Holiday Inn 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

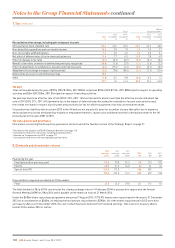

As all Fund income is designated for specific purposes and does

not result in a profit or loss for the Group, the revenue recognition

criteria as outlined in the accounting policy above are not met and

therefore the income and expenses of the Fund are not included in

the Group income statement.

The assets and liabilities relating to the Fund are included in the

appropriate headings in the Group statement of financial position as

the related legal, but not beneficial, rights and obligations rest with

the Group. These assets and liabilities include the IHG Rewards Club

liability, short-term timing surpluses and deficits and any receivables

and payables related to the Fund.

The cash flows relating to the Fund are reported within ‘cash flow

from operations’ in the Group statement of cash flows due to the

close interrelationship between the Fund and the trading

operations of the Group.

Further information on the Fund is included in note 34.

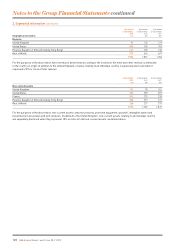

Loyalty programme – the hotel loyalty programme, IHG Rewards

Club, enables members to earn points, funded through hotel

assessments, during each qualifying stay at an IHG branded hotel

and redeem points at a later date for free accommodation or other

benefits. The future redemption liability is calculated by multiplying

the number of points expected to be redeemed by the redemption cost

per point. On an annual basis the Group engages an external actuary

who uses statistical formulas to assist in the estimate of the number

of points that will never be redeemed (‘breakage’). Actuarial gains and

losses on the future redemption liability are borne by the System Fund

and any resulting changes in the liability would correspondingly adjust

the amount of short-term timing surpluses and deficits held in the

Group statement of financial position. The future redemption liability,

which is included in trade and other payables, was $649m at

31 December 2013. Based on the conditions existing at the balance

sheet date, a 5% decrease in the breakage estimate would increase

this liability by approximately $31m.

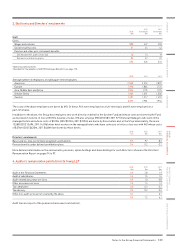

Impairment testing – intangible assets, property, plant and

equipment are tested for impairment when events or circumstances

indicate that their carrying value may not be recoverable. Goodwill is

subject to an impairment test on an annual basis or more frequently

if there are indicators of impairment. Assets that do not generate

independent cash flows are combined into cash-generating units.

The impairment testing of individual assets or cash-generating

units requires an assessment of the recoverable amount of the

asset or cash-generating unit. If the carrying value of the asset or

cash-generating unit exceeds its estimated recoverable amount,

the asset or cash-generating unit is written down to its recoverable

amount. Recoverable amount is the greater of fair value less costs

to sell and value in use. Value in use is assessed based on estimated

future cash flows discounted to their present value using a pre-tax

discount rate that is based on the Group’s weighted average cost of

capital adjusted to reflect the risks specific to the business model and

territory of the cash-generating unit or asset being tested. The outcome

of such an assessment is subjective, and the result sensitive to the

assumed future cash flows to be generated by the cash-generating

units or assets and discount rates applied in calculating the value in use.

At 31 December 2013, the Group had intangible assets of $438m and

property, plant and equipment of $1,169m, none of which were subject

to an impairment charge during the year. In respect of those assets

requiring an impairment test and depending on how recoverable

amount was assessed, neither a 10% reduction in fair value or

estimated future cash flows would have resulted in an impairment loss.

Information on impairment testing of goodwill, which had a net book

value of $80m at 31 December 2013, is included in note 12.

Pensions and other post-employment benefit plans – accounting for

pensions and other post-employment benefit plans requires the Group

to make assumptions including, but not limited to, discount rates,

rates of inflation, life expectancies and healthcare costs. The use of

different assumptions could have a material effect on the accounting

values of the relevant liabilities which could result in a material change

to the cost of such liabilities as recognised in the income statement

over time. These assumptions are subject to annual review and are

determined with the assistance of an external actuary. A sensitivity

analysis to changes in the key assumptions is included in note 26.

On 15 August 2013, the UK defined benefit plan completed a buy-in

transaction whereby the assets of the plan were invested in a bulk

insurance annuity contract that fully insures the benefits payable to

the members of the plan. As the contract has been structured to enable

the plan to move to full buy-out (following which the insurance company

would become directly responsible for the pension payments) and the

intention is to proceed on this basis, the buy-in transaction has been

accounted for as a settlement with the loss arising of $147m recorded in

the income statement as an exceptional item. An acceptable alternative

accounting treatment would have been to record the loss as an actuarial

loss in other comprehensive income.

Income taxes – deferred tax assets are recognised to the extent that it

is regarded as probable that deductible temporary differences can be

realised. The Group estimates deferred tax assets and liabilities based

on current tax laws and rates, and in certain cases, business plans,

including management’s expectations regarding the manner and timing

of recovery of the related assets. Changes in these estimates may affect

the amount of deferred tax liabilities or the valuation of deferred tax

assets and therefore the tax charge in the income statement.

Provisions for tax liabilities require judgements on the interpretation of

tax legislation, developments in case law and the potential outcomes of

tax audits and appeals which may be subject to significant uncertainty.

Therefore the actual results may vary from expectations resulting in

adjustments to provisions, the valuation of deferred tax assets, cash tax

settlements, and therefore the tax charge in the income statement.

Exceptional tax charges and credits have arisen in 2013, 2012 and 2011

as explained in note 7.

Litigation – from time to time, the Group is subject to legal

proceedings the ultimate outcome of each being always subject

to many uncertainties inherent in litigation. A provision for litigation

is made when it is considered probable that a payment will be

made and the amount of the loss can be reasonably estimated.

Significant judgment is made when evaluating, amongst other

factors, the probability of unfavourable outcome and the ability

to make a reasonable estimate of the amount of potential loss.

Litigation provisions are reviewed at each accounting period and

revisions made for changes in facts and circumstances.

New standards issued but not effective

IFRS 9 ‘Financial Instruments: Classification and Measurement’

introduces new requirements for classifying and measuring financial

assets and financial liabilities and, when finalised, willaddress hedge

accounting and impairment of financial assets. The Group will assess

the impacts when the final standard is issued. The effective date for

IFRS 9 is not expected to be before 1January 2017.

The amendments to existing accounting standards that are effective

from 1 January 2014, ‘Offsetting Financial Assets and Financial

Liabilities’ (Amendments to IAS 32) and ‘Recoverable Amount

Disclosures for Non-Financial Assets’ (Amendments to IAS 36),

are not expected to have a material impact on the Group’s reported

income or financial position.

116 IHG Annual Report and Form 20-F 2013

Accounting policies continued