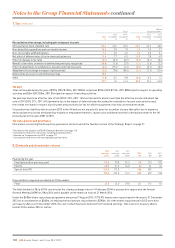

Holiday Inn 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

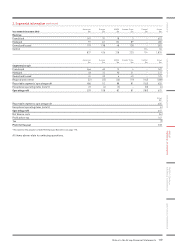

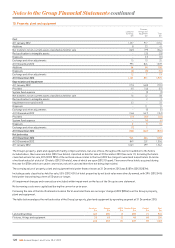

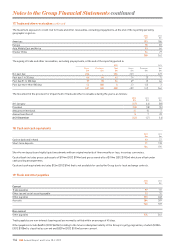

10. Property, plant and equipment

Land and

buildings

$m

Fixtures,

fittings and

equipment

$m

Total

$m

Cost

At 1 January 2012 1,237 917 2,154

Additions 833 41

Net transfers to non-current assets classified as held for sale (265) (99) (364)

Reclassification to intangible assets –(25) (25)

Disposals –(12) (12)

Exchange and other adjustments 15 10 25

At 31 December 2012 995 824 1,819

Additions 96 54 150

Disposals (2) (8) (10)

Exchange and other adjustments 12 113

At 31 December 2013 1,101 871 1,972

Depreciation and impairment

At 1 January 2012 (174) (618) (792)

Provided (11) (46) (57)

System Fund expense –(3) (3)

Net transfers to non-current assets classified as held for sale 16 42 58

Reclassification to intangible assets – 2 2

Impairment reversals (note 5) 23 –23

Disposals –11 11

Exchange and other adjustments –(5) (5)

At 31 December 2012 (146) (617) (763)

Provided (11) (35) (46)

System Fund expense –(4) (4)

Disposals 2 8 10

Exchange and other adjustments (1) 1 –

At 31 December 2013 (156) (647) (803)

Net book value

At 31 December 2013 945 224 1,169

At 31 December 2012 849 207 1,056

At 1 January 2012 1,063 299 1,362

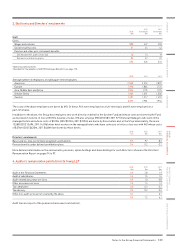

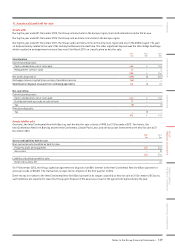

The Group’s property, plant and equipment mainly comprises hotels, but also offices, throughout the world. In addition to the hotels

included above, there was one hotel (2012 two hotels) classified as held for sale at 31 December 2013 (see note 11). Including the hotels

classified as held for sale, 81% (2012 90%) of the net book value relates to the four (2012 five) largest owned and leased hotels (in terms

of net book value) of a total of 12 hotels (2012 10 hotels), nine of which are open (2012 10 open). There were three hotels acquired during

the year for $70m which are under conversion, not yet in use and therefore not being depreciated.

The carrying value of property, plant and equipment held under finance leases at 31 December 2013 was $187m (2012 $187m).

Including assets classified as held for sale, 55% (2012 43%) of hotel properties by net book value were directly owned, with 39% (201254%)

held under leases having a term of 50 years or longer.

All impairment charges and reversals are included within impairment on the face of the Group income statement.

No borrowing costs were capitalised during the current or prior year.

Following the sale of the InterContinental London Park Lane hotel there are no longer charges (2012 $89m) over the Group’s property,

plantandequipment.

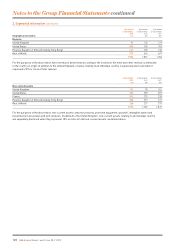

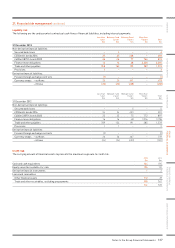

The table below analyses the net book value of the Group’s property, plant and equipment by operating segment at 31 December 2013:

Americas

$m

Europe

$m

AMEA

$m

Greater China

$m

Central

$m

Total

$m

Land and buildings 367 290 8259 21 945

Fixtures, fittings and equipment 33 63 12 48 68 224

400 353 20 307 89 1,169

128 IHG Annual Report and Form 20-F 2013

Notes to the Group Financial Statements continued