Holiday Inn 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

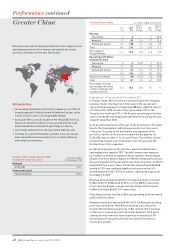

Greater China results 12 months ended 31 December

2013

$m

2012

$m

2013 vs

2012 %

change

2011

$m

2012 vs

2011 %

change

Revenue

Franchised 33– 2 50.0

Managed 92 89 3.4 77 15.6

Owned and leased 141 138 2.2 126 9.5

Total 236 230 2.6 205 12.2

Percentage of

Group Revenue 12.4 12.5 (0.1) 11.6 0.9

Operating profit before

exceptional items

Franchised 5425.0 333.3

Managed 51 51 –43 18.6

Owned and leased 47 45 4.4 37 21.6

103 100 3.0 83 20.5

Regional overheads (21) (19) (10.5) (16) (18.8)

Total 82 81 1.2 67 20.9

Percentage of Group

Operating profit before

central overheads and

exceptional items

10.0 10.6 (0.6) 9.5 1.1

Highlights for the year ended 31December 2013

In Greater China, 96% of rooms are operated under the managed

business model. The majority of hotels are in the upscale and

upper midscale segments. Comprising 208 hotels (68,545 rooms)

at 31December 2013, Greater China represented 10% of the

Group’s room count and 10% of the Group’s operating profit before

central overheads and exceptional operating items during the year

ended 31December 2013.

Good progress was made in the year on the priorities for the region

despite the challenging conditions experienced over the course

of the year. Focusing on the distribution and expansion of the

portfolio, a further six hotels were signed into the pipeline for

HUALUXE and a further 11 for Crowne Plaza. The number of open

Crowne Plaza hotels also increased by five in the year and the

Holiday Inn portfolio expanded.

Despite good progress on the priorities, market conditions were

challenging in the region in 2013. The hotel industry was impacted

by a number of factors including the China-Japan territorial islands

dispute, a series of natural disasters in Western China, particularly in

the second quarter of the year, and slower macroeconomic conditions

during 2013 than in prior years. Overall the region achieved RevPAR

growth of 1.0% representing a significant decrease on the 5.4%

growth achieved in 2012. IHG did, however, significantly outperform

the industry in 2013.

Revenue and operating profit before exceptional items increased

by$6m (2.6%) to $236m and by $1m (1.2%) to $82m respectively.

On an underlying basis, revenue and operating profit increased

by $6m (2.6%) and $2m (2.5%) respectively.

Franchised revenue was flat at $3m and operating profit increased

by $1m (25.0%) to $5m.

Managed revenue increased by $3m (3.4%) to $92m and operating

profit was flat at $51m. RevPAR increased by 0.6%, whilst the

Greater China System size grew by 11.8%, driving a 9.2% increase

in total gross revenue derived from rooms business. Total gross

revenue derived from non-rooms business increased by 3.0%.

Operating profit was partly offset by increased investment to

drive future growth.

2014 priorities

• Grow quality distribution and further expand our portfolio of

brands especially Holiday Inn and Holiday Inn Express in tier

2 and 3 cities to cater to evolving market needs;

• build upon the successful launch of the HUALUXE Hotels &

Resorts brand and continue to drive growth and fine-tune

brand standards and standard operating procedures;

• grow talent and build a strong local talent pipeline; and

• continue to localise IHG brands, systems, tools, processes

and responsible business practices to increase efficiency

and margin performance.

Maximise scale and strength and establish multi-segment local

operating expertise to drive margin and expand our strong

portfolio of brands over the next three years.

Greater China comparable RevPAR

movement on previous year 12 months ended

31December2013

Managed

All brands 0.6%

Owned and leased

InterContinental (0.1)%

Performance continued

48 IHG Annual Report and Form 20-F 2013

Greater China