Holiday Inn 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We measure our performance through a holistic set of carefully selected KPIs to monitor our success in

achieving our strategy and the progress of our Group todeliver high-quality growth. The KPIs are organised

around the elements of our strategy – our Winning Model and Targeted Portfolio, and Disciplined Execution.

Winning Model and Targeted Portfolio

KPIs 2013 progress 2014 priorities

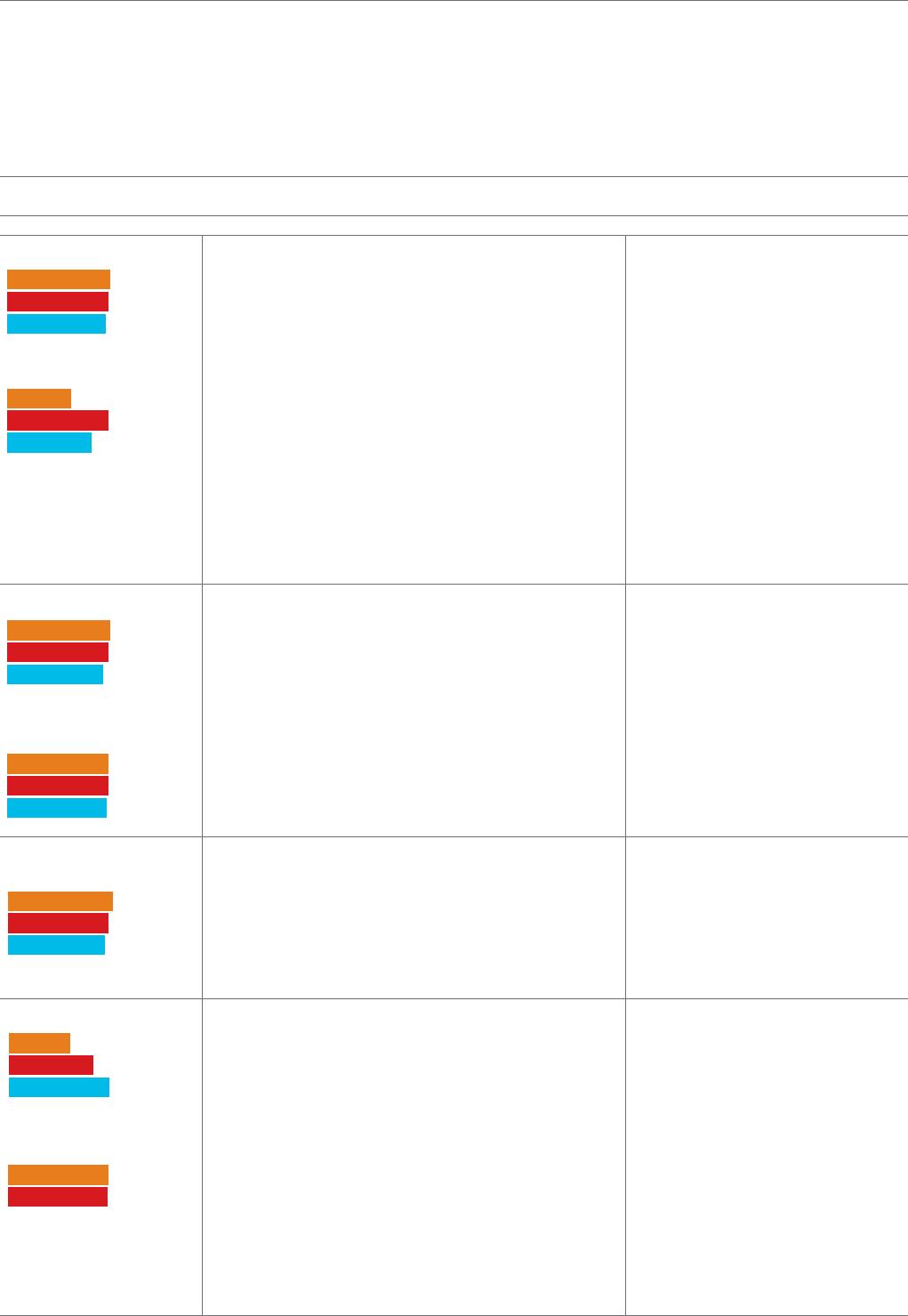

Net rooms supply2• IHG System size of 686,873 rooms (4,697 hotels) reflecting

1.6% net IHG System size growth. The slower growth rate

reflects a higher level of removals to maintain the quality of

our estate, including 17 hotels for which significant liquidated

damages totalling $46m were received.

• Completed disposal of our leasehold interest in the

InterContinental London Park Lane and agreed to dispose of

80% of our interest in the InterContinental New York Barclay,

retaining 20% in a joint venture, and entered into long-term

management contracts on both hotels.

• Pipeline of 180,461 rooms (1,120 hotels), including 21 hotels

in the pipeline for the HUALUXE brand and five hotels in the

pipeline for the EVEN brand (three of which are owned).

• Lower growth in fee revenues compared to 2012 reflects a

combination of lower RevPAR growth and lower net IHG

System size growth in 2013.

• An increasing number of open hotels in developing markets,

which drive incremental fees at a lower rate, also contributed

to lower growth in fee revenues.

• Accelerate growth strategies in

priority markets and key locations in

agreed scale markets and continue

to leverage scale.

• Support growth of our new brands EVEN

Hotels and HUALUXE Hotels & Resorts,

opening our first hotels.

Growth in fee revenues2

Total gross revenue • Total gross revenue from hotels in IHG’s System – $21.6bn,

up 2%.

• Loyalty programme relaunched to IHG Rewards Club offering

enhanced benefits for members, including free internet access

across our hotels globally – driving a 10 percentage point

increase in awareness of IHG as a brand family.

• Enrolled 6m new members (up 8% on 2012) to IHG Rewards

Club, taking the total to 77.4m members.

• Continue to strengthen IHG’s revenue

delivery systems to deliver profitable

demand to hotels.

• Continue to drive loyalty to our

portfolio of brands, driving awareness

of IHG Rewards Club and leveraging

this across our brands and regions.

• Continue to drive adoption and impact

of our performance tools, systems and

processes amongst our owners.

• Continue with investment in technology

systems and platforms.

System contribution

to revenue1

Employee Engagement

survey scores

• Continued to deliver against our people strategy, increasing

our employee engagement by 3.1% and recognised externally

as an employer of choice (see page 23).

• Launched bespoke, country-specific careers web pages and/or

websites in India, Russia and Greater China to continue our aim

to be employer of choice.

• Strengthen our approach to developing

leaders and invest in tools and training

that build leadership capabilities.

• Continue to build a winning culture

through strong leadership and

performance management.

• Continue to strengthen our talent

pipeline to meet our growth ambitions.

Global RevPAR growth1, 2 • Growth in global RevPAR has slowed in 2013, reflecting slower

growth in The Americas and IHG’s predominantly midscale

focus, and more significant slow down in Greater China due

to industry-wide challenges (see pages 12 and 13).

• Recorded improvements in guest satisfaction scores in

every region, for all of our brands and received external

recognition through awards (see page 23).

• Continued with the repositioning of the Crowne Plaza

brand and refreshed marketing messaging for Holiday Inn

and Holiday Inn Express to better reflect the differentiated

brand propositions and drive brand consideration.

• As part of simplifying and clarifying our standards for all of

the brands, in 2013, we refreshed the Holiday Inn Express

Standards’ manual ready for launch in January 2014.

• Launched two General Manager training programmes to

assist with General Manager development to deliver on the

brand promise (see page 26).

• Continue to strengthen the quality and

consistency of the brand experience,

delivering guest journeys that are

differentiated by brand.

• Continue to invest in building long-term

brand preference in light of our guest

occasion segmentation and the 2014

IHG Trends Report (see page 20).

• Continue to empower our frontline teams

with the tools and training to consistently

deliver great guest experiences that build

brand preference.

• Continue to progress with our standards

refresh across the brands.

• Support the first openings of our new

hotels for the EVEN Hotels and

HUALUXE Hotels & Resorts brands.

Guest HeartBeat1

2012

2011

2013

675,982

658,348

686,873

2012

2011

2013

6.8%

5.7%

4.3%

At constant currency

2012

2011

2013

$21.2bn

$20.2bn

Actual $bn

$21.6bn

2012

2011

2013

69%

68%

69%

2012

2011

2013

78.6%

75.8%

81.7%

2012

2011

2013

5.2%

6.2%

Comparable hotels,

constant $

3.8%

2012

2013

82.36%

82.91%

2011

Not applicable

38 IHG Annual Report and Form 20-F 2013

Key performance indicators (KPIs)