Holiday Inn 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

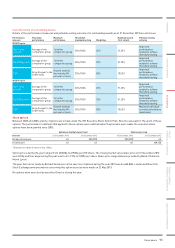

Total pension entitlements (audited information)

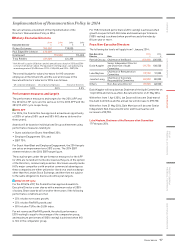

From 2014, two changes to pension arrangements are being made

in line with the objective of significantly reducing the defined

benefit liability and risks in the Company’s balance sheet.

Richard Solomons is eligible for the Enhanced Early Retirement

Facility (EERF), which is available to all members of the plan.

Richard Solomons’ facility is being phased out in line with all

other plan members meaning that he could retire without

reduction to his pension from approximately age 58 and no earlier.

This provision only applies on consent of the Company. Prior to

the phasing out, Richard Solomons was eligible to retire without

reduction from age 55.

Although the EERF is non-contractual, as part of the consultation

with employees and the plan trustees with regards to the changes

in the defined benefit section of the IC Plan in June 2013, it was

agreed at that time that the EERF would be retained. However,

the decision has now been made to phase out this facility as part

of the process of redrawing the Company’s pension arrangements.

The EERF terms require an executive to obtain Company consent.

Richard Solomons participated in the executive defined benefit

section of the IC Plan and the unfunded InterContinental Executive

Top-Up Scheme (ICETUS) until June 2013, when they both closed to

future accruals.

As set out in the Remuneration Committee Chairman’s statement,

in 2014 the Company is looking to reduce the risks and volatility

from the remaining unfunded ICETUS pension arrangements by

offering members an opportunity to cash out the ICETUS element

of their pension on a basis that is fair and reasonable, both to them

and to shareholders. Currently, approximately 11 UK employed

executives participate in the ICETUS arrangement.

This is part of the process of redrawing IHG’s pension arrangements

and minimising the future risks to the company. In the event the

cash-out offer is accepted by an Executive Director, details will be

disclosed in the relevant Annual Report on Directors’ Remuneration.

This is in relation to previously disclosed benefits.

Themain features of the executive defined benefit section of the

IC Plan, which is a funded, final salary, occupational scheme are:

• normal pension age of 60 (9 October 2021, for Richard Solomons);

• pension accrual of 1/30th of final pensionable salary for each

year of pensionable service;

• life assurance cover of four times pensionable salary;

• pensions payable in the event of ill-health; and

• spouse’s, partner’s and dependents’ pensions on death.

Following the closure of these arrangements to future accrual

from July 2013, Richard Solomons receives a cash sum in lieu of

pension contributions.

Richard Solomons’ 2013 pension benefits are as follows:

£

Director’s contributions

for the year 17,760

Deemed capital value of accrued

benefits as at1 January 201317,544,000

Deemed capital value of accrued

benefits at 31December 20131 7,886,000

Increase in transfer value

over the year 342,000

Absolute increase in accrued

pensionper annum 17,100

Increase in accrued pension

(ie excluding inflation) per annum 5,400

1

The capital values disclosed above are based on the HM Revenue &

Customs methodology of valuing pensions at 20 times their annual

amounts, which is in line with the ‘Single Figure’ value stated

elsewhere in these Accounts; the 2012 Accounts included values

calculated on an actuarial basis, which was in line with regulations

applicable at the time.

£

Accrued value of annual pension

if retired at 31 December 2013

272,050 of which:

49,640 is funded

222,410 is unfunded

Accrued value of annual pension

at 31 December 2013, assuming

retirement at normal age

(9 October 2021)

394,300 of which:

71,950 is funded

322,350 is unfunded

Additional annual pension benefit

onearly retirement under EERF

at 31December 2013

78,860 of which:

14,390 is funded

64,470 is unfunded

In addition, in 2013 Richard Solomons received a cash

allowance in lieu of pension contributions of £110,850.

The breakdown of the pension element of the single figure

for2012 and 2013 for Richard Solomons is as follows:

2013

£000

2012

£000

Pension benefit under defined benefit

section of IC Plan 135 1,14 0

Cash allowance in lieu of

pensioncontribution 111 –

Total 246 1,140

Governance 91

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION