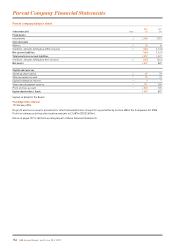

Holiday Inn 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

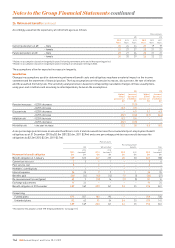

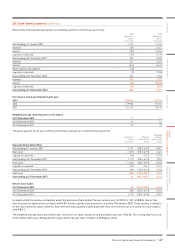

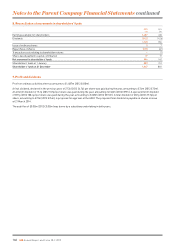

31. Capital and other commitments

2013

$m

2012

$m

Contracts placed for expenditure not provided for in the Group Financial Statements:

Property, plant and equipment 70 66

Intangible assets 13 15

83 81

The Group has also committed to invest up to $61m in three investments accounted for under the equity method of which $41m had been

spent at 31 December 2013.

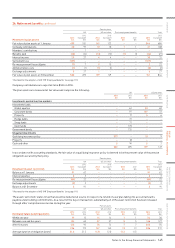

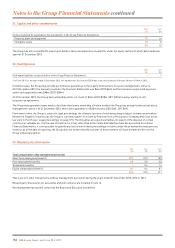

32. Contingencies

2013

$m

2012

$m

Contingent liabilities not provided for in the Group Financial Statements –11

1 On Form 20-F for the year ended 31 December 2012, this number was disclosed as $25m due to an arbitral award in Greater China on 21 March 2013.

In limited cases, the Group may provide performance guarantees to third-party hotel owners to secure management contracts.

At 31 December 2013, the amount provided in the Financial Statements was $6m (2012 $6m) and the maximum unprovided exposure

under such guarantees was $48m (2012 $50m).

At 31 December 2013, the Group had outstanding letters of credit of $41m (2012 $38m, 2011 $51m) mainly relating to self

insurance programmes.

The Group may guarantee loans made to facilitate third-party ownership of hotels in which the Group has an equity interest and also a

management contract. At 31 December 2013, there were guarantees of $20m in place (2012 $nil, 2011 $nil).

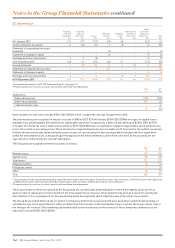

From time to time, the Group is subject to legal proceedings the ultimate outcome of each being always subject to many uncertainties

inherent in litigation. In particular, the Group is currently subject to a claim by Pan American Life Insurance Company and class action

law suits in the US (see ‘Legal proceedings’ on page 172). The Group has also given warranties in respect of the disposal of certain

of its former subsidiaries. It is the view of the Directors that, other than to the extent that liabilities have been provided for in these

Financial Statements, it is not possible to quantify any loss to which these proceedings or claims under these warranties may give rise,

however, as at the date of reporting, the Group does not believe that the outcome of these matters will have a material effect on the

Group’s financial position.

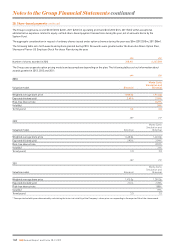

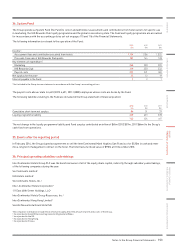

33. Related party disclosures

2013

$m

2012

$m

2011

$m

Total compensation of key management personnel

Short-term employment benefits 20.7 20.0 18.8

Post-employment benefits 0.8 0.8 0.8

Termination benefits –0.6 1.4

Equity compensation benefits 8.1 8.6 8.1

29.6 30.0 29.1

There were no other transactions with key management personnel during the years ended 31 December 2013, 2012 or 2011.

Related party disclosures for associates and joint ventures are included in note 14.

Key management personnel comprises the Board and Executive Committee.

152 IHG Annual Report and Form 20-F 2013

Notes to the Group Financial Statements continued