Holiday Inn 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

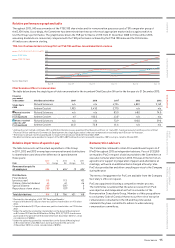

• The measurement of the future redemption liability of the

Group’s loyalty programme;

• Accounting for the hotel assessments collected as part of

the revenue cycle and the allocation of expenditures related

tothe marketing, advertising and loyalty point programmes

(theSystem Fund);

• The assessment of the carrying value of deferred tax assets

for trading losses;

• The accounting for the purchase of a qualifying insurance policy

by the UK defined benefit pension plan; and

• The accounting for the disposal of the InterContinental London

Park Lane hotel.

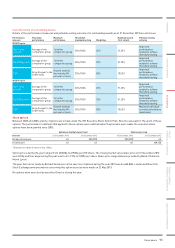

Our application of materiality

We determined planning materiality for the Group to be $27m,

which is approximately 5% of adjusted profit before tax. We used

adjusted pre-tax profit excluding exceptional items and significant

liquidated damages as we considered that to be reflective of ongoing

operating activity and the most relevant performance measure to the

stakeholders of the entity. This provided a basis for determining the

nature, timing and extent of risk assessment procedures, identifying

and assessing the risk of material misstatement and determining

the nature, timing and extent of further audit procedures.

On the basis of our risk assessment, together with our assessment

of the Group’s overall control environment, our judgement was that

overall performance materiality (i.e. our tolerance for misstatement

in an individual account or balance) for the Group should be 75% of

planning materiality, namely $20m. Our objective in adopting this

approach was to ensure that total detected and audit differences

in all accounts did not exceed our planning materiality level.

We agreed with the Audit Committee that we would report to the

Committee all audit differences in excess of $1.4m, as well as

differences below that threshold that, in our view, warranted

reporting on qualitative grounds.

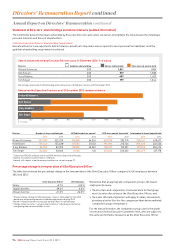

An overview of the scope of our audit

Following our assessment of the risk of material misstatement

to the Group Financial Statements, we selected 24 components

which represent the principal business units within the Group and

account for 84% (2012: 70%) of the Group’s profit before tax and

79% (2012: 78%) of the Group’s revenue. 15 of these were subject

to a full audit, whilst the remaining nine were subject to a partial

audit where the extent of audit work was based on our assessment

of the risks of material misstatement and of the materiality of the

Group’s business operations in that component. These components

were also selected to provide an appropriate basis for undertaking

audit work to address the risks of material misstatement identified

above. For the remaining components, we performed other

procedures to confirm that there were no significant risks of

material misstatement in the Group Financial Statements.

The audit work in the 24 components was executed at levels of

materiality applicable to each individual entity, which were lower

than Group materiality.

The Group audit team interacted regularly with the component teams

where appropriate during various stages of the audit, visited key

accounting locations in the US and India, visited owned hotels in

France and Hong Kong, reviewed key working papers and was

responsible for the scope and direction of the audit process.

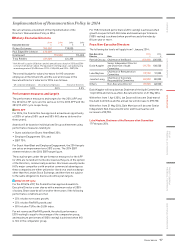

Independent Auditor Report to the members of

InterContinental Hotels Group PLC

We have audited the Group Financial Statements of

InterContinental Hotels Group PLC for the year ended

31 December 2013 which comprise the Group income statement,

theGroup statement of comprehensive income, the Group

statement of changes in equity, the Group statement of financial

position, the Group statement of cash flows and the related notes

1to 36. The financial reporting framework that has been applied

in their preparation is applicable law and International Financial

Reporting Standards (IFRSs) as adopted by the European Union.

This report is made solely to the Company’s members, as a body,

inaccordance with Chapter 3 of Part 16 of the Companies Act 2006.

Ouraudit work has been undertaken so that we might state to the

Company’s members those matters we are required to state to them

in an auditor’s report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to anyone

other than the Company and the Company’s members as a body, for

our audit work, for this report, or for the opinions we have formed.

Respective responsibilities of Directors and auditor

As explained more fully in the Statement of Directors’

Responsibilities statement on page 100, the Directors are

responsible for the preparation of the Group Financial Statements

and for being satisfied that they give a true and fair view.

Our responsibility is to audit and express an opinion on the

Group Financial Statements in accordance with applicable law

and International Standards on Auditing (ISAs) (UK and Ireland).

Those standards require us to comply with the Auditing Practices

Board’s Ethical Standards for Auditors.

Scope of the audit of the Financial Statements

An audit involves obtaining evidence about the amounts and

disclosures in the Financial Statements sufficient to give reasonable

assurance that the Financial Statements are free from material

misstatement, whether caused by fraud or error. This includes an

assessment of: whether the accounting policies are appropriate to

the Group’s circumstances and have been consistently applied and

adequately disclosed; the reasonableness of significant accounting

estimates made by the Directors; and the overall presentation of

the Financial Statements. In addition, we read all the financial and

non-financial information in the Annual Report and Form 20-F 2013

to identify material inconsistencies with the audited Financial

Statements and to identify any information that is apparently

materially incorrect based on, or materially inconsistent with,

the knowledge acquired by us in the course of performing the audit.

If we become aware of any apparent material misstatements or

inconsistencies we consider the implications for our report.

Opinion on Financial Statements

In our opinion the Group Financial Statements:

• give a true and fair view of the state of the Group’s affairs as

at 31December 2013 and of its profit for the year then ended;

• have been properly prepared in accordance with IFRSs as

adopted by the European Union; and

• have been prepared in accordance with the requirements of

the Companies Act 2006 and Article 4 of the IAS Regulation.

Our assessment of risks of material misstatement

We identified the following risks that have had the greatest effect

on the overall audit strategy; the allocation of resources in the

audit; and directing the efforts of the engagement team:

Group Financial Statements 101

Independent Auditor’s UK Report

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION