Holiday Inn 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192

|

|

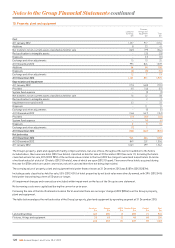

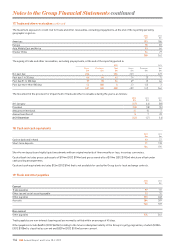

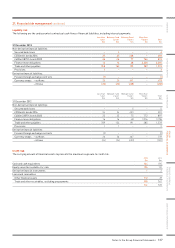

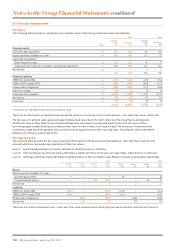

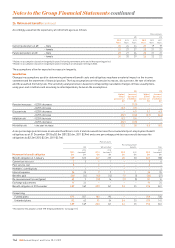

21. Financial risk management continued

Liquidity risk

The following are the undiscounted contractual cash flows of financial liabilities, including interest payments:

Less than

1 year

$m

Between 1 and

2 years

$m

Between 2 and

5 years

$m

More than

5 years

$m

Total

$m

31 December 2013

Non-derivative financial liabilities:

Secured bank loans –4––4

£250m 6% bonds 2016 25 25 438 –488

£400m 3.875% bonds 2022 26 26 77 764 893

Finance lease obligations 16 16 48 3,300 3,380

Trade and other payables 748 162 193 289 1,392

Provisions 3–––3

Derivative financial liabilities:

Forward foreign exchange contracts (1) – – – (1)

Currency swaps – outflows 26 26 441 –493

– inflows (25) (25) (438) –(488)

Less than

1 year

$m

Between 1 and

2 years

$m

Between 2 and

5 years

$m

More than

5 years

$m

Total

$m

31 December 2012

Non-derivative financial liabilities:

Secured bank loans – – 5 – 5

£250m 6% bonds 2016 24 24 453 –501

£400m 3.875% bonds 2022 25 25 75 772 897

Finance lease obligations 16 16 48 3,316 3,396

Trade and other payables 709 154 191 285 1,339

Provisions 11––2

Derivative financial liabilities:

Forward foreign exchange contracts (2) – – – (2)

Currency swaps – outflows 26 26 467 –519

– inflows (24) (24) (453) –(501)

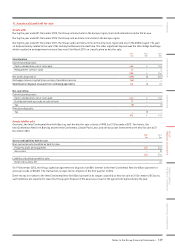

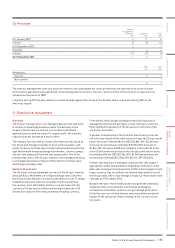

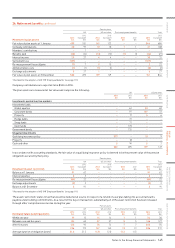

Credit risk

The carrying amount of financial assets represents the maximum exposure to credit risk.

2013

$m

2012

$m

Cash and cash equivalents 134 195

Equity securities available-for-sale 136 112

Derivative financial instruments 12

Loans and receivables:

Other financial assets 112 49

Trade and other receivables, excluding prepayments 358 362

741 720

Notes to the Group Financial Statements 137

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION