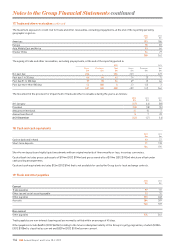

Holiday Inn 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192

|

|

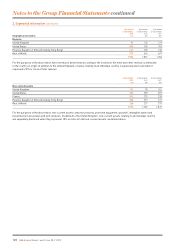

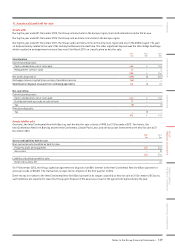

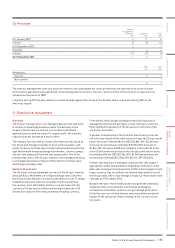

14. Investment in associates and joint ventures

Associates

$m

Joint ventures

$m

Total

$m

Cost

At 1 January 2012 60 30 90

Reclassification 4(4) –

Additions – 2 2

Transfer to non-current assets classified as held for sale (10) –(10)

Share of profit 3 – 3

Dividends (3) –(3)

Share of reserve movement 5 – 5

At 31 December 2012 59 28 87

Additions 8 2 10

Capital returns –(3) (3)

Share of profit 2–2

Dividends (5) –(5)

Exchange and other adjustments (3) –(3)

At 31 December 2013 61 27 88

Impairment

At 1 January 2012, 31 December 2012 and 31 December 2013 (3) –(3)

Net book value

At 31 December 2013 58 27 85

At 31 December 2012 56 28 84

At 1 January 2012 57 30 87

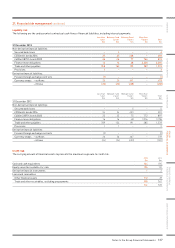

Associates Joint ventures Total

2013

$m

2012

$m

2011

$m

2013

$m

2012

$m

2011

$m

2013

$m

2012

$m

2011

$m

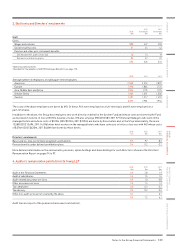

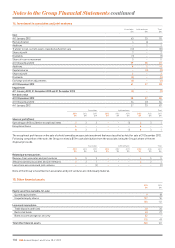

Share of profit/(loss)

Operating profit/(loss) before exceptional items 23 2 ––(1) 23 1

Exceptional items 6– – –– – 6– –

83 2 ––(1) 83 1

The exceptional profit arose on the sale of a hotel owned by an associate investment that was classified as held for sale at 31 December 2012.

Followingcompletion of the sale, the Group received a $17m cash distribution from the associate, being the Group's share of the net

disposal proceeds.

Associates Joint ventures Total

2013

$m

2012

$m

2011

$m

2013

$m

2012

$m

2011

$m

2013

$m

2012

$m

2011

$m

Related party transactions

Revenue from associates and joint ventures 45 5 –– – 45 5

Amounts owed by associates and joint ventures 22 1 –– – 22 1

Loans from associates and joint ventures ––(2) –– – ––(2)

None of the Group’s investments in associates and joint ventures are individually material.

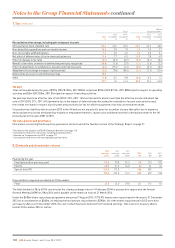

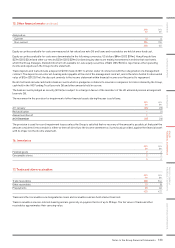

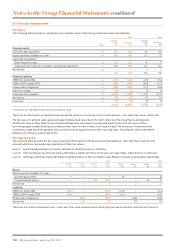

15. Other financial assets

2013

$m

2012

$m

Equity securities available-for-sale:

Quoted equity shares 918

Unquoted equity shares 127 94

136 112

Loans and receivables:

Trade deposits and loans 20 20

Restricted funds 40 29

Bank accounts pledged as security 52 –

112 49

Total other financial assets 248 161

132 IHG Annual Report and Form 20-F 2013

Notes to the Group Financial Statements continued