Holiday Inn 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Where the industry is now

The global hotel industry

The global hotel industry comprises approximately 14.6 million

rooms, according to Smith Travel Research, and these are broadly

segmented into branded (multiple hotels under the same brand

name) and independent (non-branded) hotels. Growth in demand

is driven by economic growth and an increasing trend for domestic

and global travel resulting in part from favourable demographics

and globalisation of travel.

There are a number of key industry metrics which are widely

recognised and used to track performance. These include revenue

per available room (RevPAR), average daily rate and rooms supply

growth. These are amongst the key performance measures actively

monitored by IHG. IHG also monitors macroeconomic indicators

such as gross domestic product (GDP) trends, which is a leading

indicator in hotel industry trends.

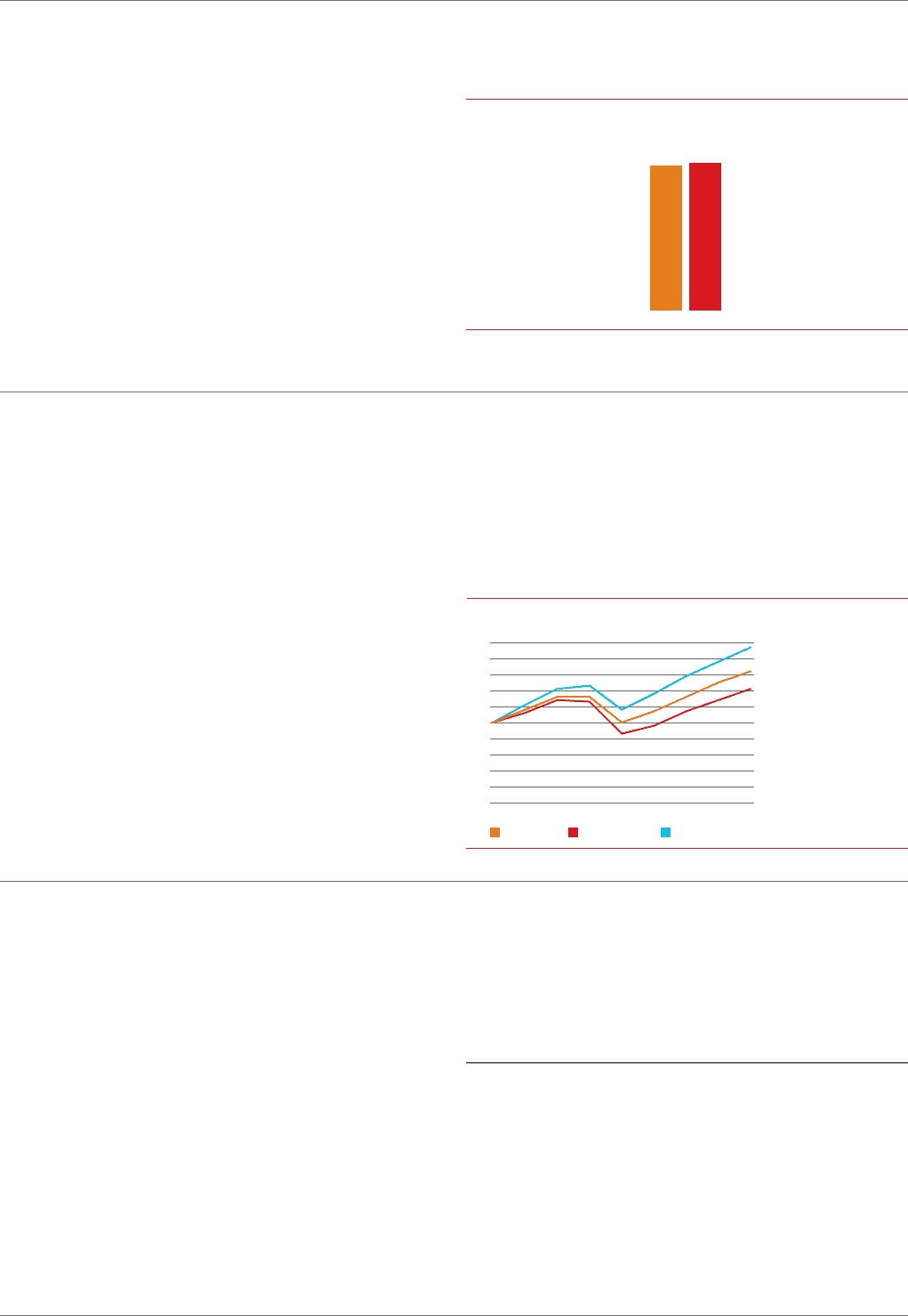

The branded hotel market

Smith Travel Research estimates that the branded hotel market

accounts for 51.5% of the total hotel market. However, this market

is fragmented in terms of key brand players with the top five

branded hotel companies (of which IHG is one) accounting for only

41% of the total branded hotel market in terms of open rooms and

72% of the development pipeline (hotels in planning and under

construction but not yet open). However, as can be seen in the

graph on the right, globally, the branded hotel market is increasing

its share of the total hotel market, due to the advantages a brand

can bring to hotel performance over that of independent hotels.

Branded hotels have shown an increased resilience through the

economic cycles, with the big branded players showing clear

revenue outperformance, as well as benefiting from advantages

in terms of economies of scale across a broad portfolio of hotels.

In the US, around 70% of the industry supply is branded. In fast

developing markets, such as China and India, branded penetration

is lower, at around 20 to 30%. However, this is expected to increase

significantly over the coming decades as branded hotels gain

traction due to the advantages of reliability, guest safety and

security and consistency of standards that large global

brandsbring.

The different business models within the hotel industry

The global hotel industry operates under a number of different

business models, depending on whether a hotel is branded or

independent. The four models typically seen are owned, leased,

managed or franchised:

• Owned hotels are owned and operated by an owner who bears

all the costs associated with the hotel but also benefits from

all of the income;

• a leased model is similar, except that the owner-operator of

a hotel does not have outright ownership of the hotel but pays

rental fees to the ultimate owner of the property;

• under a managed model, the owner of a hotel will use a

third-party manager to operate the hotel on its behalf and will

pay the manager management fees and, if the hotel is operated

under a third-party brand name, brand licensing fees; and

• a franchised hotel is owned and operated by an owner under a

third-party brand name and the owner will pay a brand licensing

fee to the brand owner.

Whilst an owner-operated hotel enables the owner to have full

control over hotel operation, it requires high capital investment.

In contrast, for hotel brand owners, a managed or franchised

model enables quicker rooms growth due to the lower capital

investment, but this requires strong relationships with third-party

hotel owners.

IHG's business model is set out on page 16.

IHG’s 2014 Trends Report (see page 20 and

www.ihgplc.com/trends_report) identified that consumers

trust brands with a heritage and they value the comfort and

security established global brands provide. However the

collision of globalisation, localisation and personalisation

means that brands need to stay relevant by becoming ‘3D’ –

managing their global, local and personal assets simultaneously.

4.5%

4.4%

2012

2013

Global industry RevPAR growth (2013 v 2012)

50

60

70

80

90

100

110

120

130

140

150

2005 2006 2007 2008 2009 2010 2011 2012 2013

Industry Independents Big brands

Source: Smith Travel

Research (STR).

Note:

•Independentsarehotels

notassignedtoabrand

per STR.

•Bigbrandsareanybrand

affiliated with the parent

companyofHilton,IHG,

Marriott,Wyndham,

Choice,AccororStarwood.

US Industry Annual Revenues Indexed to 2005

IHG’s KPIs are set out on pages 38 and 39.

10 IHG Annual Report and Form 20-F 2013

Industry overview