Holiday Inn 2013 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

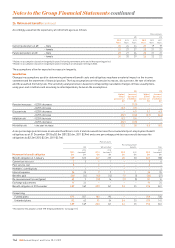

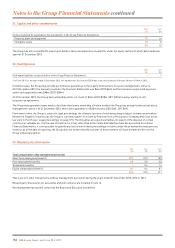

29. Equity continued

The nature and purpose of the other reserves shown in the Group statement of changes in equity on pages 106 to 108 of the Financial

Statements is as follows:

Capital redemption reserve

This reserve maintains the nominal value of the equity share capital of the Company when shares are repurchased or cancelled.

Shares held by employee share trusts

Comprises $37.6m (2012 $48.0m, 2011 $26.5m) in respect of 1.2m (2012 1.8m, 2011 1.5m) InterContinental Hotels Group PLC ordinary

shares held by employee share trusts, with a market value at 31 December 2013 of $39.8m (2012 $50m, 2011 $26m).

Other reserves

Comprises the merger and revaluation reserves previously recognised under UK GAAP, together with the reserve arising as a

consequence of the Group’s capital reorganisation in June 2005. Following the change in presentational currency to the US dollar

in 2008 (see page 111 to 112), this reserve also includes exchange differences arising on the retranslation to period-end exchange

rates of equity share capital, the capital redemption reserve and shares held by employee share trusts.

Unrealised gains and losses reserve

This reserve records movements in the fair value of available-for-sale financial assets and the effective portion of the cumulative

net change in the fair value of the cash flow hedging instruments related to hedged transactions that have not yet occurred.

Currency translation reserve

This reserve records the movement in exchange differences arising from the translation of foreign operations and exchange differences

on foreign currency borrowings and derivative instruments that provide a hedge against net investments in foreign operations.

On adoption of IFRS, cumulative exchange differences were deemed to be $nil as permitted by IFRS 1.

The fair value of derivative instruments designated as hedges of net investments in foreign operations outstanding at 31 December 2013

was a $10m net liability (2012 $17m, 2011 $36m).

Treasury shares

At 31 December 2013, 9.8m shares (2012 nil, 2011 nil) with a nominal value of $2.4m (2012 $nil, 2011 $nil) were held as treasury shares

atcost and deducted from retained earnings.

Non-controlling interest

A non-controlling interest is equity in a subsidary of the Group not attributable, directly or indirectly, to the Group. Non-controlling interests

are not material to the Group.

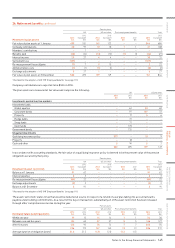

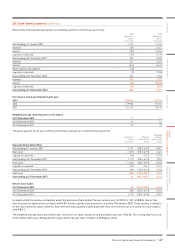

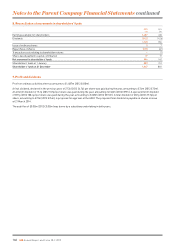

30. Operating leases

During the year ended 31 December 2013, $67m (2012 $64m, 2011 $64m) was recognised as an expense in the Group income statement in

respect of operating leases, net of amounts borne directly by the System Fund. The expense includes contingent rents of $24m (2012

$19m, 2011 $18m).

Future minimum lease payments under non-cancellable operating leases are as follows:

2013

$m

2012

$m

Due within one year 42 47

One to two years 33 34

Two to three years 29 25

Three to four years 23 22

Four to five years 23 22

More than five years 202 237

352 387

In addition, in certain circumstances the Group is committed to making additional lease payments that are contingent on the performance

of the hotels that are being leased.

The average remaining term of these leases, which generally contain renewal options, is approximately 18 years (2012 19 years).

Nomaterialrestrictions or guarantees exist in the Group’s lease obligations.

Total future minimum rentals expected to be received under non-cancellable sub-leases are $10m (2012 $10m).

Notes to the Group Financial Statements 151

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION