Holiday Inn 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

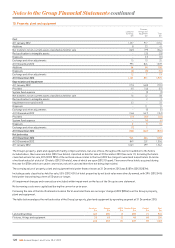

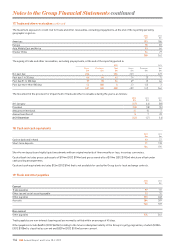

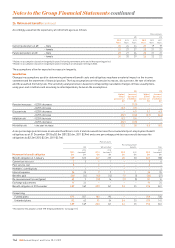

22. Loans and other borrowings

2013 2012

Current

$m

Non-current

$m

Total

$m

Current

$m

Non-current

$m

Total

$m

Secured bank loans –44 –55

Finance lease obligations 16 199 215 16 196 212

£250m 6% bonds 2016 –412 412 –403 403

£400m 3.875% bonds 2022 –654 654 –638 638

Total borrowings 16 1,269 1,285 16 1,242 1,258

Denominated in the following currencies:

Sterling –1,066 1,066 –1,041 1,041

US dollars 16 199 215 16 196 212

Other –44 –55

16 1,269 1,285 16 1,242 1,258

Secured bank loans

The New Zealand dollar mortgage is secured on the hotel property to which it relates. Non-current amounts include $4m (2012 $5m)

repayable by instalments.

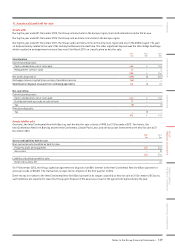

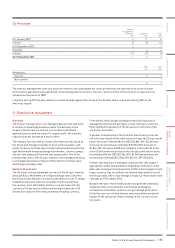

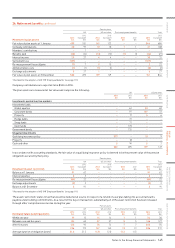

Finance lease obligations

Finance lease obligations, which relate to the 99-year lease (of which 92 years remain) on the InterContinental Boston, are payable

asfollows:

2013 2012

Minimum

lease

payments

$m

Present

value of

payments

$m

Minimum

lease

payments

$m

Present

value of

payments

$m

Less than one year 16 16 16 16

Between one and five years 64 48 64 48

More than five years 3,300 151 3,316 148

3,380 215 3,396 212

Less: amount representing finance charges (3,165) –(3,184) –

215 215 212 212

The Group has the option to extend the term of the lease for two additional 20-year terms. Payments under the lease step up at regular

intervals over the lease term.

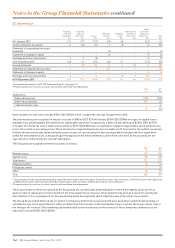

£250m 6% bonds 2016

The 6% fixed interest sterling bonds were issued on 9 December 2009 and are repayable in full on 9 December 2016. Interest is payable

annually on 9 December in each year commencing 9 December 2010 to the maturity date. The bonds were initially priced at 99.465% of

face value and are unsecured. Currency swaps were transacted at the same time the bonds were issued in order to swap the proceeds

and interest flows into US dollars (see note 23 for further details).

£400m 3.875% bonds 2022

The 3.875% fixed interest sterling bonds were issued on 28 November 2012 and are repayable on 28 November 2022. Interest is payable

annually on28 November in each year commencing 28 November 2013 to the maturity date. The bonds were initially priced at 98.787% of

face value and areunsecured.

138 IHG Annual Report and Form 20-F 2013

Notes to the Group Financial Statements continued