Holiday Inn 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

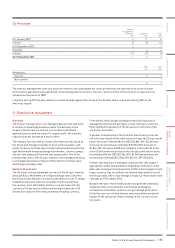

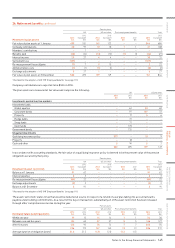

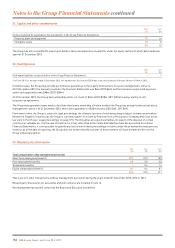

26. Retirement benefits continued

Pension plans

UK US and other Post-employment benefits Total

Movement in plan assets 2013

$m

2012

(restated1)

$m

2013

$m

2012

(restated1)

$m

2013

$m

2012

$m

2013

$m

2012

(restated1)

$m

Fair value of plan assets at 1 January 695 551 149 133 ––844 684

Company contributions 20 97 10 10 1131 108

Members’ contributions –1–––––1

Benefits paid (22) (14) (13) (12) (1) (1) (36) (27)

Interest income 29 27 44––33 31

Settlement loss (137) –––––(137) –

Re-measurement (losses)/gains (7) 7915 ––222

Administration costs (1) (1) (1) (1) ––(2) (2)

Exchange adjustments 527 1–––627

Fair value of plan assets at 31 December 582 695 159 149 ––741 844

1 Restated for the adoption of IAS 19R ‘Employee Benefits’ (see page 111).

Company contributions are expected to be $12m in 2014.

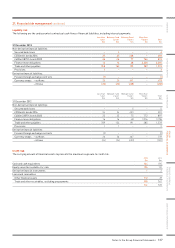

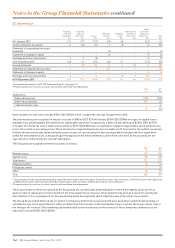

The plan assets are measured at fair value and comprise the following:

UK US and other

2013

$m

2012

$m

2013

$m

2012

$m

Investments quoted in active markets

Investment funds:

Global equities –62 33 60

Corporate bonds –97 107 72

Property –17 46

Hedge funds –31 ––

Swap funds –71 ––

Cash funds –170 ––

Government bonds –135 ––

Unquoted investments

Qualifying insurance policy 577 –10 9

Property –18 ––

Cash and other 594 52

582 695 159 149

In accordance with accounting standards, the fair value of a qualifying insurance policy is deemed to be the present value of the pension

obligations secured by thatpolicy.

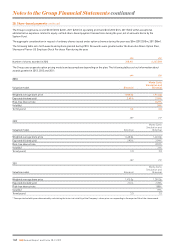

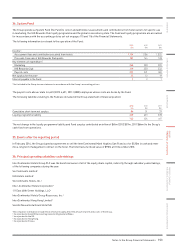

Pension plans

UK US and other Post-employment benefits Total

Movement in asset restriction 2013

$m

2012

(restated1)

$m

2013

$m

2012

(restated1)

$m

2013

$m

2012

$m

2013

$m

2012

(restated1)

$m

Balance at 1 January 91 63 ––––91 63

Interest expense 33––––33

Re-measurement (losses)/gains (89) 23 ––––(89) 23

Exchange adjustments (3) 2––––(3) 2

Balance at 31 December 291 ––––291

1 Restated for the adoption of IAS 19R ‘Employee Benefits’ (see page 111).

The asset restriction relates to tax that would be deducted at source in respect of a refund of a surplus taking into account amounts

payable under funding commitments. As a result of the buy-in transaction, substantially all of the asset restriction has been released

through other comprehensive income during the year.

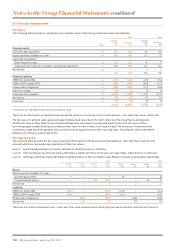

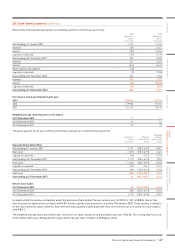

Pension plans

UK US and other Post-employment benefits Total

Estimated future benefit payments 2013

$m

2012

$m

2013

$m

2012

$m

2013

$m

2012

$m

2013

$m

2012

$m

Within one year 19 15 14 14 1134 30

Between one and five years 84 65 57 57 55146 127

After five years 123 93 76 74 77206 174

226 173 147 145 13 13 386 331

Average duration of obligation (years) 21.6 21.5 11.8 12.0 11.3 11.5

Notes to the Group Financial Statements 145

OVERVIEW STRATEGIC REPORT GOVERNANCE

GROUP

FINANCIAL STATEMENTS

PARENT COMPANY

FINANCIAL STATEMENTS ADDITIONAL INFORMATION