 December 2013

Change

over 2012 2013

Change

over 2012

Analysed by brand

InterContinental 29 711,742 2,369

Crowne Plaza 65 523,234 1,782

Holiday Inn167 321,662 885

Holiday Inn Express 42 511,295 1,842

Hotel Indigo 52612 207

Other –(1) –(141)

Total 208 21 68,545 6,944

Analysed by ownership type

Franchised 4–2,184 –

Managed 203 21 65,858 6,944

Owned and leased 1–503 –

Total 208 21 68,545 6,944

Percentage of Group

hotel and room count 4.4 0.3 10.0 0.9

1

Includes 4 Holiday Inn Resort properties (1,203 rooms) (2012: 3 Holiday Inn

Resort properties (893 rooms)).

The Greater China hotel and room count in the year increased by

21hotels (6,944 rooms) to 208 hotels (68,545 rooms). 23 hotels

(7,669rooms) opened during 2013, broadly in line with 2012.

InterContinental System size increased by 7 hotels (2,369 rooms)

to 29 hotels (11,742 rooms), with openings including the 294-room

InterContinental Sanya Haitang Bay Resort, a second for the

brand on the island resort destination of Sanya. The Group

also celebrated its 200th opening in Greater China in 2013 with

the opening of the 141-room InterContinental Shanghai Ruijin.

A further two Hotel Indigo properties (208 rooms) were opened,

including a first for the brand in Hong Kong.

Two hotels (725 rooms) were removed from the Greater China

System in 2013.

Greater China pipeline Hotels Rooms

At 31 December 2013

Change

over 2012 2013

Change

over 2012

Analysed by brand

InterContinental 22 –9,392 374

Crowne Plaza 52 –18,469 (863)

Holiday Inn141 411,944 945

Holiday Inn Express 33 47,260 1,263

Hotel Indigo 5–721 152

HUALUXE 21 66,804 1,900

Other –––(97)

Total 174 14 54,590 3,674

Analysed by ownership type

Managed 174 14 54,590 3,674

Total 174 14 54,590 3,674

1

Includes 3 Holiday Inn Resort properties (890 rooms) (2012: 3 Holiday Inn

Resort properties (850 rooms)).

The Greater China pipeline totalled 174 hotels (54,590 rooms) as

at 31 December 2013, compared to 160 hotels (50,916 rooms) as at

31 December 2012. Signings of 53 hotels (15,348 rooms) increased

from 46 hotels (13,387 rooms) in 2012. Seven InterContinental hotels

(2,129 rooms) were signed, together with 11 Crowne Plaza hotels

(3,528 rooms), whilst the total pipeline for the HUALUXE Hotels &

Resorts brand increased to 21 hotels (6,804 rooms). 26 hotels

(7,343 rooms) were signed in the Holiday Inn brand family,

including the 1,002-room Holiday Inn Express Changbaishan,

which subsequently opened as the Group’s largest Holiday Inn

Express in 2013.

16 hotels (4,005 rooms) were removed from the pipeline in 2013.

Strategic Report 49

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION